“Trade what you see; not what you think.” – The Old Fool,

Richard McCranie, trader extraordinaire.

LOOKOUT – JANE FONDA SENT ME ON ANOTHER GLOBAL WARMING

RANT!

“We’ve got about seven, eight years to cut ourselves in half

of what we use of fossil fuels, and unfortunately, the people that have the

least responsibility for it are hit the hardest ...We have to arrest and jail

those men — they’re all men [behind this]... White men are the things that

matter, and then everything else [is] at the bottom.... There’d be no climate

crisis if it wasn’t for racism.” – Jane Fonda

...Jane Fonda has apologized numerous times for

the actions that earned her the nickname “Hanoi Jane” during

the Vietnam War.

Maybe if she lives another 50-years she’ll apologize for her Global-Warming-lunacy.

My cmt: The Earth’s temperature has risen 1 degree

centigrade in the last 100 years. It doesn’t

seem likely that we have only 7 or 8 years to cut fossil fuel use in half, especially

since we are hearing this from global know-it-all, Jane Fonda.

If Global Warming is an existential threat, it can be

easily reversed by increasing the Earth’s albedo. “It appears that

stratospheric aerosol injection, at a moderate intensity, could counter most

changes to temperature and precipitation, take effect rapidly, have low direct

implementation costs, and be reversible in its direct climatic effects.” - Climate

Intervention: Reflecting Sunlight to Cool Earth. Washington, D.C.: National Academies Press.

I expect my Grandchildren will not have to worry about

man-made climate change. If the promise of safe, cheap energy from nuclear

fusion is borne out, we’ll be able to reverse global warming attributable to

CO2 in the relatively near future. Technologies now exist to remove CO2 from

the atmosphere. Unfortunately, that won’t stop non-manmade global warming – the

last Ice Age was 12,000 years ago and the Earth has been warming since then – Sorry

Greta, sea-level rise will continue.

And BTW, climate change is not causing fires in Canada.

If increased temperatures were the cause of fires, wouldn’t we be having more

forest fires where it is warmer than Canada – say, southern forests in the

Virginias, Tennessee, Georgia, etc.? As stated in “Unsettled – What Climate

Science Tells us, What it Doesn’t, and Why it Matters” by Steven Koonin,

PhD, the actual numbers show fewer fires in more recent decades, not more. (Remember, climate is defined in 30-year

slices by the IPCC. These one-year events are weather – not climate.) Man-made,

Global warming is real, but I get very tired of every anomaly being blamed on

Global Warming. (The latest was mountain landslides, but I’ll save that one for

another rant.)

My apologies to those who wanted to read a Financial

Blog.

PERSONAL INCOME (Advisor Perspectives)

“Personal income (excluding transfer receipts) rose 0.4% in May

and is up 5.5% year-over-year. However, when adjusted for inflation using the BEA's PCE

Price Index, real personal income (excluding transfer receipts) was up 0.3%

month-over-month and 1.6% year-over-year...” [It is believed

that the NBER Bases its recession decisions on the Big Four: Retail sales, Industrial

production, Employment and Real income] Here is a percent-off-high

chart based on an average of the big four. The average set a new all-time high

in November of 2018 [recessions in grey].”

Chart and analysis at

https://www.advisorperspectives.com/dshort/updates/2023/06/30/personal-income-big-four-economic-indicators-rises-may?topic=covid-19-coronavirus-coverage

PCE PRICES / / PERSONAL SPENDING (Reuters)

“U.S. consumer spending fizzled in May as households cut

back on purchases of new light trucks and other long-lasting manufactured goods

amid higher borrowing costs, suggesting the economy lost some speed in the

second quarter...underlying price pressures remained too strong to discourage

the Federal Reserve from returning to its strategy of raising interest rates in

July, economists said... Excluding the volatile food and energy components, the

PCE price index climbed 0.3% after rising 0.4% in the prior month. The

so-called core PCE price index increased 4.6% on a year-on-year basis in May

after advancing 4.7% in April.

https://www.reuters.com/markets/us/us-consumer-spending-edges-up-may-inflation-still-high-2023-06-30/

MARKET REPORT / ANALYSIS

-Friday the S&P 500 rose about 1.2% to 4450.

-VIX rose about 0.4% to 13.59. (The Options

Players may not be so sanguine about the rally.)

-The yield on the 10-year Treasury slipped to 3.836%.

PULLBACK DATA:

-Drop from Top: 7.2%. 25.4% max (on a closing basis).

-Trading Days since Top: 374-days.

The S&P 500 is 11.2% ABOVE its 200-dMA and 5.3%

ABOVE its 50-dMA.

