“Trade what you see; not what you think.” – The Old Fool, Richard McCranie, trader extraordinaire.

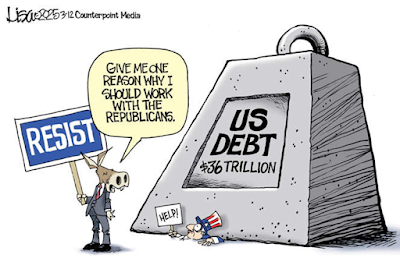

MOUNTING DEBT MAY LEAD TO SHOCKING DEVELOPMENTS (CNBC)

“The first thing is the debt issue, we have a very severe supply-demand problem,” Bridgewater founder Ray Dalio told CNBC’s Sara Eisen at CONVERGE LIVE in Singapore regarding U.S. debt. Dalio, who was speaking on the same panel as Salesforce CEO Marc Benioff, said this will require the White House to sell a quantity of debt the world is just not going to want to buy. “That’s a set of circumstances that is imminent, OK? That is paramount importance,” he said, adding that most people don’t understand the mechanics of debt.” Story at...

https://www.cnbc.com/2025/03/12/ray-dalio-warns-growing-us-debt-will-lead-to-shocking-developments.html

My cmt: As demand to buy treasury bonds declines, interest rates will rise and kill the economy. Unchecked, the existence of our country will be at risk.

CPI / CORE CPI (CNBC)

“The consumer price index, a wide-ranging measure of costs across the U.S. economy, ticked up a seasonally adjusted 0.2% for the month, putting the annual inflation rate at 2.8%, according to the Labor Department agency. The all-item CPI had increased 0.5% in January... Excluding food and energy prices, the core CPI also rose 0.2% on the month and was at 3.1% on a 12-month basis, the lowest reading since April 2021. The core CPI had climbed 0.4% in January.” Story at...

https://www.cnbc.com/2025/03/12/cpi-inflation-report-february-2025.html

CRUDE INVENTORIES (EIA)

“U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) increased by 1.4 million barrels from the previous week. At 435.2 million barrels, U.S. crude oil inventories are about 5% below the five year average for this time of year.” Report at...

https://ir.eia.gov/wpsr/wpsrsummary.pdf

MARKET REPORT / ANALYSIS AS OF 1PM FRIDAY

-Wednesday the S&P 500 rose about 0.5% to 5599.

-VIX fell about 10% to 24.23.

-The yield on the 10-year Treasury rose (compared to about this time, prior trading day) to 4.316%.

MY TRADING POSITIONS:

None

CURRENT SUMMARY OF APPROXIMATELY 50 INDICATORS:

Today, of the 50-Indicators I track, 18 gave Bear-signs and 3 were Bullish. The rest are neutral. (It is normal to have a lot of neutral indicators since many of the indicators are top or bottom indicators that will signal only at extremes.)

TODAY’S COMMENT

As of today’s close, the S&P 500 was down 8.5% from its all-time high. The S&P 500 closed 2.4% below its 200-day, moving average.

The daily, bull-bear spread of 50-indicators declined to

a Bearish -15 (15 more Bear indicators than Bull indicators). The

10-dMA of the spread continues to move higher – that is a bullish sign, but

there has been no confirmation of this bullish trend so far.

We got the stock bounce Wednesday that RSI and Bollinger

Bands had suggested. They were both oversold Tuesday. Bollinger Bands aren’t

oversold today.

Unchanged-volume was again very high. As I’ve often said

(and you’re probably tired of reading it), many believe that this indicator

suggests investor confusion at market turning points. Are markets turning back

up? It’s always possible, but the best we can say is that investors are

confused. “High-unchanged-volume” is not one of my indicators because it is

often wrong.

Down volume has been falling at the recent lows,

suggesting reduced selling. Unfortunately, the “Buying-Pressure minus Selling

Pressure” indicator (below) is still falling so that indicator is not yet confirming

reduced selling.

This indicator is based on my best guess of the Lowry Research methodology. Lowry Research is one of the oldest stock market, technical analysis/investment companies. They do not publish their methodology, however, there are descriptions on the internet. One clear difference is that their model is based only on publicly traded companies while mine is based on all issues listed on the NYSE.

Today was day 15 in the decline. Jeffrey Saut has

suggested that these declines tend to last 17 to 25 sessions unless markets are

sliding into a significant, bear-market. My own numbers agree: 32-days (about

25-sessions) from top to bottom is average for declines less than 10%. When declines

get larger than 10%, the length of correction (top to bottom) can be more than 2-months,

excluding major bear markets that can take years to resolve. (As always, there are exceptions.) We can’t completely

rule out that this is the start of a bear-market, but the odds of that seem

low.

BOTTOM LINE

No bottom yet. I am bearish with a very conservative allocation of only about 30% invested in stock holdings.

