More FED Hikes ... Core Inflation Remains Sticky ... Momentum Trading DOW Stocks & ETFs … Stock Market Analysis ...

“Trade what you see; not what you think.” – The Old Fool,

Richard McCranie, trader extraordinaire.

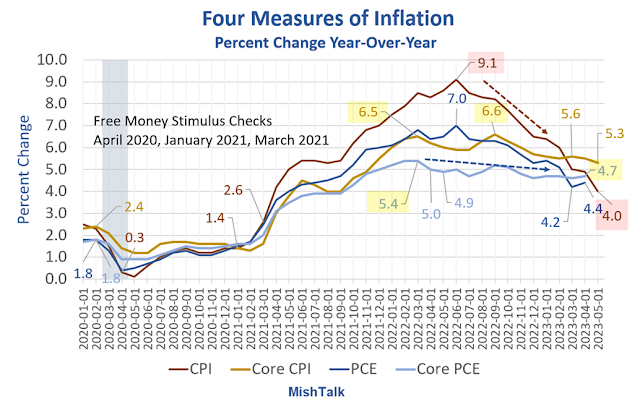

CORE INFLATION REMAINS STICKY (MishTalk)

Chart and discussion at...

https://mishtalk.com/economics/cpi-inflation-has-dropped-dramatically-but-core-cpi-and-core-pce-inflation-are-dropping-very-slowly/

POWELL EXPECTS MORE FED RATE HIKES AHEAD (CNBC)

“Inflation has moderated somewhat since the middle of

last year,” he said. “Nonetheless, inflation pressures continue to run high,

and the process of getting inflation back down to 2% has a long way to go.” ...Powell

also noted that getting inflation lower will require slowing down the economy

to below-trend growth... [He] affirmed that more interest rate increases

are likely ahead until additional progress is made on bringing down inflation.”

Story at...

https://www.cnbc.com/2023/06/21/powell-expects-more-fed-rate-hikes-ahead-as-inflation-fight-has-a-long-way-to-go.html

MARKET REPORT / ANALYSIS

-Wednesday the S&P 500 slipped about 0.5% to 4366.

-VIX fell about 5% to 13.20.

-The yield on the 10-year Treasury was little changed at

3.725%.

PULLBACK DATA:

-Drop from Top: 9%. 25.4% max (on a closing basis).

-Trading Days since Top: 367-days.

The S&P 500 is 9.5% ABOVE its 200-dMA and 4.2%

ABOVE its 50-dMA.

*I won’t call the correction over until the S&P 500

makes a new-high; however, evidence suggests the bottom was in the 3600 area

and we called a buy on 4 October 2022.

MY TRADING POSITIONS:

I am not trading as much as in the past. You may wish to

use the momentum charts and/or the Monday 40-day gain charts for trading the

Dow stocks and ETFs.

MSFT – Microsoft.

XLK – Technology ETF.

XLY - Consumer Discretionary ETF.

KRE – Regional Banking ETF. This is a very small position

for me. KRE tested the May 4 low of 36.08 on much lower volume 11 & 12

May.

SHY – Short term bonds. 30-day yield is 5.04% - 9 June

2023. (Trailing 1-year yield is 3.04%.) Once this weak period ends, I’ll sell

SHY and buy stocks/stock ETFs.

TODAY’S COMMENT:

Powell’s assertion that more rate hikes are necessary, is

not really a surprise – the expectation for another rate hike in July was above

50%. It’s a worry though - his statement

looks more bearish than may have been expected by markets. In the end, though, we

need to watch market reaction rather than worry about the news. The close today

wasn’t particularly encouraging as the Index fell nearly 0.5% in the last hour

or so of trading.

Based on my indicators last week, it looks like the

S&P 500 will see a about a 4% drop from today’s close over the next few

weeks. I am suggesting a small decline, because, so far, indicators are not too

bearish. That could always change.

The daily spread of 20 Indicators (Bulls minus Bears) declined

from -1 to -5 (a positive number is bullish; negatives are bearish); the 10-day

smoothed sum that smooths the daily fluctuations declined from +57 to +44.

(The trend direction is more important than the actual number for the 10-day

value.) These numbers sometimes change after I post the blog based on data that

comes in late. Most of these 20 indicators are short-term so they tend to

bounce around a lot.

LONG-TERM INDICATOR: The Long Term NTSM indicator remained

HOLD: PRICE is positive; SENTIMENT, VOLUME & VIX are neutral.

(The important BUY in this indicator was on 21 October,

7-days after the bottom. For my NTSM overall signal, I suggested that a

short-term buying opportunity occurred on 27 September (based on improved

market internals on the retest), although without market follow-thru, I was

unwilling to call a buy; however, I did close shorts and increased stock

holdings. I issued a Buy-Signal on 4 October, 6-days before the final bottom,

based on stronger market action that confirmed the market internals signal. The

NTSM sell-signal was issued 20 December, 8 sessions before the high of this

recent bear market, based on the bearish “Friday Rundown” of indicators.)

Bottom line: I remain a cautious Bull.

ETF - MOMENTUM ANALYSIS:

TODAY’S RANKING OF 15 ETFs

(Ranked Daily)

ETF ranking follows:

The top ranked ETF receives

100%. The rest are then ranked based on their momentum relative to the leading

ETF.

*For additional background on

the ETF ranking system see NTSM Page at…

http://navigatethestockmarket.blogspot.com/p/exchange-traded-funds-etf-ranking.html

DOW STOCKS - TODAY’S MOMENTUM RANKING

OF THE DOW 30 STOCKS (Ranked Daily)

DOW 30 momentum ranking

follows:

The top ranked Stock receives

100%. The rest are then ranked based on their momentum relative to the leading Stock.

For more details, see NTSM

Page at…

https://navigatethestockmarket.blogspot.com/p/a-system-for-trading-dow-30-stocks-my_8.html

WEDNESDAY MARKET INTERNALS

(NYSE DATA)

My basket of Market Internals remained HOLD. (My basket of Market Internals

is a decent trend-following analysis of current market action, but should not

be used alone for short term trading. They are most useful when they diverge

from the Index.)

...My current invested

position is about 55% stocks, including stock mutual funds and ETFs. I’m

usually about 50% invested in stocks.

I trade about 15-20% of the

total portfolio using the momentum-based analysis I provide here. If I can see

a definitive bottom, I’ll add a lot more stocks to the portfolio using an

S&P 500 ETF.