*I won’t call the correction over until the S&P 500

makes a new-high; however, evidence suggests the bottom was in the 3600 area

and we called a buy on 4 October 2022.

MY TRADING POSITIONS:

I am not trading as much as in the past. You may wish to

use the momentum charts and/or the Monday 40-day gain charts for trading the

Dow stocks and ETFs.

MSFT – Microsoft.

XLK – Technology ETF.

XLY - Consumer Discretionary ETF.

KRE – Regional Banking ETF. This is a very small position

for me. KRE tested the May 4 low of 36.08 on much lower volume 11 &

12 May.

I haven’t sold yet. On the positive side, it has not

breached its recent low around 36.

SHY – Short term bonds. 30-day yield is 5.04% - 9 June

2023. (Trailing 1-year yield is 3.04%.) Once this weak period ends, I’ll sell

SHY and buy stocks/stock ETFs.

TODAY’S COMMENT:

10 Trading days ago, on 15 June, RSI, Bollinger Bands,

Breadth-vs-the-S&P 500 and my Money Trend indicator all suggested a

short-term top and it was a statistically significant up-day. The S&P 500 was 4426.

After a 2-week, weak period the S&P 500 has shrugged

off its malaise and again climbed to its upper trend line (going back to the

October lows) and closed slightly higher at 4450.

Today, Friday was another statistically significant up-day.

That just means that the price-volume move exceeded my statistical parameters.

Statistics show that a statistically-significant, up-day is followed by a

down-day about 60% of the time. Tops almost

always occur on Statistically-significant, up-days, but not all

statistically-significant, up-days occur at tops. Today could be a short-term

top, but, unlike 2-weeks ago, there are now only 2 top indicators that are

bearish and that is not a strong top signal. If the markets continue to make

big moves up next week, we’ll see more weakness in the markets. We could still

see a pullback, or alternatively, the Index may crawl along the upper

trend-line for a while longer.

The S&P 500 remains stretched too far ahead of

breadth, so I still expect weakness in the Index. The catch is, this one

indicator alone is not enough to call a top and the Friday summary of

Indicators has improved a lot.

This above discussion helps explain why I have pointed

out that short-term trading is a fool’s game. Mr. Market doesn’t always follow

indicators – mine or anyone else’s, especially when we are projecting a small pullback.

Here’s my weekly review of indicators:

The weekly rundown of indicators reversed to the Bull

side (now 8-bear and 14-bull). (These indicators tend to be both long-term and

short-term, so they are different than the 20 that I report on daily.)

BULL SIGNS

-Today (30 June) was a Follow-thru day that cancels prior

Distribution Days.

-The 10-dMA percentage of issues advancing on

the NYSE (Breadth) is above 50%.

-The 50-dMA percentage of issues advancing on the NYSE

(Breadth) is above 50%.

-The 100-dMA percentage of issues advancing on

the NYSE (Breadth) is above 50%.

-My Money Trend indicator is rising.

-McClellan Oscillator.

-The long-term, 50-dEMA, Fosback Hi-Low Logic Index.

-Slope of the 40-dMA of New-highs is rising.

-The Smart Money (late-day action).

-On average, the size of up-moves has been larger than

the size of down-moves over the last month.

-VIX indicator.

-The 5-10-20 Timer System is BUY.

-The 5-day EMA is above the 10-day EMA so short-term

momentum is bullish.

-S&P 500 spread vs. Utilities (XLU-ETF) shows the

Index outpacing Utilities.

NEUTRAL

-There have been 1 Statistically-Significant days (big

moves in price-volume) in the last 15-days.

-Sentiment.

-Bollinger Band Squeeze 28 April - expired.

-Bollinger Bands.

-The 50-dMA percentage of issues advancing on the NYSE

(Breadth) has not been below 50%, for more than 3 days in a row.

-Overbought/Oversold Index (Advance/Decline Ratio).

-There was a Zweig Breadth Thrust 31 March. That’s a

rare, very-bullish sign, but the McClellan Oscillator subsequently turned

negative, so this indicator has expired.

-The S&P 500 is 11.2% above its 200-dMA. (Bear

indicator is 12% above the 200-day.)

-The short-term, 10-day EMA, Fosback Hi-Low Logic Index

is neutral.

-There have been 4 up-days over the last 10 sessions – neutral.

-There have been 12 up-days over the last 20 sessions -

neutral.

-The graph of the 100-day Count (the 100-day sum of

up-days) is neutral.

-RSI

-There was a 90% down-volume day 9 March.

-There was a Hindenburg Omen signal 3 May 2023. The

McClellan Oscillator turned positive 18 May. – Expired.

