“Trade what you see; not what you think.” – The Old Fool, Richard McCranie, trader extraordinaire.

“The Supreme Court on Friday said President Biden does not have authority for his roughly $400 billion program to forgive student loan debt, the latest blow from a Supreme Court that has been dismissive of this administration’s bold claims of power.” Story at

https://www.washingtonpost.com/politics/2023/06/30/supreme-court-decision-student-loan-forgiveness/

My cmt: The Constitution is clear: Federal spending is controlled by the Legislative Branch, not the Executive Branch of Government. The most troubling fact in this decision is that 3 Justices of the Supreme Court don’t understand the Constitution, the very document they are enjoined to interpret. Didn’t they take Civics in high school? ...

... In reality, I think they understand the Constitution very well. They just chose to ignore it (even though they swore an oath to uphold it) – the very definition of judicial hubris.

...Even Biden knew he didn’t have the authority to cancel the debt. Last year USA Today wrote, “During a weekend interview [in October 2022] with the progressive group NowThis News, President Joe Biden made the startling claim that he had ‘signed a law to forgive student debt.’ After going into some detail about how much the ‘law’ would offer 40 million Americans, he also said, ‘It’s passed. I got it passed by a vote or two, and it’s in effect.’” Story from USA Today at...

https://www.usatoday.com/story/opinion/columnist/2022/10/26/biden-student-debt-relief-gaffe-should-alarm-all-americans/10595785002/

Biden’s claim wasn’t true, of course. This is just another example of our President’s declining mental facilities; but at least he understands the Constitution, or did 8 months ago.

“President Biden was using the Higher Education Relief Opportunities for Students (HEROES) Act of 2003 to order the largest loan forgiveness program in U.S. history. The law is only a few pages long and was intended to assist military personnel deployed abroad in combat zones. The idea of using that law in order to avoid getting congressional approval for such a massive expenditure was laughable. The Office of Legal Counsel considered the theory and issued a memo stating that it would be unconstitutional.” Story at...

https://www.msn.com/en-us/news/politics/constitutional-cruelty-democrats-now-oppose-a-democratic-process-on-student-loans/ar-AA1dinu9?cvid=cfda53592d24465d9b79d31241846c7d&ei=18

“Hard to believe, given that Mulvaney’s face on a can spurned this entire marketing mess for Bud Light parent company Anheuser-Busch in the first place, but the transgender influencer has taken the same stance as many others in the LGBTQ+ community — accusing the brand of not offering support amidst a massive backlash for using Mulvaney in the first place.” Story at...

Anheuser-Busch Fires Back at Dylan Mulvaney as Bud Light Marketing Disaster Rolls On (msn.com)

My cmt: Bud Light sales have dropped 24% since they used transgender influencer, Dylan Mulvaney, as a spokesman. The failure of Busch to understand its Bud Light customers will be taught in Business Schools for generations.

“The June Manufacturing PMI® registered 46 percent, 0.9 percentage point lower than the 46.9 percent recorded in May. Regarding the overall economy, this figure indicates a seventh month of contraction after a 30-month period of expansion... Demand remains weak, production is slowing due to lack of work, and suppliers have capacity. There are signs of more employment reduction actions in the near term.” Press release at...

https://www.prnewswire.com/news-releases/manufacturing-pmi-at-46-june-2023-manufacturing-ism-report-on-business-301868365.html

-Monday the S&P 500 rose about 0.1% to 4456.

-VIX slipped about 0.4% to 13.57.

-The yield on the 10-year Treasury rose to 3.858%.

-Drop from Top: 7.1%. 25.4% max (on a closing basis).

-Trading Days since Top: 375-days.

The S&P 500 is 11.3% ABOVE its 200-dMA and 5.3% ABOVE its 50-dMA.

*I won’t call the correction over until the S&P 500 makes a new-high; however, evidence suggests the bottom was in the 3600 area and we called a buy on 4 October 2022.

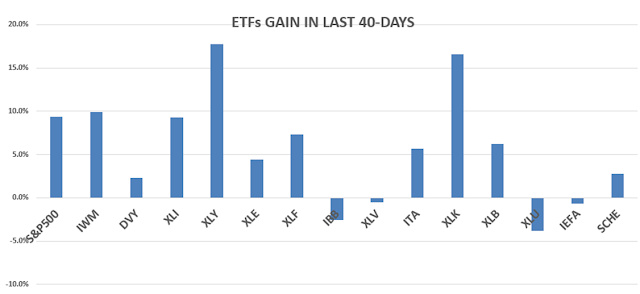

I am not trading as much as in the past. You may wish to use the momentum charts and/or the Monday 40-day gain charts for trading the Dow stocks and ETFs.

XLK – Technology ETF.

XLY - Consumer Discretionary ETF.

I haven’t sold yet. On the positive side, it has not breached its recent low around 36.

Volume was low today; trading closed at 1pm. Indicators improved, but the main issue for the S&P 500 is that it is at its upper trend line. This suggests the rate of future increases are somewhat limited. The Index may continue higher as it crawls along that upper trendline, but sooner or later, it will begin a decline toward the lower trend line and the 50-dMA. I suspect that will begin shortly after the Holiday based on previous indicators. For now, current indicators are improving so I could be wrong. That’s why I remain fully invested.

TODAY’S RANKING OF 15 ETFs (Ranked Daily)

ETF ranking follows:

The top ranked ETF receives 100%. The rest are then ranked based on their momentum relative to the leading ETF.

*For additional background on the ETF ranking system see NTSM Page at…

http://navigatethestockmarket.blogspot.com/p/exchange-traded-funds-etf-ranking.html

DOW STOCKS - TODAY’S MOMENTUM RANKING OF THE DOW 30 STOCKS (Ranked Daily)

DOW 30 momentum ranking follows:

For more details, see NTSM Page at…

https://navigatethestockmarket.blogspot.com/p/a-system-for-trading-dow-30-stocks-my_8.html

MONDAY MARKET INTERNALS (NYSE DATA)

My basket of Market Internals slipped to HOLD. (My basket of Market Internals is a decent trend-following analysis of current market action, but should not be used alone for short term trading. They are most useful when they diverge from the Index.)