Have a Happy & safe Thanksgiving.

Trade what you see; not what you think.” – The Old Fool,

Richard McCranie, trader extraordinaire.

“Far more money has been lost by investors in preparing for

corrections, or anticipating corrections, than has been lost in the corrections

themselves.” - Peter Lynch, former manager of Fidelity’s Magellan®

fund.

DURABLE GOODS ORDERS (rttnews)

“...durable goods orders crept up by 0.2 in October after falling by a revised 0.4 percent in September... Economists had expected durable goods orders to climb by 0.5 percent...” Story at...

https://www.rttnews.com/3493494/u-s-durable-goods-orders-rise-0-2-in-october-less-than-expected.aspx

PCE PRICES / GDP (Financial Review)

“The so-called core personal consumption expenditures price index, which strips out volatile food and energy items, increased 2.8 per cent from October last year and 0.3 per cent from a month earlier, according to Bureau of Economic Analysis data. A good part of that acceleration was due to the impact of higher stock prices on the calculation... the US economy expanded at a solid pace in the third quarter, largely powered by a broad-based advance in consumer spending and steady business investment. Gross domestic product increased at a 2.8 per cent annualised pace in the third quarter." Story at...

https://www.afr.com/world/north-america/us-gdp-expands-at-a-solid-2-8pc-pace-helped-by-consumer-spending-20241128-p5ku4q

JOBLESS CLAIMS (Reuters)

“The number of Americans filing new applications for unemployment benefits fell again last week, but many laid-off workers are experiencing long bouts of joblessness, keeping the door open to another interest rate cut from the Federal Reserve in December. Initial claims for state unemployment benefits dropped 2,000 to a seasonally adjusted 213,000 for the week ended Nov. 23...” Story at...

https://www.reuters.com/markets/us/us-weekly-jobless-claims-decline-further-2024-11-27/

CRUDE INVENTORIES (EIA)

“U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) decreased by 1.8 million barrels from the previous week. At 428.4 million barrels, U.S. crude oil inventories are about 5% below the five year average for this time of year.” Report at...

https://ir.eia.gov/wpsr/wpsrsummary.pdf

“An average of 13.4 million barrels per day (b/d) of

crude oil was produced in the United States during August 2024, a new record

according to data from our Petroleum Supply Monthly.

More crude oil was produced in the United States during August 2024 than during

December 2023, when the previous monthly record of 13.3 million b/d was set.” –

EIA at...

https://www.eia.gov/todayinenergy/detail.php?id=63824

My cmt: The 2020 dip is COVID related. Fracking started to accelerate in 2010 and that accounts for the big jump in production.

MARKET REPORT / ANALYSIS

-Wednesday the S&P 500 declined about 0.4% to 5999.

-VIX declined about 0.1% to 14.11.

-The yield on the 10-year Treasury declined (compared to about this time, prior trading day) to 4.261%.

MY TRADING POSITIONS:

XLK – Holding since the October 2022 lows. Added more 9/20.

SSO – added 10/16.

SPY – added 9/19 & more 10/16

QLD – added 11/5.

UWM – added 11/11

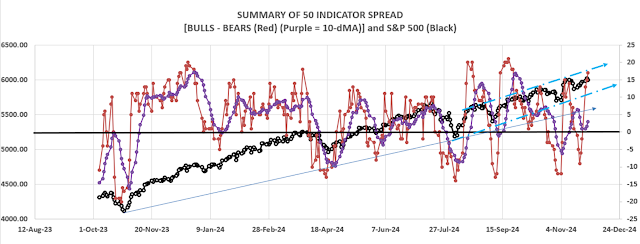

CURRENT SUMMARY OF APPROXIMATELY 50 INDICATORS:

Today, of the 50-Indicators I track, 3 gave Bear-signs and 20 were Bullish. The rest are neutral. (It is normal to have a lot of neutral indicators since many of the indicators are top or bottom indicators that will signal only at extremes.)

The daily Bull/Bear, 50-Indicator spread (Bull Indicators minus Bear Indicators, red curve in the chart above) improved to +17 (17 more Bull indicators than Bear indicators).

TODAY’S COMMENT

Today’s Bull-Bear spread of +17, a very bullish sign.

The 10-dMA of the 50-Indicator Spread (purple line in the

chart above) is moving higher today so the overall 50-Indicator spread signal

is Bullish. (I follow the 10-dMA for trading buy-signals and as an indicator

for sell signals.)

The S&P 500 has not returned to its upper trend line

so it appears that the Index will run higher. VIX is falling and Sentiment

turned bullish. That was a surprise. There are now a lot of investors betting

against the market on the Guggenheim leveraged mutual funds that I track. That’s

because until today, there had been 7 up-days in a row. Tuesday, there had been

8-days out of the last 10 that were up – that was one of the bear signs

yesterday. Sentiment is likely to return to neutral soon.