-The Calm-before-the-Storm/Panic Indicator flashed a

panic-buying signal 10 November - expired.

-2.8% of all issues traded on the NYSE made new, 52-week

highs when the S&P 500 made a new all-time-high, 3 January 2022. (There is

no bullish signal for this indicator.) This indicated that the advance was too

narrow and a correction was likely to be >10%. It proved correct, but is now

Expired.

-10 May there was a Bullish Outside Reversal Day –

Expired.

BEAR SIGNS

-The smoothed advancing volume on the NYSE is falling.

-Issues advancing on the NYSE (Breadth) compared to the

S&P 500. The Index is too far ahead of Breadth.

-Smoothed Buying Pressure minus Selling Pressure is falling.

-MACD of S&P 500 price made a bearish crossover 26

May

-Long-term new-high/new-low data.

-Short-term new-high/new-low data.

-XLI-ETF (Cyclical Industrials) is underperforming the

S&P 500; the trend direction is flat to slightly down.

-45% of the 15-ETFs that I track have been up over the

last 10-days.

On Friday, 21 February, 2 days after the top before the

Coronavirus pullback, there were 10 bear-signs and 1 bull-sign. Now there

are 8 bear-signs and 14-Bull. Last week, there were 13 bear-sign and 8

bull-signs.

The daily spread of 20 Indicators (Bulls minus Bears) remained

from +4 (a positive number is bullish; negatives are bearish); the 10-day

smoothed sum that smooths the daily fluctuations declined from -28 to -29.

(The trend direction is more important than the actual number for the 10-day

value.) These numbers sometimes change after I post the blog based on data that

comes in late. Most of these 20 indicators are short-term so they tend to

bounce around a lot.

LONG-TERM INDICATOR: The Long Term NTSM indicator remained

BUY: PRICE & VIX are positive; SENTIMENT & VOLUME are neutral.

(The important BUY in this indicator was on 21 October,

7-days after the bottom. For my NTSM overall signal, I suggested that a

short-term buying opportunity occurred on 27 September (based on improved

market internals on the retest), although without market follow-thru, I was

unwilling to call a buy; however, I did close shorts and increased stock

holdings. I issued a Buy-Signal on 4 October, 6-days before the final bottom,

based on stronger market action that confirmed the market internals signal. The

NTSM sell-signal was issued 20 December, 8 sessions before the high of this

recent bear market, based on the bearish “Friday Rundown” of indicators.)

Bottom line: I remain a cautious Bull, expecting a

decline of around 4-5% on the S&P 500 to start soon.

ETF - MOMENTUM ANALYSIS:

TODAY’S RANKING OF 15 ETFs

(Ranked Daily)

ETF ranking follows:

The top ranked ETF receives

100%. The rest are then ranked based on their momentum relative to the leading

ETF.

*For additional background on

the ETF ranking system see NTSM Page at…

http://navigatethestockmarket.blogspot.com/p/exchange-traded-funds-etf-ranking.html

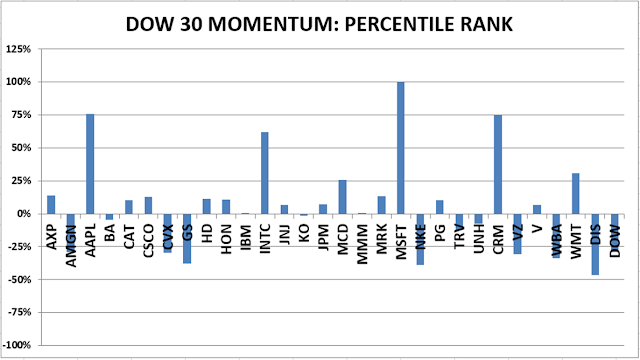

DOW STOCKS - TODAY’S MOMENTUM RANKING

OF THE DOW 30 STOCKS (Ranked Daily)

DOW 30 momentum ranking

follows:

The top ranked Stock receives

100%. The rest are then ranked based on their momentum relative to the leading Stock.

For more details, see NTSM

Page at…

https://navigatethestockmarket.blogspot.com/p/a-system-for-trading-dow-30-stocks-my_8.html

FRIDAY MARKET INTERNALS (NYSE

DATA)

My basket of Market Internals

remained HOLD. (My basket of Market Internals is a decent trend-following analysis of

current market action, but should not be used alone for short term trading.

They are most useful when they diverge from the Index.)

...My current invested

position is about 55% stocks, including stock mutual funds and ETFs. I’m

usually about 50% invested in stocks.

I trade about 15-20% of the

total portfolio using the momentum-based analysis I provide here. If I can see

a definitive bottom, I’ll add a lot more stocks to the portfolio using an

S&P 500 ETF.

