“Trade what you see; not what you think.” – The Old Fool,

Richard McCranie, trader extraordinaire.

“Far more money has been lost by investors in preparing for

corrections, or anticipating corrections, than has been lost in the corrections

themselves.” - Peter Lynch, former manager of Fidelity’s Magellan®

fund.

HIS RETIREMENT FUND IS IN LIMBO (WSJ)

“...Through a friend, he heard about a firm called Yield Wealth and the “guaranteed” 15.25% return it was offering to investors on some products. “I figured this is an amazing opportunity and I’ll be set for life,” recalls Whitacre, 60... In March, Whitacre withdrew his entire 401(k) from Fidelity - $763,094.21 - and rolled it over into an individual retirement account with Yield, which was affiliated with a firm called Next Level Holdings... Now Whitacre, like hundreds of other investors who altogether put at least $50 million into these products, wonders if he’ll ever see his money again... Among the investors who fell for this were many of the insurance agents and stockbrokers who sold Next Level or Yield... “Let’s pray we get something out of this,” says Kimberly Whitacre, “but right now we can’t even get answers.” On Nov. 21, she learned that the insurance company Regan [Paul Regan, previously barred for life from acting as a broker by the SEC] had said “guaranteed” her investment denied that it had provided such coverage, adding that “the paperwork and signatures of our officials were used fraudulently....” Most investors know that reaching for yield isn’t wise. In this case, it appears to have been catastrophic.” - Jason Zweig, WSJ. Story at...

https://www.wsj.com/finance/investing/i-dont-know-where-to-turn-or-what-to-do-his-763-094-retirement-fund-is-in-limbo-f89ca638

“It’s a day that ends in y, which means that the Biden

Administration has lost another court case about executive overreach. President

Biden issued an order in 2021 raising the minimum pay for workers on federal

contracts to $15 an hour (soon to be $17.75). This is outside Mr. Biden’s

authority, according to a 2-1 ruling this month at the Ninth Circuit Court of

Appeals.” – WSJ at...

Opinion | Biden’s $17.75 Wage Rule Loses in Court

My cmt: King Biden, stopped again...and they accuse Trump of acting unconstitutionally – Trump did, but the Democrats ignore their own unconstitutional actions.

NATIONAL ACTIVITY INDEX (SeekingAlpha)

“The Chicago Fed National Activity Index ("CFNAI") dropped to -0.40 in October from -0.27 in September (revised from -0.28). Three of the four broad categories of indicators used to build the index declined from September, and all four categories made negative contributions in October.” Story at...

https://seekingalpha.com/news/4329679-chicago-fed-national-activity-index-sinks-deeper-into-the-red-in-october

DALLAS FED MANUFACTURING (fxEmpire)

“On November 25, 2024, the Federal Reserve Bank of Dallas released Dallas Fed Manufacturing Index report. The report indicated that Dallas Fed Manufacturing Index improved from -3 in October to -2.7 in November, compared to analyst consensus of -2.4.” Story at...

https://www.fxempire.com/news/article/dallas-fed-manufacturing-index-rises-to-2-7-sp500-settles-near-6000-1478726

MARKET REPORT / ANALYSIS

-Monday the S&P 500 was up about 0.3% to 5987.

-VIX declined about 4% to 14.6.

-The yield on the 10-year Treasury declined (compared to about this time, prior trading day) to 4.275%.

MY TRADING POSITIONS:

XLK – Holding since the October 2022 lows. Added more 9/20.

SSO – added 10/16.

SPY – added 9/19 & more 10/16

QLD – added 11/5.

UWM – added 11/11

CURRENT SUMMARY OF APPROXIMATELY 50 INDICATORS:

Today, of the 50-Indicators I track, 4 gave Bear-signs and 17 were Bullish. The rest are neutral. (It is normal to have a lot of neutral indicators since many of the indicators are top or bottom indicators that will signal only at extremes.)

The daily Bull/Bear, 50-Indicator spread (Bull Indicators minus Bear Indicators, red curve in the chart above) improved to +13 (13 more Bull indicators than Bear indicators).

TODAY’S COMMENT

I updated the DOW 30 momentum analysis to include NVIDIA and Sherwin-Williams and deleted Intel and Dow Corp. I wondered if NVIDIA would be the new momentum leader, but it did not happen. Its recent weakness is holding it back. NVIDIA would have been the momentum leader in my analysis back in September and October, just not now.

I noted Friday that there

seem to be a lot of indicators that are improving and we might see a big

positive switch in the indicators. That happened today, and yes, it’s bullish.

Today’s Bull-Bear spread of +13.

The 10-dMA of the 50-Indicator Spread (purple line in the

chart above) is still falling today so the overall 50-Indicator spread signal

is Bearish; (I follow the 10-dMA for trading buy-signals and as an indicator

for sell signals.), but I’ll ignore this signal for now. The 10-day data always

lags.

Hindenburg Omens were canceled when the McClellan

Oscillator turned positive Friday,

“Looking good, Billy Ray! Feeling good, Louis!”

BOTTOM LINE

I’m bullish.

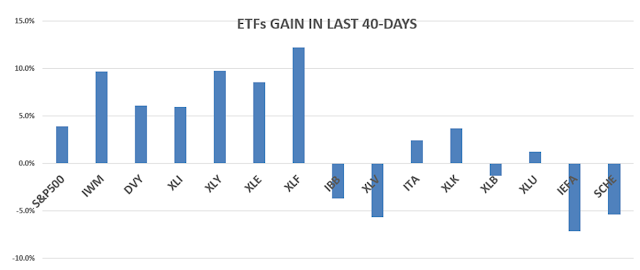

ETF - MOMENTUM ANALYSIS:

TODAY’S RANKING OF 15 ETFs (Ranked Daily) ETF ranking follows:

The top ranked ETF receives

100%. The rest are then ranked based on their momentum relative to the leading

ETF.

