“Trade what you see; not what you think.” – The Old Fool, Richard McCranie, trader extraordinaire.

“The Conference Board Consumer Confidence Index® fell by 7.2 points in March to 92.9 (1985=100)...‘Consumer confidence declined for a fourth consecutive month in March, falling below the relatively narrow range that had prevailed since 2022,’ said Stephanie Guichard, Senior Economist, Global Indicators at The Conference Board...’Consumers’ expectations were especially gloomy, with pessimism about future business conditions deepening and confidence about future employment prospects falling to a 12-year low.’” Press release at...

https://www.conference-board.org/topics/consumer-confidence

“New home sales increased 1.8% to a seasonally adjusted annual rate of 676,000 units last month...” Story at...

https://finance.yahoo.com/news/us-home-sales-rebound-february-155839094.html

“Fifth District manufacturing activity slowed in March, according to the most recent survey from the Federal Reserve Bank of Richmond. The composite manufacturing index fell to −4 in March from 6 in February, led by a notable decrease, from 12 to −7, in the shipments index.” Report at...

https://www.richmondfed.org/region_communities/regional_data_analysis/surveys/manufacturing

-Tuesday the S&P 500 rose about 0.2% to 5777.

-VIX fell about 2% to 17.15.

-The yield on the 10-year Treasury slipped to 4.331% (compared to about this time prior market day).

SSO added 3/24/2025 SOLD 3/25/2025 (Decided to reduce risk and buy SPY instead.)

SPY added 3/25/2025

Today, of the 50-Indicators I track, 5 gave Bear-signs and 15 were Bullish. The rest are neutral. (It is normal to have a lot of neutral indicators since many of the indicators are top or bottom indicators that will signal only at extremes.)

TODAY’S COMMENT

The daily, bull-bear spread of 50-indicators improved to a Bullish +10 (10 more Bull indicators than Bear indicators). The 10-dMA of the spread improved again – another bullish sign. Indicators are popping higher. The Index is 0.4% above its 200-dMA and has closed above the 200-day on consecutive days. That’s a good sign.

I am cautiously bullish. Indicators suggest the correction is over, but I have my doubts.

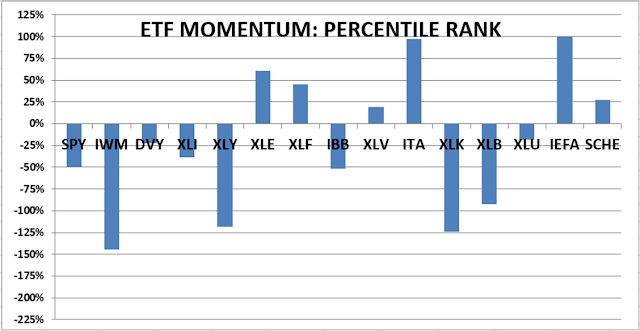

TODAY’S RANKING OF 15 ETFs (Ranked Daily) ETF ranking follows:

*For additional background on the ETF ranking system see NTSM Page at…

http://navigatethestockmarket.blogspot.com/p/exchange-traded-funds-etf-ranking.html

For more details, see NTSM Page at…

https://navigatethestockmarket.blogspot.com/p/a-system-for-trading-dow-30-stocks-my_8.html

My basket of Market Internals remained BUY. (My basket of Market Internals is a decent trend-following analysis that is most useful when it diverges from the Index.)

I trade about 15-20% of the total portfolio using the momentum-based analysis I provide here. When I see bullish signs, I add a lot more stocks to the portfolio, usually by using an S&P 500 ETF as I did back in October 2022 and 2023.