Friday will be a busy day, so I’ll post Friday’s Blog late

Friday or on Saturday.

“Trade what you see; not what you think.” – The Old Fool,

Richard McCranie, trader extraordinaire.

JOBLESS CLAIMS (NY Post)

“The number of Americans filing new claims for

unemployment benefits fell last week by the most in 20 months, offering an

upbeat picture of the labor market that could see the Federal

Reserve continuing to raise interest rates to cool demand.”

Story at...

https://nypost.com/2023/06/29/jobless-claims-post-biggest-drop-in-20-months/

GDP (CNBC)

“Gross domestic product increased at a 2% annualized pace

for the January-through-March period, up from the previous estimate of 1.3%...”Story

at...

https://www.cnbc.com/2023/06/29/first-quarter-economic-growth-was-actually-2percent-up-from-1point3percent-first-reported-in-major-gdp-revision.html

MARKET REPORT / ANALYSIS

-Thursday the S&P 500 rose about 5% to 4396.

-VIX rose about 0.8% to 13.54.

-The yield on the 10-year Treasury rose to 3.846%.

PULLBACK DATA:

-Drop from Top: 8.3%. 25.4% max (on a closing basis).

-Trading Days since Top: 372-days.

The S&P 500 is 9.9% ABOVE its 200-dMA and 4.2%

ABOVE its 50-dMA.

*I won’t call the correction over until the S&P 500

makes a new-high; however, evidence suggests the bottom was in the 3600 area

and we called a buy on 4 October 2022.

MY TRADING POSITIONS:

I am not trading as much as in the past. You may wish to

use the momentum charts and/or the Monday 40-day gain charts for trading the

Dow stocks and ETFs.

MSFT – Microsoft.

XLK – Technology ETF.

XLY - Consumer Discretionary ETF.

KRE – Regional Banking ETF. This is a very small position

for me. KRE tested the May 4 low of 36.08 on much lower volume 11 &

12 May.

I haven’t sold yet. On the positive side, it has not

breached its recent low around 36.

SHY – Short term bonds. 30-day yield is 5.04% - 9 June

2023. (Trailing 1-year yield is 3.04%.) Once this weak period ends, I’ll sell

SHY and buy stocks/stock ETFs.

TODAY’S COMMENT:

Well, so much for a decline. 9 Trading days ago, on 15 June, RSI, Bollinger

Bands, Breadth-vs-the-S&P 500 and my Money Trend indicator all suggested a

short-term top. The S&P 500 was

4426. For now, that remains the

short-term top, while some of the warnings that suggested a decline have waned.

However, I still have warning signs flashing. I think the

most significant one is that Breadth (issues advancing on the NYSE) compared to

the S&P 500 shows that the Index is too far ahead of the market in

general. This usually leads to a decline

of some kind. In this case I expect a

decline toward the 50-dMA. So far, the Index declined to about 3% above the 50-day a couple of days ago. I’d expect it to be within 1%. Will it make it? We’ll see.

The daily spread of 20 Indicators (Bulls minus Bears) improved

from -5 to +4 (a positive number is bullish; negatives are bearish); the 10-day

smoothed sum that smooths the daily fluctuations declined from -25 to -28.

(The trend direction is more important than the actual number for the 10-day

value.) These numbers sometimes change after I post the blog based on data that

comes in late. Most of these 20 indicators are short-term so they tend to

bounce around a lot.

LONG-TERM INDICATOR: The Long Term NTSM indicator improved

to BUY: PRICE & VIX are positive; SENTIMENT & VOLUME are neutral.

(The important BUY in this indicator was on 21 October,

7-days after the bottom. For my NTSM overall signal, I suggested that a

short-term buying opportunity occurred on 27 September (based on improved

market internals on the retest), although without market follow-thru, I was

unwilling to call a buy; however, I did close shorts and increased stock

holdings. I issued a Buy-Signal on 4 October, 6-days before the final bottom,

based on stronger market action that confirmed the market internals signal. The

NTSM sell-signal was issued 20 December, 8 sessions before the high of this

recent bear market, based on the bearish “Friday Rundown” of indicators.)

Bottom line: I remain a cautious Bull, expecting a

decline of around 3% on the S&P 500.

ETF - MOMENTUM ANALYSIS:

TODAY’S RANKING OF 15 ETFs

(Ranked Daily)

ETF ranking follows:

The top ranked ETF receives

100%. The rest are then ranked based on their momentum relative to the leading

ETF.

