ASHEVILLE – SAFE FROM NATURAL DISASTERS? (msn.com)

“In online forums discussing where to escape heat, floods and fire, Asheville consistently comes up. One poster wrote in 2019, they didn’t want “to be in a place that has constant threat of natural disasters that will destroy our property so we are planning on moving to (the) Asheville area.” Even the climate experts who call Asheville home believed they were insulated from the worst risks. Susan Hassol, a veteran climate change communicator and science writer, said she and others “have labored under the illusion that we live in a relatively climate-safe place.” Story at...

People moved to Asheville to escape extreme weather. They forgot its tragic history. (msn.com)

My cmt: They lived in the mountains near a river and didn’t know there was a flood risk. North Carolina publishes FEMA flood maps for each county that are searchable by address. We have the same service in my hometown. Everyone should know if they live in a flood zone. A Google search should be able to find the local flood maps. If not, call your local government and know your flood zone.

ANOTHER MAJOR HURRICANE PREDICTED TO STRIKE FLORIDA

Hurricane Milton has reached Category 5 strength and the CNBC pundits were talking about the risks to insurance companies. Only 4 storms have made a US landfall at Category 5 strength. One of those was Hurricane Andrew in 1992. I was at the 1993 Hurricane Conference almost a year later. There was a presentation by the insurance industry where they said that the most expensive natural disaster of 1992 was not Andrew – it was a deep freeze in the South that caused massive damage due to frozen pipes and other issues. Curious, but this is a big storm. Milton is now forecast to weaken to Cat 3 at landfall, still a major, dangerous storm. Let’s hope that the forecast is correct and Hurricane Milton continues to weaken. Either way, the storm is likely to cause huge damage. The Tampa area is a lot more populated now than Dade County was in 1992 where Andrew made landfall.

MARKET REPORT / ANALYSIS

-Monday the S&P 500 fell about 1% to 5696.

-VIX rose about 18% to 19.21.

-The yield on the 10-year Treasury rose (compared to about this time, prior trading day) to 4.028%.

MY TRADING POSITIONS:

XLK – Holding since the October 2022 lows. Added more 9/20.

UWM – added 7/15 & more 9/20.

QLD – added 7/24.

SSO – added 9/16.

SPY – added 9/19 & more 9/20

CURRENT SUMMARY OF APPROXIMATELY 50 INDICATORS:

The Bull/Bear Spread remained in a BULL position at 10 Bear-sign and 12-Bull. (The rest are neutral. It is normal to have a lot of neutral indicators since many of those are top or bottom indicators that will signal only at extremes.)

The Bull/Bear, 50-Indicator spread (Bull Indicators minus Bear Indicators) declined to +2 (2 more Bull indicators than Bear indicators). The 10-dMA is sloping down, a bearish sign.

TODAY’S COMMENT:

Indicators declined on Monday and are now in a Neutral indication. The 10-dMA of indicators continues to decline and that’s a continuing worry.

Monday was a statistically significant down-day. That

just means that the price-volume move exceeded my statistical parameters.

Statistics show that a statistically-significant, down-day is followed by an up-day

about 60% of the time.

The S&P 500 is 1.2% below its all-time high from last

week. If this weakness does develop into a more significant correction, I would

expect that the decline would not exceed 10%, based on numbers we saw at the

all-time high last week. I suspect it is more likely that the decline would

take the Index to its lower trend line (roughly S&P 5675) or perhaps down

another 2.5% to its 50-dMA (5558).

BOTTOM LINE

I’m neutral at this point waiting to see what the indicators tell us.

ETF - MOMENTUM ANALYSIS:

TODAY’S RANKING OF 15 ETFs (Ranked Daily) ETF ranking follows:

The top ranked ETF receives

100%. The rest are then ranked based on their momentum relative to the leading

ETF.

*For additional background on the ETF ranking system see NTSM Page at…

http://navigatethestockmarket.blogspot.com/p/exchange-traded-funds-etf-ranking.html

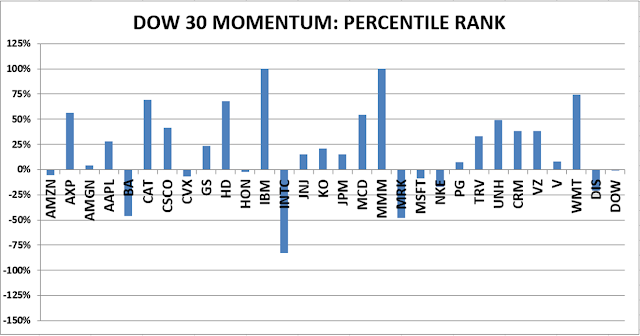

DOW STOCKS - TODAY’S MOMENTUM RANKING

OF THE DOW 30 STOCKS (Ranked Daily)

The top ranked Stock receives

100%. The rest are then ranked based on their momentum relative to the leading Stock.