ETF - MOMENTUM ANALYSIS:

TODAY’S RANKING OF 15 ETFs (Ranked Daily) ETF ranking follows:

The top ranked ETF receives

100%. The rest are then ranked based on their momentum relative to the leading

ETF.

*For additional background on the ETF ranking system see NTSM Page at…

http://navigatethestockmarket.blogspot.com/p/exchange-traded-funds-etf-ranking.html

DOW STOCKS - TODAY’S MOMENTUM RANKING

OF THE DOW 30 STOCKS (Ranked Daily)

The top ranked Stock receives

100%. The rest are then ranked based on their momentum relative to the leading Stock.

For more details, see NTSM Page at…

https://navigatethestockmarket.blogspot.com/p/a-system-for-trading-dow-30-stocks-my_8.html

WEDNESDAY MARKET INTERNALS

(NYSE DATA)

My basket of Market Internals declined to SELL again. (My basket of Market Internals is a decent trend-following analysis that is most useful when it diverges from the Index.)

...My current invested

position is about 30% stocks, including stock mutual funds and ETFs – extreme

bearish. (I’ll need to recalculate the %.) 50% invested in stocks is a normal

position. (75% is my max stock allocation when I am confident that markets will

continue higher; 30% in stocks is my Bear market position.)

I trade about 15-20% of the total portfolio using the momentum-based analysis I provide here. When I see bullish signs, I add a lot more stocks to the portfolio, usually by using an S&P 500 ETF as I did back in October 2022 and 2023.

“The first thing is the debt issue, we have a very severe supply-demand problem,” Bridgewater founder Ray Dalio told CNBC’s Sara Eisen at CONVERGE LIVE in Singapore regarding U.S. debt. Dalio, who was speaking on the same panel as Salesforce CEO Marc Benioff, said this will require the White House to sell a quantity of debt the world is just not going to want to buy. “That’s a set of circumstances that is imminent, OK? That is paramount importance,” he said, adding that most people don’t understand the mechanics of debt.” Story at...

https://www.cnbc.com/2025/03/12/ray-dalio-warns-growing-us-debt-will-lead-to-shocking-developments.html

My cmt: As demand to buy treasury bonds declines, interest rates will rise and kill the economy. Unchecked, the existence of our country will be at risk.

“The consumer price index, a wide-ranging measure of costs across the U.S. economy, ticked up a seasonally adjusted 0.2% for the month, putting the annual inflation rate at 2.8%, according to the Labor Department agency. The all-item CPI had increased 0.5% in January... Excluding food and energy prices, the core CPI also rose 0.2% on the month and was at 3.1% on a 12-month basis, the lowest reading since April 2021. The core CPI had climbed 0.4% in January.” Story at...

https://www.cnbc.com/2025/03/12/cpi-inflation-report-february-2025.html

“U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) increased by 1.4 million barrels from the previous week. At 435.2 million barrels, U.S. crude oil inventories are about 5% below the five year average for this time of year.” Report at...

https://ir.eia.gov/wpsr/wpsrsummary.pdf

-Wednesday the S&P 500 rose about 0.5% to 5599.

-VIX fell about 10% to 24.23.

-The yield on the 10-year Treasury rose (compared to about this time, prior trading day) to 4.316%.

None

Today, of the 50-Indicators I track, 18 gave Bear-signs and 3 were Bullish. The rest are neutral. (It is normal to have a lot of neutral indicators since many of the indicators are top or bottom indicators that will signal only at extremes.)

TODAY’S COMMENT

As of today’s close, the S&P 500 was down 8.5% from its all-time high. The S&P 500 closed 2.4% below its 200-day, moving average.

This indicator is based on my best guess of the Lowry Research methodology. Lowry Research is one of the oldest stock market, technical analysis/investment companies. They do not publish their methodology, however, there are descriptions on the internet. One clear difference is that their model is based only on publicly traded companies while mine is based on all issues listed on the NYSE.

No bottom yet. I am bearish with a very conservative allocation of only about 30% invested in stock holdings.

TODAY’S RANKING OF 15 ETFs (Ranked Daily) ETF ranking follows:

*For additional background on the ETF ranking system see NTSM Page at…

http://navigatethestockmarket.blogspot.com/p/exchange-traded-funds-etf-ranking.html

For more details, see NTSM Page at…

https://navigatethestockmarket.blogspot.com/p/a-system-for-trading-dow-30-stocks-my_8.html

My basket of Market Internals declined to SELL again. (My basket of Market Internals is a decent trend-following analysis that is most useful when it diverges from the Index.)

I trade about 15-20% of the total portfolio using the momentum-based analysis I provide here. When I see bullish signs, I add a lot more stocks to the portfolio, usually by using an S&P 500 ETF as I did back in October 2022 and 2023.