BOTTOM LINE

I’m bullish.

ETF - MOMENTUM ANALYSIS:

TODAY’S RANKING OF 15 ETFs (Ranked Daily) ETF ranking follows:

The top ranked ETF receives

100%. The rest are then ranked based on their momentum relative to the leading

ETF.

*For additional background on the ETF ranking system see NTSM Page at…

http://navigatethestockmarket.blogspot.com/p/exchange-traded-funds-etf-ranking.html

DOW STOCKS - TODAY’S MOMENTUM RANKING

OF THE DOW 30 STOCKS (Ranked Daily)

The top ranked Stock receives

100%. The rest are then ranked based on their momentum relative to the leading Stock.

For more details, see NTSM Page at…

https://navigatethestockmarket.blogspot.com/p/a-system-for-trading-dow-30-stocks-my_8.html

WEDNESDAY MARKET INTERNALS

(NYSE DATA)

My basket of Market Internals improved to BUY. (My basket of Market Internals is a decent trend-following analysis that is most useful when it diverges from the Index.)

...My current invested

position is about 70% stocks, including stock mutual funds and ETFs. I’m

usually about 50% invested in stocks when markets are stretched. (75% is my max

stock allocation when I am confident that markets will continue higher.)

I trade about 15-20% of the total portfolio using the

momentum-based analysis I provide here. When I see bullish signs, I add a lot more

stocks to the portfolio, usually by using an S&P 500 ETF as I did back in

October 2022 and 2023.

“...durable goods orders crept up by 0.2 in October after falling by a revised 0.4 percent in September... Economists had expected durable goods orders to climb by 0.5 percent...” Story at...

https://www.rttnews.com/3493494/u-s-durable-goods-orders-rise-0-2-in-october-less-than-expected.aspx

“The so-called core personal consumption expenditures price index, which strips out volatile food and energy items, increased 2.8 per cent from October last year and 0.3 per cent from a month earlier, according to Bureau of Economic Analysis data. A good part of that acceleration was due to the impact of higher stock prices on the calculation... the US economy expanded at a solid pace in the third quarter, largely powered by a broad-based advance in consumer spending and steady business investment. Gross domestic product increased at a 2.8 per cent annualised pace in the third quarter." Story at...

https://www.afr.com/world/north-america/us-gdp-expands-at-a-solid-2-8pc-pace-helped-by-consumer-spending-20241128-p5ku4q

“The number of Americans filing new applications for unemployment benefits fell again last week, but many laid-off workers are experiencing long bouts of joblessness, keeping the door open to another interest rate cut from the Federal Reserve in December. Initial claims for state unemployment benefits dropped 2,000 to a seasonally adjusted 213,000 for the week ended Nov. 23...” Story at...

https://www.reuters.com/markets/us/us-weekly-jobless-claims-decline-further-2024-11-27/

“U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) decreased by 1.8 million barrels from the previous week. At 428.4 million barrels, U.S. crude oil inventories are about 5% below the five year average for this time of year.” Report at...

https://ir.eia.gov/wpsr/wpsrsummary.pdf

https://www.eia.gov/todayinenergy/detail.php?id=63824

My cmt: The 2020 dip is COVID related. Fracking started to accelerate in 2010 and that accounts for the big jump in production.

-Wednesday the S&P 500 declined about 0.4% to 5999.

-VIX declined about 0.1% to 14.11.

-The yield on the 10-year Treasury declined (compared to about this time, prior trading day) to 4.261%.

XLK – Holding since the October 2022 lows. Added more 9/20.

SSO – added 10/16.

SPY – added 9/19 & more 10/16

QLD – added 11/5.

UWM – added 11/11

Today, of the 50-Indicators I track, 3 gave Bear-signs and 20 were Bullish. The rest are neutral. (It is normal to have a lot of neutral indicators since many of the indicators are top or bottom indicators that will signal only at extremes.)

The daily Bull/Bear, 50-Indicator spread (Bull Indicators minus Bear Indicators, red curve in the chart above) improved to +17 (17 more Bull indicators than Bear indicators).

Today’s Bull-Bear spread of +17, a very bullish sign.

I’m bullish.

TODAY’S RANKING OF 15 ETFs (Ranked Daily) ETF ranking follows:

*For additional background on the ETF ranking system see NTSM Page at…

http://navigatethestockmarket.blogspot.com/p/exchange-traded-funds-etf-ranking.html

For more details, see NTSM Page at…

https://navigatethestockmarket.blogspot.com/p/a-system-for-trading-dow-30-stocks-my_8.html

My basket of Market Internals improved to BUY. (My basket of Market Internals is a decent trend-following analysis that is most useful when it diverges from the Index.)