“Trade what you see; not what you think.” – The Old Fool,

Richard McCranie, trader extraordinaire.

“When you want to help people, you tell them the truth.

When you want to help yourself, you tell them what they want to hear... The

fact that so many successful politicians are such shameless liars is not only a

reflection on them, it is also a reflection on us. When the people want the

impossible, only liars can satisfy.” ― Thomas

Sowell, senior fellow at the Hoover Institution.

MARKET REPORT / ANALYSIS

-Monday the S&P 500 rose about 0.2% to 4412.

-VIX rose about 2% to 15.07.

-The yield on the 10-year Treasury rose to 4.004%.

PULLBACK DATA:

-Drop from Top: 8.1%. 25.4% max (on a closing basis).

-Trading Days since Top: 379-days.

The S&P 500 is 9.8% ABOVE its 200-dMA and 3.6%

ABOVE its 50-dMA.

*I won’t call the correction over until the S&P 500

makes a new-high; however, evidence suggests the bottom was in the 3600 area

and we called a buy on 4 October 2022.

MY TRADING POSITIONS:

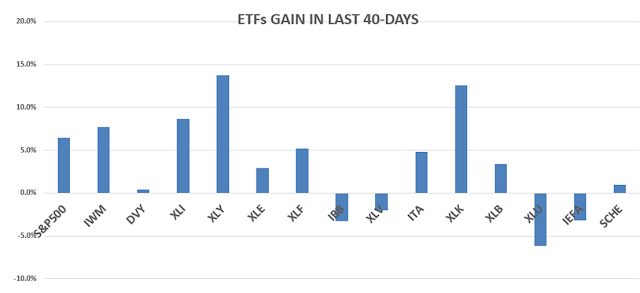

I am not trading as much as in the past. You may wish to

use the momentum charts and/or the Monday, 40-day gain charts for trading the

Dow stocks and ETFs.

MSFT – Microsoft.

XLK – Technology ETF.

XLY - Consumer Discretionary ETF.

KRE – Regional Banking ETF. This is a very small position

for me. KRE tested the May 4 low of 36.08 on much lower volume 11 &

12 May.

I haven’t sold yet. On the positive side, it has not

breached its recent low around 36.

SHY – Short term bonds. 30-day yield is 5.04% - 9 June

2023. (Trailing 1-year yield is 3.04%.) Once this weak period ends, I’ll sell

SHY and buy stocks/stock ETFs.

TODAY’S COMMENT:

The black curve in the above chart shows the S&P 500

since last July 2022. The Index has been in an uptrend since the October lows

and more recently, since mid-March. It bounced off its upper trendline on 15

June and again on 3 July. It is currently below its mid-June high when we said

it looked like the Index had made a short-term high. That call remains, but indicators, other than

the chart, are much more positive. Mr.

Market may ignore my indicator (It wouldn’t be unusual.) and the Index could

continue higher along its upper trend line. That’s a good reason for not

shorting the advance right now. I am still expecting the S&P 500 to retreat

to its lower trend line, sooner rather than later.

The red and green lines represent buying pressure minus

selling pressure so the upward trending lines are bullish. We can also see why this indicator was

instrumental in calling the October 2022 bottom.

The daily spread of 20 Indicators (Bulls minus Bears) remained

+1 (a positive number is bullish; negatives are bearish); the 10-day smoothed

sum that smooths the daily fluctuations improved from -14 to -5. (The

trend direction is more important than the actual number for the 10-day value.)

These numbers sometimes change after I post the blog based on data that comes

in late. Most of these 20 indicators are short-term so they tend to bounce

around a lot.

LONG-TERM INDICATOR: The Long Term NTSM indicator

remained HOLD: PRICE is positive; SENTIMENT, VIX & VOLUME are neutral.

(The important BUY in this indicator was on 21 October,

7-days after the bottom. For my NTSM overall signal, I suggested that a

short-term buying opportunity occurred on 27 September (based on improved

market internals on the retest), although without market follow-thru, I was

unwilling to call a buy; however, I did close shorts and increased stock

holdings. I issued a Buy-Signal on 4 October, 6-days before the final bottom,

based on stronger market action that confirmed the market internals signal. The

NTSM sell-signal was issued 20 December, 8 sessions before the high of this

recent bear market, based on the bearish “Friday Rundown” of indicators.)

Bottom line: I remain a cautious Bull, still expecting a

decline of around 4-5% on the S&P 500 to start soon.

ETF - MOMENTUM ANALYSIS:

TODAY’S RANKING OF 15 ETFs

(Ranked Daily)

ETF ranking follows:

The top ranked ETF receives

100%. The rest are then ranked based on their momentum relative to the

leading ETF.

*For additional background on

the ETF ranking system see NTSM Page at…

http://navigatethestockmarket.blogspot.com/p/exchange-traded-funds-etf-ranking.html

DOW STOCKS - TODAY’S MOMENTUM RANKING

OF THE DOW 30 STOCKS (Ranked Daily) DOW 30 momentum ranking

follows:

The top ranked Stock receives

100%. The rest are then ranked based on their momentum relative to the leading Stock.

For more details, see NTSM

Page at…

https://navigatethestockmarket.blogspot.com/p/a-system-for-trading-dow-30-stocks-my_8.html

MONDAY MARKET INTERNALS (NYSE

DATA)

My basket of Market Internals remained BUY. (My basket of Market

Internals is a decent trend-following analysis of current market action, but

should not be used alone for short term trading. They are most useful when they

diverge from the Index.)

...My current invested

position is about 55% stocks, including stock mutual funds and ETFs. I’m

usually about 50% invested in stocks.

I trade about 15-20% of the

total portfolio using the momentum-based analysis I provide here. If I can see

a definitive bottom, I’ll add a lot more stocks to the portfolio using an S&P

500 ETF.