*For additional background on the ETF ranking system see NTSM Page at…

http://navigatethestockmarket.blogspot.com/p/exchange-traded-funds-etf-ranking.html

DOW STOCKS - TODAY’S MOMENTUM RANKING OF THE DOW 30 STOCKS (Ranked Daily)

The top ranked Stock receives

100%. The rest are then ranked based on their momentum relative to the leading Stock.

For more details, see NTSM Page at…

https://navigatethestockmarket.blogspot.com/p/a-system-for-trading-dow-30-stocks-my_8.html

MONDAY MARKET INTERNALS (NYSE DATA)

My basket of Market Internals improved to BUY. (My basket of Market Internals is a decent trend-following analysis that is most useful when it diverges from the Index.)

...My current invested

position is about 70% stocks, including stock mutual funds and ETFs. I’m

usually about 50% invested in stocks when markets are stretched. (75% is my max

stock allocation when I am confident that markets will continue higher.)

I trade about 15-20% of the total portfolio using the

momentum-based analysis I provide here. When I see bullish signs, I add a lot more

stocks to the portfolio, usually by using an S&P 500 ETF as I did back in

October 2022 and 2023.

“...Through a friend, he heard about a firm called Yield Wealth and the “guaranteed” 15.25% return it was offering to investors on some products. “I figured this is an amazing opportunity and I’ll be set for life,” recalls Whitacre, 60... In March, Whitacre withdrew his entire 401(k) from Fidelity - $763,094.21 - and rolled it over into an individual retirement account with Yield, which was affiliated with a firm called Next Level Holdings... Now Whitacre, like hundreds of other investors who altogether put at least $50 million into these products, wonders if he’ll ever see his money again... Among the investors who fell for this were many of the insurance agents and stockbrokers who sold Next Level or Yield... “Let’s pray we get something out of this,” says Kimberly Whitacre, “but right now we can’t even get answers.” On Nov. 21, she learned that the insurance company Regan [Paul Regan, previously barred for life from acting as a broker by the SEC] had said “guaranteed” her investment denied that it had provided such coverage, adding that “the paperwork and signatures of our officials were used fraudulently....” Most investors know that reaching for yield isn’t wise. In this case, it appears to have been catastrophic.” - Jason Zweig, WSJ. Story at...

https://www.wsj.com/finance/investing/i-dont-know-where-to-turn-or-what-to-do-his-763-094-retirement-fund-is-in-limbo-f89ca638

Opinion | Biden’s $17.75 Wage Rule Loses in Court

My cmt: King Biden, stopped again...and they accuse Trump of acting unconstitutionally – Trump did, but the Democrats ignore their own unconstitutional actions.

“The Chicago Fed National Activity Index ("CFNAI") dropped to -0.40 in October from -0.27 in September (revised from -0.28). Three of the four broad categories of indicators used to build the index declined from September, and all four categories made negative contributions in October.” Story at...

https://seekingalpha.com/news/4329679-chicago-fed-national-activity-index-sinks-deeper-into-the-red-in-october

“On November 25, 2024, the Federal Reserve Bank of Dallas released Dallas Fed Manufacturing Index report. The report indicated that Dallas Fed Manufacturing Index improved from -3 in October to -2.7 in November, compared to analyst consensus of -2.4.” Story at...

https://www.fxempire.com/news/article/dallas-fed-manufacturing-index-rises-to-2-7-sp500-settles-near-6000-1478726

-Monday the S&P 500 was up about 0.3% to 5987.

-VIX declined about 4% to 14.6.

-The yield on the 10-year Treasury declined (compared to about this time, prior trading day) to 4.275%.

XLK – Holding since the October 2022 lows. Added more 9/20.

SSO – added 10/16.

SPY – added 9/19 & more 10/16

QLD – added 11/5.

UWM – added 11/11

Today, of the 50-Indicators I track, 4 gave Bear-signs and 17 were Bullish. The rest are neutral. (It is normal to have a lot of neutral indicators since many of the indicators are top or bottom indicators that will signal only at extremes.)

The daily Bull/Bear, 50-Indicator spread (Bull Indicators minus Bear Indicators, red curve in the chart above) improved to +13 (13 more Bull indicators than Bear indicators).

I updated the DOW 30 momentum analysis to include NVIDIA and Sherwin-Williams and deleted Intel and Dow Corp. I wondered if NVIDIA would be the new momentum leader, but it did not happen. Its recent weakness is holding it back. NVIDIA would have been the momentum leader in my analysis back in September and October, just not now.

I’m bullish.

TODAY’S RANKING OF 15 ETFs (Ranked Daily) ETF ranking follows:

*For additional background on the ETF ranking system see NTSM Page at…

http://navigatethestockmarket.blogspot.com/p/exchange-traded-funds-etf-ranking.html

DOW STOCKS - TODAY’S MOMENTUM RANKING OF THE DOW 30 STOCKS (Ranked Daily)

For more details, see NTSM Page at…

https://navigatethestockmarket.blogspot.com/p/a-system-for-trading-dow-30-stocks-my_8.html

MONDAY MARKET INTERNALS (NYSE DATA)

My basket of Market Internals improved to BUY. (My basket of Market Internals is a decent trend-following analysis that is most useful when it diverges from the Index.)