“Trade what you see; not what you think.” – The Old Fool, Richard McCranie, trader extraordinaire.

“The number of Americans filing for unemployment benefits rose more than expected last week as high-profile companies continue to announce major job cuts. Figures released Thursday by the Labor Department show initial claims for the week ending Feb. 24 jumped by 13,000 to 215,000...” Story at...

https://www.foxbusiness.com/economy/jobless-claims-jumped-more-expected-last-week

“Inflation rose in line with expectations in January, according to an important gauge the Federal Reserve uses as it deliberates cutting interest rates. The personal consumption expenditures price index excluding food and energy costs increased 0.4% for the month and 2.8% from a year ago... The moves came amid an unexpected jump in personal income, which rose 1%, well above the forecast for 0.3%. Spending decreased 0.1% versus the estimate for a 0.2% gain.” Story at...

https://www.cnbc.com/2024/02/29/pce-inflation-january-2023-.html

“The latest Chicago Purchasing Manager's Index (Chicago Business Barometer) fell to 44.0 in February from 46.0 in January, marking the third straight monthly decline.. The latest reading is worse than the 48.1 forecast and keeps the index in contraction territory for a third consecutive month.”

Commentary and charts at...

https://www.advisorperspectives.com/dshort/updates/2024/02/29/chicago-pmi-falls-for-3rd-straight-month-in-february

-Thursday the S&P 500 rose about 0.5% to 5096.

-VIX dipped about 3% to 13.40.

-The yield on the 10-year Treasury slipped to 4.262%.

QLD- Added 2/20/2024

UWM – Added 1/22/2024.

XLK – Technology ETF (holding since the October 2022 lows).

INTC – Added 12/6/2023.

Salesforce reported and beat on earnings and revenue, but their guidance for 2024 was light so CRM dipped about 2% in afterhours trading on Wednesday. Apparently yhe news wasn’t as bad as it first seemed – CRM was up 3% on Thursday.

It is not unusual in my summary of 50 indicators to have Bear-indicators even in strong bull-markets. Now, the most concerning of the Bear-indicators are those that show the markets are stretched. For example, I mentioned that the S&P 500 was 12.2% above its 200-dMA in yesterday’s blog post. Today let’s review another worrisome indicator.

What does this mean. We need to be on our toes and accept that a 10% decline (or more) is possible at any time. Hopefully, we’ll get some warning in the indicators before we get a decline of that magnitude.

Now there are 3 bear-signs and 18-Bull. Wednesday there were 6 bear-signs and 15-Bull signs.

I remain cautiously bullish.

TODAY’S RANKING OF 15 ETFs (Ranked Daily) ETF ranking follows:

*For additional background on the ETF ranking system see NTSM Page at…

http://navigatethestockmarket.blogspot.com/p/exchange-traded-funds-etf-ranking.html

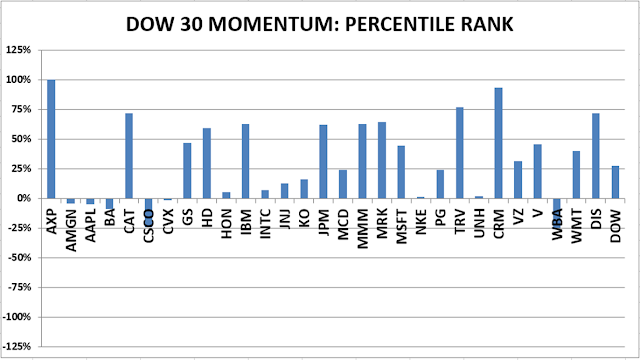

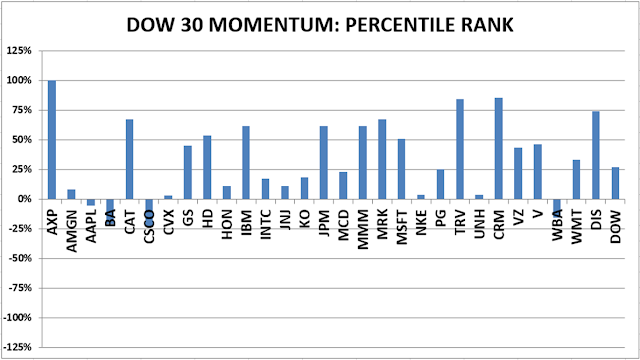

DOW STOCKS - TODAY’S MOMENTUM RANKING OF THE DOW 30 STOCKS (Ranked Daily)

DOW 30 momentum ranking follows:

The DOW added Amazon to the Dow 30. I’ll add it, but it’s a time consuming effort and may take awhile. Walmart split 3 for 1 today and that took some manipulation in the momentum ranking, too.

For more details, see NTSM Page at…

https://navigatethestockmarket.blogspot.com/p/a-system-for-trading-dow-30-stocks-my_8.html

My basket of Market Internals remained BUY. (My basket of Market Internals is a decent trend-following analysis of current market action, but should not be used alone for short term trading. They are most useful when they diverge from the Index.)