*For additional background on

the ETF ranking system see NTSM Page at…

http://navigatethestockmarket.blogspot.com/p/exchange-traded-funds-etf-ranking.html

DOW STOCKS - TODAY’S MOMENTUM RANKING

OF THE DOW 30 STOCKS (Ranked Daily)

DOW 30 momentum ranking

follows:

The top ranked Stock receives

100%. The rest are then ranked based on their momentum relative to the leading Stock.

The top ranked Stock receives

100%. The rest are then ranked based on their momentum relative to the leading Stock.

For more details, see NTSM

Page at…

https://navigatethestockmarket.blogspot.com/p/a-system-for-trading-dow-30-stocks-my_8.html

THURSDAY MARKET INTERNALS

(NYSE DATA)

My basket of Market Internals improved to HOLD. (My basket of Market

Internals is a decent trend-following analysis of current market action, but

should not be used alone for short term trading. They are most useful when they

diverge from the Index.)

...My current invested

position is about 55% stocks, including stock mutual funds and ETFs. I’m

usually about 50% invested in stocks.

I trade about 15-20% of the

total portfolio using the momentum-based analysis I provide here. If I can see

a definitive bottom, I’ll add a lot more stocks to the portfolio using an

S&P 500 ETF.

“Trade what you see; not what you think.” – The Old Fool,

Richard McCranie, trader extraordinaire.

EIA CRUDE OIL INVENTORIES (EIA)

“U.S. commercial crude oil inventories (excluding those

in the Strategic Petroleum Reserve) decreased by 9.6 million barrels from the

previous week. At 453.7 million barrels, U.S. crude oil inventories are

approximately 1% below the five year average for this time of year.” Report

at...

https://ir.eia.gov/wpsr/wpsrsummary.pdf

ANNUAL ENERGY OUTLOOK (EIA)

“High

international demand leads to continued growth in U.S. production, and combined

with relatively little growth in domestic consumption, allows the United States

to remain a net exporter of petroleum products and natural gas through 2050 in

all AEO2023 cases. Despite no significant change in the

domestic consumption of petroleum and other liquids through 2040 across most

AEO2023 cases, we expect U.S. production to remain at historically high

volumes. Domestic natural gas consumption also remains relatively stable,

despite a shift in electricity generation towards renewables. Production of

natural gas, however, continues to grow in response to international demand for

liquefied natural gas.” Press release at...

https://www.eia.gov/pressroom/releases/press529.php

CHEVROLET JUST KILLED THE 40,000 SILVERADO ELECTRIC TRUCK

(msn.com)

“...the forthcoming 2024 Silverado electric

truck... starting price for the Work Truck, or WT version [was]... $40,000.

...But now, Chevrolet has announced its WT EV pricing.

The starting price is radically higher than stated in the original hype since

its reveal in January 2022. In fact, the price has almost doubled. Now, the

base price for the Silverado 3WT is $74,800.” Story at...

Chevrolet

Just Killed the $40,000 Silverado Electric Truck (msn.com)

FORD LOSES NEARLY 60,000 FOR EVERY ELECTRIC VEHICLE SOLD

(The Street.com)

“Ford (F) only delivered 12,000

electric vehicles in the first quarter, which means that the carmaker lost

$58,333 for each clean car sold during this period... Last month, the Blue Oval

said it expects an operating loss of $3 billion for Ford Model e this year.”

https://www.thestreet.com/technology/ford-loses-nearly-60000-for-every-electric-vehicle-sold

Don’t worry. We taxpayers have loaned Ford 3-billion

dollars to build a battery plant.

MARKET REPORT / ANALYSIS

-Wednesday the S&P 500 dipped about 1 point to 4377.

-VIX slipped about 2% to 13.43.

-The yield on the 10-year Treasury was 3.713%.

PULLBACK DATA:

-Drop from Top: 8.8%. 25.4% max (on a closing basis).

-Trading Days since Top: 372-days.

The S&P 500 is 9.5% ABOVE its 200-dMA and 3.8%

ABOVE its 50-dMA.

*I won’t call the correction over until the S&P 500

makes a new-high; however, evidence suggests the bottom was in the 3600 area

and we called a buy on 4 October 2022.

MY TRADING POSITIONS:

I am not trading as much as in the past. You may wish to

use the momentum charts and/or the Monday 40-day gain charts for trading the

Dow stocks and ETFs.

MSFT – Microsoft.

XLK – Technology ETF.

XLY - Consumer Discretionary ETF.

KRE – Regional Banking ETF. This is a very small position

for me. KRE tested the May 4 low of 36.08 on much lower volume 11 &

12 May.

I’ll probably sell this position – it has been very

weak recently. But I forgot to! In my defense - it is a small

position. On the positive side, it has not breached its recent low around 36.

