“Trade what you see; not what you think.” – The Old Fool, Richard McCranie, trader extraordinaire.

Semafor reported Tuesday that Tester has made it clear he would oppose Harris' efforts to do away with the filibuster outright if he wins another six-year term this November.” Story at...

Senate Democrat in must-win state comes out against Kamala Harris’ plan to end filibuster (msn.com)

My cmt: The Tenth Amendment to the U.S. Constitution states that the powers not delegated to the United States by the Constitution, nor prohibited by it to the States, are reserved to the States respectively, or to the people. Abortion is not covered in the Constitution, so why would Harris think that the Federal Government has the power to codify Roe vs Wade? The Supreme Court already ruled on the issue and specifically stated the States have the authority. Apparently, she plans to stack the Court too.

“Sales of new US single-family homes fell in August, but declining mortgage rates and house prices could stimulate demand in the months ahead. New home sales dropped 4.7% to a seasonally adjusted annual rate of 716,00 units last month...Sales rose 9.8% on a year-on-year basis in August.” Story at...

https://nypost.com/2024/09/25/business/new-home-sales-prices-dropped-ahead-of-fed-rate-cut/

“U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) decreased by 4.5 million barrels from the previous week. At 413.0 million barrels, U.S. crude oil inventories are about 5% below the five year average for this time of year.” Report at...

https://ir.eia.gov/wpsr/wpsrsummary.pdf

-Wednesday the S&P 500 slipped about 0.2% to 572.

-VIX rose about 0.1% to 15.41.

-The yield on the 10-year Treasury rose to 3.781% (compared to about this time, prior trading day).

XLK – Holding since the October 2022 lows. Added more 9/20.

UWM – added 7/15 & more 9/20.

QLD – added 7/24.

SSO – added 9/16.

SPY – added 9/19 & more 9/20

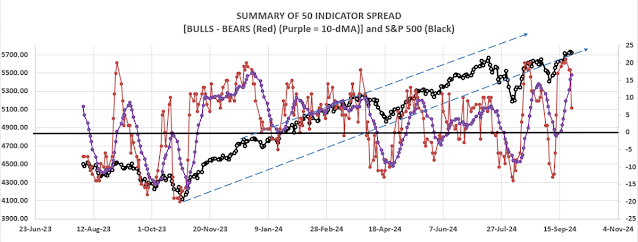

The Bull/Bear Spread remained in a BULL position at 7 Bear-sign and 15-Bull. (The rest are neutral. It is normal to have a lot of neutral indicators since many of those are top or bottom indicators that will signal only at extremes.)

The Bull/Bear, 50-Indicator spread (Bull Indicators minus Bear Indicators) slipped to +8 (8 more Bull indicators than Bear indicators). The 10-dMA is sloping upward, remaining bullish.

The Advance/Decline Ratio remains overbought, so we could easily see another pause in the S&P 500 advance. This tends to be a very short-term signal so it is not a signal to worry about. Overall, indicators look good even though the number of bullish indicators was down Wednesday.

I am bullish.

TODAY’S RANKING OF 15 ETFs (Ranked Daily) ETF ranking follows:

*For additional background on the ETF ranking system see NTSM Page at…

http://navigatethestockmarket.blogspot.com/p/exchange-traded-funds-etf-ranking.html

For more details, see NTSM Page at…

https://navigatethestockmarket.blogspot.com/p/a-system-for-trading-dow-30-stocks-my_8.html

My basket of Market Internals remained BUY. (My basket of Market Internals is a decent trend-following analysis that is most useful when it diverges from the Index.)