“Trade what you see; not what you think.” – The Old Fool, Richard McCranie, trader extraordinaire.

“Americans won’t miss the Venezuelan and MS-13 gang members dispatched by the Trump Administration to El Salvador on the weekend. Most of them are criminals who were in the U.S. illegally. But it’s still troubling to see U.S. officials appear to disdain the law in the name of upholding it.

President Trump ordered the deportation of nearly 300 alleged members of Venezuela’s Tren de Aragua gang, as well as several from MS-13, the ruthless Salvadoran gang. They were apparently deported without a hearing in an immigration court, much less a criminal conviction... The Administration invoked the Alien Enemies Act of 1798 to justify the deportations without need for due process. That law has rarely been used in U.S. history and not since World War II....“They’re not gonna stop us,” Tom Homan, Mr. Trump’s immigration czar, told Fox News on Monday. “We’re not stopping. I don’t care what the judges think, I don’t care what the left thinks, we’re coming.” Elon Musk threatened Judge Boasberg with impeachment, and the MAGA-sphere chanted that Mr. Trump should ignore the courts. Are we already arriving at a constitutional impasse when the Administration thinks it can ignore court orders?” – WSJ Editorial Board at...

https://www.wsj.com/opinion/trump-deportations-gang-members-james-boasberg-tom-homan-nayib-bukele-ms-13-tren-de-aragua-6e377106?mod=commentary_trendingnow_article_pos2

“The index’s three-month moving average by contrast increased to 0.03 in January from minus 0.13 in December. The CFNAI diffusion index—which captures how much the change in the monthly index is spread among the indicators over three months—similarly increased, reaching 0.10 from minus 0.07 a month earlier. Periods of economic expansion have historically been associated with values of the CFNAI diffusion index above minus 0.35.” Story at...

https://www.wsj.com/economy/u-s-economic-growth-falls-back-below-average-02120246

-Monday the S&P 500 rose about 1.8% to 5768.

-VIX fell about 9% to 17.48.

-The yield on the 10-year Treasury rose to 4.338% (compared to about this time prior market day).

SSO added 3/24/2025

XLK added 3/24/2025

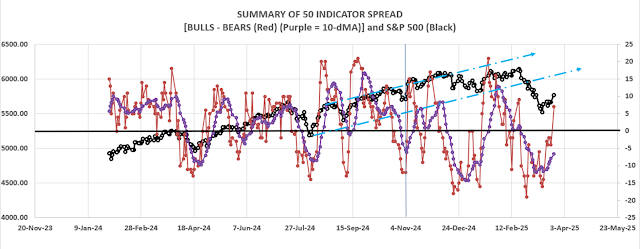

Today, of the 50-Indicators I track, 6 gave Bear-signs and 13 were Bullish. The rest are neutral. (It is normal to have a lot of neutral indicators since many of the indicators are top or bottom indicators that will signal only at extremes.)

TODAY’S COMMENT

The daily, bull-bear spread of 50-indicators improved to a Bullish +7 (7 more Bull indicators than Bear indicators). The 10-dMA of the spread improved again – another bullish sign. The spread was +9 around mid-day today, but breadth declined a little and flipped one of my breadth indicators back to the bear side.

Still, I am left with the problem that the S&P 500 may still need to retest the low. The low on 13 March (7 trading session ago) was on lower volume than the previous low, but market internals didn’t improve appreciably. That suggests that a retrace to the 5525 level is still possible and I think it will re-test the lows; but I am following the indicators, not what I think. I am cautiously bullish.

I moved to a 50% invested position today, 24 March. Investors are more bullish and that has pushed indicators to the bullish side.

TODAY’S RANKING OF 15 ETFs (Ranked Daily) ETF ranking follows:

*For additional background on the ETF ranking system see NTSM Page at…

http://navigatethestockmarket.blogspot.com/p/exchange-traded-funds-etf-ranking.html

DOW STOCKS - TODAY’S MOMENTUM RANKING OF THE DOW 30 STOCKS (Ranked Daily)

For more details, see NTSM Page at…

https://navigatethestockmarket.blogspot.com/p/a-system-for-trading-dow-30-stocks-my_8.html

MONDAY MARKET INTERNALS (NYSE DATA)

My basket of Market Internals reversed to BUY. (My basket of Market

Internals is a decent trend-following analysis that is most useful when it

diverges from the Index.)

...My current invested

position is about 50% stocks, including stock mutual funds and ETFs. 50%

invested in stocks is a normal position. (75% is my max stock allocation when I

am confident that markets will continue higher; 30% in stocks is my Bear market

position.)

I trade about 15-20% of the total portfolio using the momentum-based analysis I provide here. When I see bullish signs, I add a lot more stocks to the portfolio, usually by using an S&P 500 ETF as I did back in October 2022 and 2023.

I trade about 15-20% of the total portfolio using the momentum-based analysis I provide here. When I see bullish signs, I add a lot more stocks to the portfolio, usually by using an S&P 500 ETF as I did back in October 2022 and 2023.