“I know not with what weapons World War III will be fought, but World War IV will be fought with sticks and stones.” - Albert Einstein

“Trade what you see; not what you think.” – The Old Fool, Richard McCranie, trader extraordinaire.

Political commentary from Michael Ramirez at...

https://michaelpramirez.com/index.html#/

There are many paths to a revived conservative agenda, including tying up President Harris in knots while getting the next GOP generation ready.” - Holman W. Jenkins, Jr.. member of the editorial board of The Wall Street Journal. Opinion at...

https://www.wsj.com/opinion/conservatives-can-be-optimists-2024-presidential-election-10558c74

“The number of Americans filing new applications for unemployment benefits fell to a five-month low last week and consumer spending increased more than expected in September, showcasing the economy's strength heading into the final stretch of 2024... Though prices pushed higher last month, inflation is firmly on a downward trend, with other data on Thursday showing labor costs posting their smallest gain in more than three years in the third quarter... Initial claims for state unemployment benefits dropped 12,000 to a seasonally adjusted 216,000 for the week ended Oct. 26...” tory at...

https://finance.yahoo.com/news/us-weekly-jobless-claims-fall-123827119.html

-Thursday the S&P 500 declined about 1.9% to 5705.

-VIX jumped about 14% to 23.16.

-The yield on the 10-year Treasury slipped (compared to about this time, prior trading day) to 4.282%.

XLK – Holding since the October 2022 lows. Added more 9/20.

SSO – added 10/16.

SPY – added 9/19 & more 10/16

Today, of the 50-Indicators I track, 16 gave Bear-signs and 5 were Bullish. The rest are neutral. (It is normal to have a lot of neutral indicators since many of the indicators are top or bottom indicators that will signal only at extremes.)

The daily Bull/Bear, 50-Indicator spread (Bull Indicators minus Bear Indicators, red curve in the chart above) declined to -11 (11 more Bear indicators and Bull indicators).

Today’s Bull-Bear spread of -11 is bearish. The 10-dMA of the 50-Indicator Spread (purple line in the chart above) remained bearish since it is still moving lower. (I follow the 10-dMA for trading buy-signals and as an indicator for sell signals.)

https://www.investopedia.com/terms/h/hindenburgomen.asp

As we’ve noted before, the Omen sends a lot of false warnings.

I’m neutral on the markets, even though the indicators are bearish. I suspect that the weakness is close to finished. That’s not a well-informed opinion – there’s not much evidence yet, other than the chart and a couple of statistical indicators. We may have to wait until the election is over before the market get’s out of its funk.

TODAY’S RANKING OF 15 ETFs (Ranked Daily) ETF ranking follows:

*For additional background on the ETF ranking system see NTSM Page at…

http://navigatethestockmarket.blogspot.com/p/exchange-traded-funds-etf-ranking.html

For more details, see NTSM Page at…

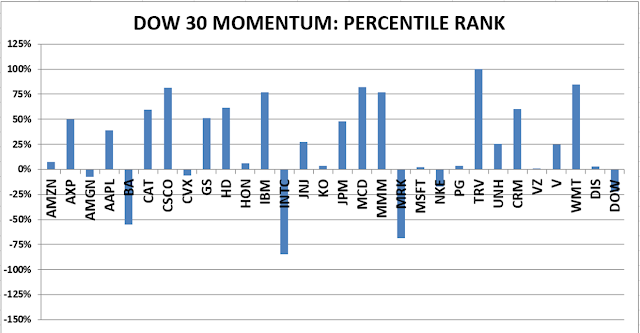

https://navigatethestockmarket.blogspot.com/p/a-system-for-trading-dow-30-stocks-my_8.html

My basket of Market Internals remained SELL. (My basket of Market Internals is a decent trend-following analysis that is most useful when it diverges from the Index.)