“Trade what you see; not what you think.” – The Old Fool, Richard McCranie, trader extraordinaire.

https://www.nbcnews.com/science/environment/nyc-flooding-climate-change-infrastructure-limitations-rcna118170

My cmt: The rain came from a stalled tropical system, Ophelia, that merged with a front. Gee, that’s never happened before. It must be Global Warming?

“Scott Hall, one of the 18 co-defendants of former President Donald Trump in his Georgia election interference case, pleaded guilty Friday in Atlanta to five misdemeanor conspiracy charges... At a hearing in Fulton County Superior Court, Hall confirmed to Judge Scott McAfee that his plea deal requires him to testify in future proceedings in the case, including trials of his co-defendants, including Trump.” Story at...

https://www.cnbc.com/2023/09/29/first-co-defendant-in-trump-georgia-election-case-pleads-guilty.html

"The Manufacturing PMI® registered 49 percent in September, 1.4 percentage points higher than the 47.6 percent recorded in August. The overall economy expanded weakly after nine months of contraction following a 30-month period of expansion. (A Manufacturing PMI® above 48.7 percent, over a period of time, generally indicates an expansion of the overall economy.)” Press release at...

https://www.prnewswire.com/news-releases/manufacturing-pmi-at-49-september-2023-manufacturing-ism-report-on-business-301943535.html

“U.S. construction spending increased in August, lifted by outlays on single- and multi-family housing, though mortgage rates at nearly 23-year highs could slow momentum. The Commerce Department said on Monday that construction spending rose 0.5%.” Story at...

https://finance.yahoo.com/news/us-construction-spending-rises-august-144244258.html

-Monday the S&P 500 was unchanged at 4288.

-VIX rose about 0.5% to 17.61.

-The yield on the 10-year Treasury rose to 4.676%.

-Drop from Top: 10.6%. 25.4% max (on a closing basis).

-Trading Days since Top: 438-days.

The S&P 500 is 2.1% ABOVE its 200-dMA and 3.6% BELOW its 50-dMA.

*I won’t call the correction over until the S&P 500 makes a new-high; however, evidence suggests the bottom was in the 3600 area and we called a buy on 4 October 2022.

XLK – Technology ETF (holding since the October 2022 lows).

XLY - Consumer Discretionary ETF. (Holding since the October 2022 lows - I bought more XLY Monday, 8/21.)

I took profits and then reestablished positions as follows:

SPY – I bought a large position in the S&P 500 Friday, 8/14, in my 401k (it has limited choices).

XLE – Added Tuesday, 8/22.

SSO – 2x S&P 500 ETF. Added 8/24.

CSCO – added 9/5.

Mary Ann Bartels, of Sanctuary Wealth said this afternoon on CNBC’s Fast Money, “This is just a correction. Expect a 5-10% pullback from July highs.” (A 10% drop would be 4130 on the S&P 500.) I tend to agree with her assessment, but the first of the month is when a lot of automatic deposits are made into 401k accounts. The early part of the month, especially the first trading day, is usually up, so it is a little disconcerting to see the markets down/flat today. Breadth slipped today as market internals were very weak and that’s a worrying sign.

I’m not selling now. I’d prefer to hang on since I am still expecting a relatively shallow pullback from August highs and if the markets haven’t bottomed yet, they are not far from it.

TODAY’S RANKING OF 15 ETFs (Ranked Daily)

ETF ranking follows:

*For additional background on the ETF ranking system see NTSM Page at…

http://navigatethestockmarket.blogspot.com/p/exchange-traded-funds-etf-ranking.html

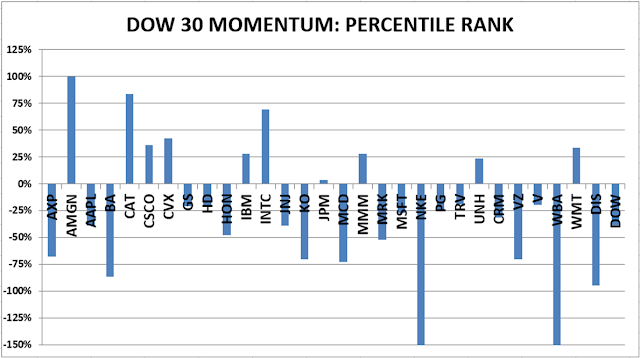

DOW 30 momentum ranking follows:

For more details, see NTSM Page at…

https://navigatethestockmarket.blogspot.com/p/a-system-for-trading-dow-30-stocks-my_8.html

MONDAY MARKET INTERNALS (NYSE DATA)

My basket of Market Internals remained SELL. (My basket of Market Internals is a decent trend-following analysis of current market action, but should not be used alone for short term trading. They are most useful when they diverge from the Index.)