SHY – Short term bonds. 30-day yield is 5.04% - 9 June

2023. (Trailing 1-year yield is 3.04%.) Once this weak period ends, I’ll sell

SHY and buy stocks/stock ETFs.

TODAY’S COMMENT:

Not much change from yesterday – I still am expecting a

decline toward the 50-dMA.

The daily spread of 20 Indicators (Bulls minus Bears) declined

from -2 to -5 (a positive number is bullish; negatives are bearish); the 10-day

smoothed sum that smooths the daily fluctuations declined from -13 to -25.

(The trend direction is more important than the actual number for the 10-day

value.) These numbers sometimes change after I post the blog based on data that

comes in late. Most of these 20 indicators are short-term so they tend to

bounce around a lot.

LONG-TERM INDICATOR: The Long Term NTSM indicator

remained HOLD: PRICE is positive; SENTIMENT, VIX & VOLUME are neutral.

(The important BUY in this indicator was on 21 October,

7-days after the bottom. For my NTSM overall signal, I suggested that a

short-term buying opportunity occurred on 27 September (based on improved

market internals on the retest), although without market follow-thru, I was

unwilling to call a buy; however, I did close shorts and increased stock

holdings. I issued a Buy-Signal on 4 October, 6-days before the final bottom,

based on stronger market action that confirmed the market internals signal. The

NTSM sell-signal was issued 20 December, 8 sessions before the high of this

recent bear market, based on the bearish “Friday Rundown” of indicators.)

Bottom line: I remain a cautious Bull, expecting a

decline of another 2-3% on the S&P 500.

ETF - MOMENTUM ANALYSIS:

TODAY’S RANKING OF 15 ETFs

(Ranked Daily)

ETF ranking follows:

The top ranked ETF receives

100%. The rest are then ranked based on their momentum relative to the leading

ETF.

*For additional background on

the ETF ranking system see NTSM Page at…

http://navigatethestockmarket.blogspot.com/p/exchange-traded-funds-etf-ranking.html

DOW STOCKS - TODAY’S MOMENTUM RANKING

OF THE DOW 30 STOCKS (Ranked Daily)

DOW 30 momentum ranking

follows:

The top ranked Stock receives

100%. The rest are then ranked based on their momentum relative to the leading Stock.

For more details, see NTSM

Page at…

https://navigatethestockmarket.blogspot.com/p/a-system-for-trading-dow-30-stocks-my_8.html

WEDNESDAY MARKET INTERNALS

(NYSE DATA)

My basket of Market Internals slipped to SELL. (My basket of Market

Internals is a decent trend-following analysis of current market action, but

should not be used alone for short term trading. They are most useful when they

diverge from the Index.)

...My current invested

position is about 55% stocks, including stock mutual funds and ETFs. I’m usually

about 50% invested in stocks.

I trade about 15-20% of the

total portfolio using the momentum-based analysis I provide here. If I can see

a definitive bottom, I’ll add a lot more stocks to the portfolio using an

S&P 500 ETF.

“Trade what you see; not what you think.” – The Old Fool,

Richard McCranie, trader extraordinaire.

“What we’ve done in our politics is create a situation

where we’re electing idiots...And so I don’t look at it through the lens of

like, you know, is this what I should do or what I shouldn’t do? I look at it

through the lens of how do we elect serious people? And I think electing

serious people can’t be partisan.” – Liz Cheny, former GOP Representative

(WY)

“The Supreme Court on Tuesday rejected the theory that

state legislatures have almost unlimited power to decide the rules for federal

elections and draw partisan congressional maps without interference from state

courts. The Constitution’s Elections Clause “does not insulate state

legislatures from the ordinary exercise of state judicial review,” Chief

Justice John G. Roberts Jr. wrote in a 6 to 3 decision.” Story at...

Supreme

Court rejects theory that would have meant radical changes to election rules

(msn.com)

“If the [super volcano in Italy] ...erupts, it could

launch molten rock and volcanic gases high into the stratosphere. It could lead

to 100ft tsunamis, leading sulfur, and toxic ash to spread causing fears it

could destroy crops and wildlife, plunging the Earth into a global winter.”

Story at...

Supervolcano

'on verge of eruption' and could spark mass extinction and nuclear winter

(msn.com)

Mass extinction and nuclear winter? Time to concentrate on

short-term investments! This could be good news though – we won’t have to

listen to Global Warming hype anymore.