For more details, see NTSM Page at…

https://navigatethestockmarket.blogspot.com/p/a-system-for-trading-dow-30-stocks-my_8.html

MONDAY MARKET INTERNALS (NYSE

DATA)

My basket of Market Internals remained SELL. (My basket of Market Internals is a decent trend-following analysis that is most useful when it diverges from the Index.)

...My current invested

position is about 65% stocks, including stock mutual funds and ETFs. I’m

usually about 50% invested in stocks when markets are stretched. (75% is my max

stock allocation when I am strongly bullish.)

I trade about 15-20% of the total portfolio using the

momentum-based analysis I provide here. When I see bullish signs, I add a lot more

stocks to the portfolio, usually by using an S&P 500 ETF as I did back in

October 2022 and 2023.

“In online forums discussing where to escape heat, floods and fire, Asheville consistently comes up. One poster wrote in 2019, they didn’t want “to be in a place that has constant threat of natural disasters that will destroy our property so we are planning on moving to (the) Asheville area.” Even the climate experts who call Asheville home believed they were insulated from the worst risks. Susan Hassol, a veteran climate change communicator and science writer, said she and others “have labored under the illusion that we live in a relatively climate-safe place.” Story at...

People moved to Asheville to escape extreme weather. They forgot its tragic history. (msn.com)

My cmt: They lived in the mountains near a river and didn’t know there was a flood risk. North Carolina publishes FEMA flood maps for each county that are searchable by address. We have the same service in my hometown. Everyone should know if they live in a flood zone. A Google search should be able to find the local flood maps. If not, call your local government and know your flood zone.

Hurricane Milton has reached Category 5 strength and the CNBC pundits were talking about the risks to insurance companies. Only 4 storms have made a US landfall at Category 5 strength. One of those was Hurricane Andrew in 1992. I was at the 1993 Hurricane Conference almost a year later. There was a presentation by the insurance industry where they said that the most expensive natural disaster of 1992 was not Andrew – it was a deep freeze in the South that caused massive damage due to frozen pipes and other issues. Curious, but this is a big storm. Milton is now forecast to weaken to Cat 3 at landfall, still a major, dangerous storm. Let’s hope that the forecast is correct and Hurricane Milton continues to weaken. Either way, the storm is likely to cause huge damage. The Tampa area is a lot more populated now than Dade County was in 1992 where Andrew made landfall.

-Monday the S&P 500 fell about 1% to 5696.

-VIX rose about 18% to 19.21.

-The yield on the 10-year Treasury rose (compared to about this time, prior trading day) to 4.028%.

XLK – Holding since the October 2022 lows. Added more 9/20.

UWM – added 7/15 & more 9/20.

QLD – added 7/24.

SSO – added 9/16.

SPY – added 9/19 & more 9/20

The Bull/Bear Spread remained in a BULL position at 10 Bear-sign and 12-Bull. (The rest are neutral. It is normal to have a lot of neutral indicators since many of those are top or bottom indicators that will signal only at extremes.)

The Bull/Bear, 50-Indicator spread (Bull Indicators minus Bear Indicators) declined to +2 (2 more Bull indicators than Bear indicators). The 10-dMA is sloping down, a bearish sign.

Indicators declined on Monday and are now in a Neutral indication. The 10-dMA of indicators continues to decline and that’s a continuing worry.

I’m neutral at this point waiting to see what the indicators tell us.

TODAY’S RANKING OF 15 ETFs (Ranked Daily) ETF ranking follows:

*For additional background on the ETF ranking system see NTSM Page at…

http://navigatethestockmarket.blogspot.com/p/exchange-traded-funds-etf-ranking.html

For more details, see NTSM Page at…

https://navigatethestockmarket.blogspot.com/p/a-system-for-trading-dow-30-stocks-my_8.html

My basket of Market Internals remained SELL. (My basket of Market Internals is a decent trend-following analysis that is most useful when it diverges from the Index.)