Momentum Trading DOW Stocks & ETFs … Stock Market Analysis ...

“Trade what you see; not what you think.” – The Old Fool,

Richard McCranie, trader extraordinaire.

“The S&P 500 has some more downside this week to

breach the October lows and bottom somewhere around 4200. 4200 is not some

magical number. Stocks could bottom just above or a few percent below, but that

scenario relies on the market finding buying interest this coming week.” Paul

Schatz, President Heritage Capital. Commentary at...

https://investfortomorrow.com/blog/ugly-friday-for-the-bulls-but-it-is-monday-scenario-building-for-q4/

MARKET REPORT / ANALYSIS

-Monday the S&P 500 fell 0.2% to 4217.

-VIX bucked the trend and dropped about 6% to 20.37.

-The yield on the 10-year Treasury slipped to 4.848%.

PULLBACK DATA:

-Drop from Top: 12.1%. 25.4% max (on a closing basis).

(47% retracement.)

-Trading Days since Top: 453-days.

The S&P 500 is 0.4% BELOW its 200-dMA and 3.8%

BELOW its 50-dMA.

*I won’t call the correction over until the S&P 500

makes a new-high; however, evidence suggests the bottom was in the 3600 area

and we called a buy on 4 October 2022.

MY TRADING POSITIONS:

XLK – Technology ETF (holding since the October 2022

lows).

XLY - Consumer Discretionary ETF. (Holding since the

October 2022 lows - I bought more XLY Monday, 8/21.)

I took profits and then reestablished positions as

follows:

SPY – I bought a large position in the S&P 500

Friday, 8/14, in my 401k (it has limited choices).

XLE – Added Tuesday, 8/22.

SSO – 2x S&P 500 ETF. Added 8/24.

CSCO – added 9/5.

I have considered selling CSCO because it is no longer

a momentum leader - but I am still holding it. INTC would probably have been my

choice, but it has been under pressure due to restrictions on chip sales to

China.

TODAY’S COMMENT:

I am watching the numbers as the markets fall to see if

we can I identify a bottom of this dip. So far, no bottom. Volume was lower

today, but other internals were worse.

I updated the Summary of Indicators and it was worse, too:

Monday there were 2 Bull and 20 Bear indicators. (It was 2 Bull and 18 Bear

Friday.)

Cyclical Industrials (XLI) are under-performing the

S&P 500 Index and that is a bearish sign. I thought I’d take a look at Consumer

Staples (XLP) vs. the Index. If

investors are concerned, then XLP should be outpacing the S&P 500. Over the last 5 days, XLP has outperformed

the Index, a bearish sign. On the bullish side, the Index is outpacing

Utilities (XLU); But, in the end, price matters most and the Index has broken

its 200-dMA so I am looking at Trend Break rules.

Trend breaks are declared on several different rules, depending

on who is doing the talking: (1) when price exceeds an established trendline 2

days in a row. (2) Others say a break must be 3% above or below the trend line. If we apply that to the 200-dMA, we may

accept a drop below 4108 as a point to sell. (3) Lance Roberts says a break

below the 200-dMA must stay there for a trading week, 5-days. Pick your poison.

The markets may be close to a bottom, but how much more

can I take? Not much, but I am going to be patient for a bit longer.

The daily spread of 20 Indicators (Bulls minus Bears) declined

from -11 to -12 (a positive number is bullish; negatives are bearish); the

10-day smoothed sum that smooths the daily fluctuations declined from +7

to -8. (The trend direction is more important than the actual number for the

10-day value.) These numbers sometimes change after I post the blog based on

data that comes in late. Most of these 20 indicators are short-term so they

tend to bounce around a lot.

LONG-TERM INDICATOR: The Long Term NTSM indicator switched

to SELL: VOLUME & VIX is bearish; PRICE & SENTIMENT are neutral. I may

be following this indicator soon; but not yet.

(The important BUY in this indicator was on 21 October,

7-days after the bottom. For my NTSM overall signal, I suggested that a

short-term buying opportunity occurred on 27 September (based on improved

market internals on the retest), although without market follow-thru, I was

unwilling to call a buy; however, I did close shorts and increased stock

holdings. I issued a Buy-Signal on 4 October, 6-days before the final bottom,

based on stronger market action that confirmed the market internals signal. The

NTSM sell-signal was issued 21 December, 9 sessions before the high of this

recent bear market, based on the bearish “Friday Rundown” of indicators.)

BOTTOM LINE HASN’T CHANGED:

I haven’t sold yet, but with today’s test of recent lows

and a test of the 200-dMA, we must be concerned. The Friday Summary Rundown of

Indicators is also quite bearish. If we

see more losses this week, I’ll be forced to take profits going back to the

October 2022 lows. (They are now a lot less than they were in June.) The

markets may bounce higher – I’ll wait and see what happens Monday and maybe

Tuesday. About 3 weeks ago, I said that I didn’t expect the S&P 500 to fall

much below 4200 – we’ll see.

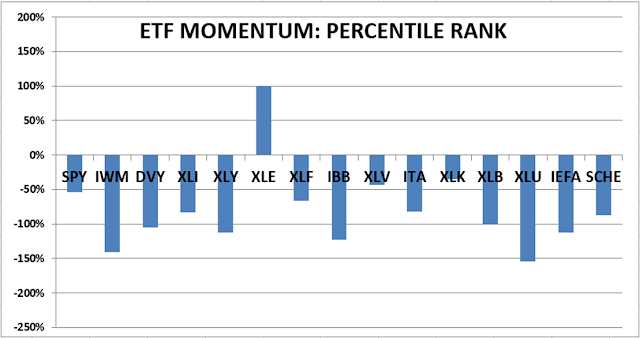

ETF - MOMENTUM ANALYSIS:

TODAY’S RANKING OF 15 ETFs (Ranked Daily)

ETF ranking follows:

The top ranked ETF receives

100%. The rest are then ranked based on their momentum relative to the leading

ETF.

*For additional background on

the ETF ranking system see NTSM Page at…

http://navigatethestockmarket.blogspot.com/p/exchange-traded-funds-etf-ranking.html

DOW STOCKS - TODAY’S MOMENTUM RANKING

OF THE DOW 30 STOCKS (Ranked Daily)

DOW 30 momentum ranking

follows:

The top ranked Stock receives

100%. The rest are then ranked based on their momentum relative to the leading Stock.

For more details, see NTSM

Page at…

https://navigatethestockmarket.blogspot.com/p/a-system-for-trading-dow-30-stocks-my_8.html

MONDAY MARKET INTERNALS (NYSE

DATA)

My basket of Market Internals remained SELL. (My basket of Market

Internals is a decent trend-following analysis of current market action, but

should not be used alone for short term trading. They are most useful when they

diverge from the Index.)

...My current invested

position is about 75% stocks, including stock mutual funds and ETFs. I’m

usually about 50% invested in stocks. I’m “over invested” now expecting new,

all-time highs this year. That burns all the cash. I have about 25% of the portfolio in bonds.

I trade about 15-20% of the

total portfolio using the momentum-based analysis I provide here. When I see a

definitive bottom, I add a lot more stocks to the portfolio using an S&P

500 ETF as I did back in October.