“Trade what you see; not what you think.” – The Old Fool, Richard McCranie, trader extraordinaire.

Supreme Court rejects theory that would have meant radical changes to election rules (msn.com)

Supervolcano 'on verge of eruption' and could spark mass extinction and nuclear winter (msn.com)

Mass extinction and nuclear winter? Time to concentrate on short-term investments! This could be good news though – we won’t have to listen to Global Warming hype anymore.

“Reflecting a continued spike in orders for transportation equipment, the Commerce Department released a report on Tuesday showing an unexpected surge in new orders for U.S. manufactured durable goods in the month of May. The Commerce Department said durable goods orders shot up by 1.7 percent in May...” Story at...

https://www.rttnews.com/3372440/u-s-durable-goods-orders-unexpectedly-jump-in-may-as-aircraft-demand-soars.aspx

"’Consumer confidence improved in June to its highest level since January 2022, reflecting improved current conditions and a pop in expectations,’ said Dana Peterson, Chief Economist at The Conference Board... ‘Although the Expectations Index remained a hair below the threshold signaling recession ahead, a new measure found considerably fewer consumers now expect a recession in the next 12 months compared to May.” Press release at...

https://www.prnewswire.com/news-releases/us-consumer-confidence-improved-substantially-in-june-301864485.html

“New home sales surged in May, as buyers looked to new construction as an alternative to the low inventory of existing homes for sale. Sales of newly constructed homes were up 12.2% in May from April, and up 20% from a year ago...” Story at...

https://www.cnn.com/2023/06/27/homes/new-home-sales-may/index.html

“If history is any indication, investors may have reason to be even more optimistic about the next six months, according to Thomas Lee, founder of Fundstrat Global Advisors. In the 22 instances when the S&P 500 finished the first half of the year more than 10% higher since 1950, the median return for the second half is 8% with a 82% win ratio, according to Fundstrat’s data.

The stock market is headed for a big first-half gain. What history says that means for the rest of 2023. (msn.com)

“...our obsession with centrally planned decarbonisation is causing all sorts of unintended consequences. Electric vehicles put a massive stress on roads: last month it was reported that their sheer weight could sink our bridges. The batteries are heavy, with many popular models weighing more than two tonnes, and while that might be fine for motorways built for big lorries, on smaller roads it has put huge strain on surfaces of many highways. They are literally buckling under the pressure [creating a pothole crisis]...

... Everyone accepts that we need to combat climate change... But it needs to be properly planned and well-executed. Instead we don’t have enough chargers for all the EVs we are expected to buy. We don’t generate enough electricity to power them all up, And now it turns out that our roads are woefully unprepared for all the extra strain that will be put on them.” Story at...

Time to slam the brakes on the electric vehicle calamity (msn.com)

-Tuesday the S&P 500 rose about 1.2% to 4378.

-VIX slipped about 3% to 13.77.

-The yield on the 10-year Treasury rose to 3.767%.

-Drop from Top: 8.7%. 25.4% max (on a closing basis).

-Trading Days since Top: 372-days.

The S&P 500 is 9.6% ABOVE its 200-dMA and 4% ABOVE its 50-dMA.

*I won’t call the correction over until the S&P 500 makes a new-high; however, evidence suggests the bottom was in the 3600 area and we called a buy on 4 October 2022.

I am not trading as much as in the past. You may wish to use the momentum charts and/or the Monday 40-day gain charts for trading the Dow stocks and ETFs.

XLK – Technology ETF.

XLY - Consumer Discretionary ETF.

I’ll probably sell this position – it has been very weak recently. But I forgot to! In my defense - it is a small position. On the positive side, it has not breached its recent low around 36.

I don’t think the weak period is over for the stock market. Buying Pressure minus Selling Pressure is still on the sell side; my Money Trend indicator also remains bearish.

Bottom line: I remain a cautious Bull, expecting a

decline of another 3-4% on the S&P 500.

ETF - MOMENTUM ANALYSIS:

TODAY’S RANKING OF 15 ETFs (Ranked Daily)

ETF ranking follows:

The top ranked ETF receives 100%. The rest are then ranked based on their momentum relative to the leading ETF.

*For additional background on the ETF ranking system see NTSM Page at…

http://navigatethestockmarket.blogspot.com/p/exchange-traded-funds-etf-ranking.html

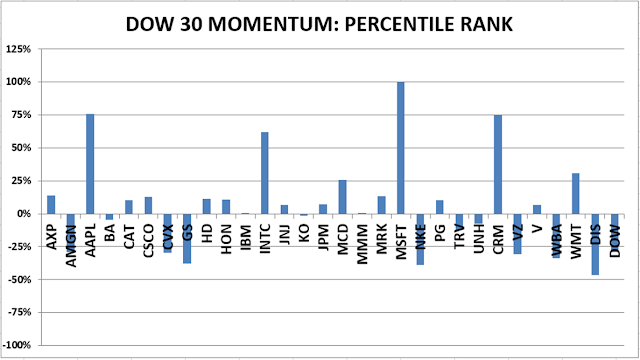

DOW STOCKS - TODAY’S MOMENTUM RANKING

OF THE DOW 30 STOCKS (Ranked Daily)

DOW 30 momentum ranking follows:

The top ranked Stock receives

100%. The rest are then ranked based on their momentum relative to the leading Stock.

For more details, see NTSM Page at…

https://navigatethestockmarket.blogspot.com/p/a-system-for-trading-dow-30-stocks-my_8.html

TUESDAY MARKET INTERNALS (NYSE

DATA)

My basket of Market Internals improved to HOLD. (My basket of Market Internals is a decent trend-following analysis of current market action, but should not be used alone for short term trading. They are most useful when they diverge from the Index.)

TODAY’S RANKING OF 15 ETFs (Ranked Daily)

ETF ranking follows:

The top ranked ETF receives 100%. The rest are then ranked based on their momentum relative to the leading ETF.

*For additional background on the ETF ranking system see NTSM Page at…

http://navigatethestockmarket.blogspot.com/p/exchange-traded-funds-etf-ranking.html

DOW 30 momentum ranking follows:

For more details, see NTSM Page at…

https://navigatethestockmarket.blogspot.com/p/a-system-for-trading-dow-30-stocks-my_8.html

My basket of Market Internals improved to HOLD. (My basket of Market Internals is a decent trend-following analysis of current market action, but should not be used alone for short term trading. They are most useful when they diverge from the Index.)