ISM Manufacturing ... Construction Spending ... Momentum Trading DOW Stocks & ETFs … Stock Market Analysis ...

“Trade what you see; not what you think.” – The Old Fool,

Richard McCranie, trader extraordinaire.

“Far more

money has been lost by investors in preparing for corrections, or anticipating

corrections, than has been lost in the corrections themselves.” -

Peter Lynch, former manager of Fidelity’s Magellan® fund.

"The one thing that doesn't abide by majority rule

is a person's conscience." – Atticus Finch.

"Whoever heard you get indicted for interfering with

a presidential election, where you have every right to do it, you get indicted,

and your poll numbers go up. When people get indicted your pull numbers go down."

– Donald Trump, admitting he interfered with the 2020 election.

"Coal production continues to rise sharply. Bloomberg

reports, “Even as temperatures on Earth smash new records and scientists warn

the climate is reaching dangerous tipping points, the amount of coal being

consumed keeps on growing.” Coal will not be replaced soon because it is a

critical energy source for producing electricity and cannot be replaced in the

foreseeable future.

Alternative energy contributes very little to the global

total. Hydroelectric contributes 14%, and nuclear contributes 9%. Since a

reactor meltdown at the Three Mile Island location in 1979, it has been hard to

get the American public to accept new nuclear facilities. Nuclear

power could make a comeback.

Bloomberg points out that India and China depend heavily

on coal for their energy production. China is the world’s largest producer of

greenhouse gases, and India is third after the US." From...

Coal

Is Energy King, And Nothing Could Be Worse (msn.com)

ISM MANUFACTURING PMI (ISM)

“The Manufacturing PMI® registered 47.2 percent in

August, up 0.4 percentage point from the 46.8 percent recorded in July. The

overall economy continued in expansion for the 52nd month after one month of

contraction in April 2020. (A Manufacturing PMI® above 42.5 percent, over

a period of time, generally indicates an expansion of the overall

economy.) Report at...

https://www.ismworld.org/supply-management-news-and-reports/reports/ism-report-on-business/pmi/august/

CONSTRUCTION SPENDING (Reuters)

“U.S. construction spending fell more than expected in

July as higher mortgages and increased supply weighed on single-family

homebuilding. The Commerce Department's Census Bureau said on Tuesday that

construction spending dropped 0.3% after being unchanged in June.

https://www.reuters.com/markets/us/us-construction-spending-falls-more-than-expected-july-2024-09-03/

MARKET REPORT / ANALYSIS

-Tuesday the S&P 500 fell about 2.1% to 5529.

-VIX jumped about 38% to 20.72.

-The yield on the 10-year Treasury decline to 3.831%

(compared to about this time, prior trading day).

MY TRADING POSITIONS:

XLK – Holding since the October 2022 lows.

XLK – added more 7/26. This reestablishes the position I

had before this recent weakness.

UWM – added 7/15.

QLD – added 7/24.

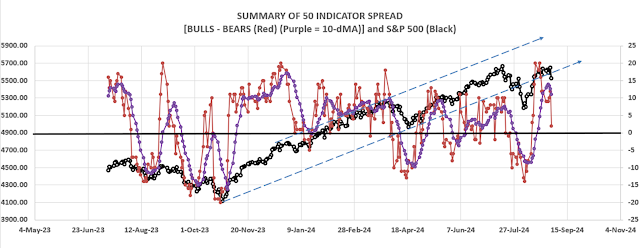

CURRENT SUMMARY OF APPROXIMATELY 50 INDICATORS:

The Bull/Bear Spread dropped to Neutral at 10 Bear-signs

and 12-Bull. (The rest are neutral. It is normal to have a lot of neutral

indicators since many of those are top or bottom indicators that will signal

only at extremes.)

The Bull/Bear, 50-Indicator spread (Bull Indicators minus

Bear Indicators) dropped from +12 to +2 (2more Bull indicators than Bear

indicators). The 10-dMA continued down, a bearish sign and that’s a worry.

TODAY’S COMMENT:

Wow! I thought we were out of the woods Friday, but today

was a painful reminder that Mr. Market doesn’t

pay attention to my blog.

The S&P 500 broke its lower trend line going back to

the 25 October low. One of the pundits on CNBC said that the recent low of 5

August would probably be retested. I

didn’t believe him then, but he may be right.

On a positive note, Tuesday was a statistically

significant down-day. That just means that the price-volume move exceeded my

statistical parameters. Statistics show that a statistically-significant, down-day

is followed by an up-day about 60% of the time.

I may sell some leveraged positions depending on

market action tomorrow.

LONG-TERM INDICATOR: The Long Term NTSM indicator

remained HOLD: VIX, VOLUME, SENTIMENT & PRICE are neutral. (This indicator

is more valuable for Sell-signals and during major Bear Markets.) I am going to

stop reporting this indicator. It seems confusing to show indicators with

different outcomes. I’ll continue to

track it because it can be valuable information.

{The important major BUY in this indicator was on 21

October 2022, 7-days after the bear-market bottom. For my NTSM overall signal,

I suggested that a short-term buying opportunity occurred on 27 September 2022 (based

on improved market internals on the retest), although without market

follow-thru, I was unwilling to call a buy; however, I did close shorts and

increased stock holdings. I issued a Buy-Signal on 4 October, 6-days before the

final bottom, based on stronger market action that confirmed the market

internals signal. The NTSM sell-signal was issued 21 December, 9 sessions

before the high of the 2022 bear market, based on the bearish “Summary of 50”

indicator.}

BOTTOM LINE

Time to get neutral and watch indicators. The 10-day

moving average of 50-indicators is now falling and that’s a worry.

ETF - MOMENTUM ANALYSIS:

TODAY’S RANKING OF 15 ETFs (Ranked Daily) ETF ranking

follows:

The top ranked ETF receives

100%. The rest are then ranked based on their momentum relative to the leading

ETF.

*For additional background on

the ETF ranking system see NTSM Page at…

http://navigatethestockmarket.blogspot.com/p/exchange-traded-funds-etf-ranking.html

DOW STOCKS - TODAY’S MOMENTUM RANKING

OF THE DOW 30 STOCKS (Ranked Daily)

The top ranked Stock receives

100%. The rest are then ranked based on their momentum relative to the leading Stock.

For more details, see NTSM

Page at…

https://navigatethestockmarket.blogspot.com/p/a-system-for-trading-dow-30-stocks-my_8.html

TUESDAY MARKET INTERNALS (NYSE

DATA)

My basket of Market Internals remained HOLD. (My basket of Market

Internals is a decent trend-following analysis of current market action, but

should not be used alone for short term trading. They are most useful when they

diverge from the Index.)

...My current invested

position is about 75% stocks, including stock mutual funds and ETFs. I’m

usually about 50% invested in stocks when markets are stretched; my current

stock position is above the norm. (75% is my max stock allocation when I am

strongly bullish.)

I trade about 15-20% of the total portfolio using the

momentum-based analysis I provide here. When I see a definitive bottom, I add a

lot more stocks to the portfolio, usually by using an S&P 500 ETF as I did

back in October 2022 and 2023.