DURABLE ORDERS (RTT News)

“Reflecting a continued spike in orders for

transportation equipment, the Commerce Department released a report on Tuesday

showing an unexpected surge in new orders for U.S. manufactured durable goods

in the month of May. The Commerce Department said durable goods orders shot up

by 1.7 percent in May...” Story at...

https://www.rttnews.com/3372440/u-s-durable-goods-orders-unexpectedly-jump-in-may-as-aircraft-demand-soars.aspx

CONSUMER CONFIDENCE (Conference Board via prnewswire)

"’Consumer confidence improved in June to its

highest level since January 2022, reflecting

improved current conditions and a pop in expectations,’ said Dana Peterson, Chief Economist at The Conference

Board... ‘Although the Expectations Index remained a hair below the

threshold signaling recession ahead, a new measure found considerably fewer

consumers now expect a recession in the next 12 months compared to May.” Press

release at...

https://www.prnewswire.com/news-releases/us-consumer-confidence-improved-substantially-in-june-301864485.html

NEW HOME SALES (CNN)

“New home sales surged in May, as buyers looked to new

construction as an alternative to the low inventory of existing homes for sale.

Sales of newly constructed homes were up 12.2% in May from April, and up 20%

from a year ago...” Story at...

https://www.cnn.com/2023/06/27/homes/new-home-sales-may/index.html

WHAT HISTORY SAYS ABOUT THE 2ND HALF (MarketWatch)

“If history is any indication, investors may have reason

to be even more optimistic about the next six months, according to Thomas Lee,

founder of Fundstrat Global Advisors. In the 22 instances when the S&P 500

finished the first half of the year more than 10% higher since 1950, the median

return for the second half is 8% with a 82% win ratio, according to Fundstrat’s

data.

The

stock market is headed for a big first-half gain. What history says that means

for the rest of 2023. (msn.com)

ELECTRIC VEHICLE CALAMITY (The Telegraph)

“...our obsession with centrally planned decarbonisation

is causing all sorts of unintended consequences. Electric vehicles put a

massive stress on roads: last month it was reported that their sheer weight

could sink our bridges. The batteries are heavy, with many popular

models weighing more than two tonnes, and while that might be fine for

motorways built for big lorries, on smaller roads it has put huge strain on

surfaces of many highways. They are literally buckling under the pressure

[creating a pothole crisis]...

... Everyone accepts that we need to combat climate

change... But it needs to be properly planned and well-executed. Instead we

don’t have enough chargers for all the EVs we are expected to buy. We don’t

generate enough electricity to power them all up, And now it turns out that our

roads are woefully unprepared for all the extra strain that will be put on

them.” Story at...

Time

to slam the brakes on the electric vehicle calamity (msn.com)

MARKET REPORT / ANALYSIS

-Tuesday the S&P 500 rose about 1.2% to 4378.

-VIX slipped about 3% to 13.77.

-The yield on the 10-year Treasury rose to 3.767%.

PULLBACK DATA:

-Drop from Top: 8.7%. 25.4% max (on a closing basis).

-Trading Days since Top: 372-days.

The S&P 500 is 9.6% ABOVE its 200-dMA and 4% ABOVE

its 50-dMA.

*I won’t call the correction over until the S&P 500

makes a new-high; however, evidence suggests the bottom was in the 3600 area

and we called a buy on 4 October 2022.

MY TRADING POSITIONS:

I am not trading as much as in the past. You may wish to

use the momentum charts and/or the Monday 40-day gain charts for trading the

Dow stocks and ETFs.

MSFT – Microsoft.

XLK – Technology ETF.

XLY - Consumer Discretionary ETF.

KRE – Regional Banking ETF. This is a very small position

for me. KRE tested the May 4 low of 36.08 on much lower volume 11 &

12 May.

I’ll probably sell this position – it has been very

weak recently. But I forgot to! In my defense - it is a small

position. On the positive side, it has not breached its recent low around 36.

SHY – Short term bonds. 30-day yield is 5.04% - 9 June

2023. (Trailing 1-year yield is 3.04%.) Once this weak period ends, I’ll sell SHY

and buy stocks/stock ETFs.

TODAY’S COMMENT:

I don’t think the weak period is over for the stock

market. Buying Pressure minus Selling Pressure is still on the sell side; my

Money Trend indicator also remains bearish.

On a cautionary note: short-term trading is a fool’s game

and I may not be able to identify a good buying point. That said, I think the time to

buy will be when there is a statistically significant day and the Index is near

its 50-dMA (now about 4210 on the S&P 500).

A new disconcerting issue arrived today: Sentiment is

very high and close to issuing a sell signal. I measure Sentiment as a 5-day

moving average of %-Bulls (Bulls/{bulls+bears}) based on the amounts invested

in Rydex/Guggenheim mutual funds.

