Crude Inventories ... Momentum Trading DOW Stocks & ETFs … Stock Market Analysis ...

“Trade what you see; not what you think.” – The Old Fool,

Richard McCranie, trader extraordinaire.

“Far

more money has been lost by investors in preparing for corrections, or

anticipating corrections, than has been lost in the corrections themselves.” -

Peter Lynch, former manager of Fidelity’s Magellan® fund.

“Since this is an era when many people are concerned

about 'fairness' and 'social justice,' what is your 'fair share' of what

someone else has worked for?” ― Thomas Sowell

CRUDE INVENTORIES (EIA)

“U.S. commercial crude oil inventories (excluding those

in the Strategic Petroleum Reserve) decreased by 1.5 million barrels from the

previous week. At 447.0 million barrels, U.S. crude oil inventories are about

3% below the five-year average for this time of year.” Report at...

https://ir.eia.gov/wpsr/wpsrsummary.pdf

MARKET REPORT / ANALYSIS

-Wednesday the S&P 500 slipped about 0.2% to 5165.

-VIX declined about 0.6% to 13.75.

-The yield on the 10-year Treasury rose to 4.188%.

MY TRADING POSITIONS:

QLD- Added 2/20/2024

UWM – Added 1/22/2024.

XLK – Technology ETF (holding since the October 2022

lows).

INTC – Added 12/6/2023.

CRM – Added 1/22/2024

DWCPF - Dow Jones U.S. Completion Total Stock Market

Index. – Added 12/7/2023 when I sold the S&P 500. This is a large position

in my retirement account betting on Small Caps.

TODAY’S COMMENT:

The Russell 200 (Green) is still underperforming the S&P 500 (Blue) as we see in the chart above. But that wasn’t the case today as the Russell was

up 0.3% while the S&P 500 fell about 0.2%. I think the Russell will catch

up so I am heavily weighted toward small caps in IWM, UWM and DWCPF.

CURRENT SUMMARY OF APPROXIMATELY 50 INDICATORS:

Now there are 8 bear-signs and 17-Bull. Monday,

there were 10 bear-signs and 15 bull-signs. Here are a few of the significant

indicators.

-On the Bull side, Buying-Pressure minus Selling-Pressure

turned up. That’s a good sign. It has been bearish since mid-January.

For the Bears, the market remains stretched to the high

side, but neither of the following signals, by themselves, are enough to get me

to adjust the portfolio:

- The S&P 500 is 13.1% above its 200-dMA. Markets are

getting stretched. (The Bear indicator is 12% above the 200-day.)

- All the ETFs I track were above their respective

200-dMA, today, 3/12/2024. That’s too bullish, so it’s a bearish indicator.

This indicator will be extended for a week.

These indicators suggest we need to be alert to the

possibility that markets could retreat and Friday’s Outside Reversal Day is

concerning, even though it is not always correct.

LONG-TERM INDICATOR: The Long Term NTSM indicator

remained HOLD: PRICE is positive; SENTIMENT, VOLUME & VIX are neutral.

(The Long-Term Indicator is not a good top-indicator. It

can signal BUY at a top.)

(The important major BUY in this indicator was on 21

October 2022, 7-days after the bear-market bottom. For my NTSM overall signal,

I suggested that a short-term buying opportunity occurred on 27 September

(based on improved market internals on the retest), although without market

follow-thru, I was unwilling to call a buy; however, I did close shorts and

increased stock holdings. I issued a Buy-Signal on 4 October, 6-days before the

final bottom, based on stronger market action that confirmed the market

internals signal. The NTSM sell-signal was issued 21 December, 9 sessions

before the high of this recent bear market, based on the bearish “Friday Rundown”

of indicators.)

BOTTOM LINE

I remain cautiously bullish.

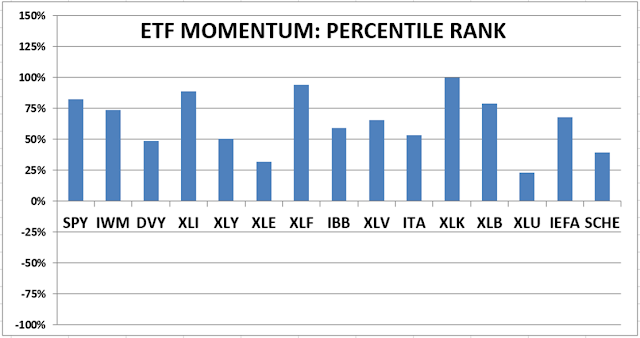

ETF - MOMENTUM ANALYSIS:

TODAY’S RANKING OF 15 ETFs (Ranked Daily) ETF ranking

follows:

The top ranked ETF receives

100%. The rest are then ranked based on their momentum relative to the leading

ETF.

*For additional background on

the ETF ranking system see NTSM Page at…

http://navigatethestockmarket.blogspot.com/p/exchange-traded-funds-etf-ranking.html

DOW STOCKS - TODAY’S MOMENTUM RANKING

OF THE DOW 30 STOCKS (Ranked Daily)

DOW 30 momentum ranking

follows:

The DOW added Amazon to the Dow 30 & Monday I added it to the Momentum

analysis.

The top ranked Stock receives

100%. The rest are then ranked based on their momentum relative to the leading Stock.

For more details, see NTSM

Page at…

https://navigatethestockmarket.blogspot.com/p/a-system-for-trading-dow-30-stocks-my_8.html

WEDNESDAY MARKET INTERNALS

(NYSE DATA)

My basket of Market Internals improved to BUY. (My basket of Market

Internals is a decent trend-following analysis of current market action, but

should not be used alone for short term trading. They are most useful when they

diverge from the Index.)

...My current invested

position is about 70% stocks, including stock mutual funds and ETFs. I’m

usually about 50% invested in stocks. I’m “over invested” now expecting

continuation of bullish market action.

I trade about 15-20% of the total portfolio using the

momentum-based analysis I provide here. When I see a definitive bottom, I add a

lot more stocks to the portfolio using an S&P 500 ETF as I did back in

October.