It is currently at 90%-bulls (as of Monday’s close). On a

standard deviation basis this again close to levels seen during the dot.com

crash. This isn’t by itself a great indicator since sentiment can remain

elevated for some time, but it is a level that has preceded pullbacks of

varying degrees – from small pullbacks of a couple % to major crashes. I’d need to see more negative signs to take

action, but it is a cautionary indication.

I’ll stick with my suggestion that the S&P 500 is

most likely to decline about 3-4% below today’s close. I’d be surprised if the Index drops below its

50-dMA, but it certainly could happen.

The daily spread of 20 Indicators (Bulls minus Bears) improved

from -9 to -2 (a positive number is bullish; negatives are bearish); the 10-day

smoothed sum that smooths the daily fluctuations declined from -3 to -13.

(The trend direction is more important than the actual number for the 10-day

value.) These numbers sometimes change after I post the blog based on data that

comes in late. Most of these 20 indicators are short-term so they tend to

bounce around a lot.

LONG-TERM INDICATOR: The Long Term NTSM indicator remained

HOLD: PRICE is positive; SENTIMENT, VIX & VOLUME are neutral.

(The important BUY in this indicator was on 21 October,

7-days after the bottom. For my NTSM overall signal, I suggested that a

short-term buying opportunity occurred on 27 September (based on improved

market internals on the retest), although without market follow-thru, I was

unwilling to call a buy; however, I did close shorts and increased stock

holdings. I issued a Buy-Signal on 4 October, 6-days before the final bottom,

based on stronger market action that confirmed the market internals signal. The

NTSM sell-signal was issued 20 December, 8 sessions before the high of this

recent bear market, based on the bearish “Friday Rundown” of indicators.)

Bottom line: I remain a cautious Bull, expecting a

decline of another 3-4% on the S&P 500.

ETF - MOMENTUM ANALYSIS:

TODAY’S RANKING OF 15 ETFs

(Ranked Daily)

ETF ranking follows:

The top ranked ETF receives

100%. The rest are then ranked based on their momentum relative to the leading

ETF.

*For additional background on

the ETF ranking system see NTSM Page at…

http://navigatethestockmarket.blogspot.com/p/exchange-traded-funds-etf-ranking.html

DOW STOCKS - TODAY’S MOMENTUM RANKING

OF THE DOW 30 STOCKS (Ranked Daily)

DOW 30 momentum ranking

follows:

The top ranked Stock receives

100%. The rest are then ranked based on their momentum relative to the leading Stock.

For more details, see NTSM

Page at…

https://navigatethestockmarket.blogspot.com/p/a-system-for-trading-dow-30-stocks-my_8.html

TUESDAY MARKET INTERNALS (NYSE

DATA)

My basket of Market Internals improved to HOLD. (My basket of Market

Internals is a decent trend-following analysis of current market action, but

should not be used alone for short term trading. They are most useful when they

diverge from the Index.)

..My current invested

position is about 55% stocks, including stock mutual funds and ETFs. I’m

usually about 50% invested in stocks.

I trade about 15-20% of the

total portfolio using the momentum-based analysis I provide here. If I can see

a definitive bottom, I’ll add a lot more stocks to the portfolio using an

S&P 500 ETF.

“Trade what you see; not what you think.” – The Old Fool,

Richard McCranie, trader extraordinaire.

“As math and reading scores plummet, perhaps public

education should focus on teaching fundamentals.” - Michael Ramirez.

“...the demand from figures like former Sen. Claire McCaskill

(D-Mo.) for people to “back off” on the story [by whistleblowers that there was

interference in the Hunter Biden investigation] is being heeded by some in the

media, in again blacking out or downplaying the story. While many of us have

stressed the need to authenticate these statements, Hunter Biden has notably

not denied that he sent the message and the allegations from the investigation

have self-verifying elements. The news blackout again raises concerns over

a de facto state media in the United States that operates by

consent rather than coercion. This is a major story either way it turns out but

networks and newspapers are again showing a distinct lack of curiosity.”

Jonathon Turley.

https://jonathanturley.org/2023/06/24/everybody-needs-to-back-off-the-media-and-political-figures-continue-to-ignore-the-biden-corruption-scandal/

CASS FREIGHT INDEX (CASS Information Systems)

“The shipments component of the Cass Freight Index® rose

1.9% m/m in May, but fell 0.8% m/m in seasonally adjusted (SA) terms and fell

5.6% y/y. While it was a softer-than-normal seasonal increase from April, it

was nonetheless an increase.

Freight markets continue to work through a downcycle

which featured its first y/y decline 17 months ago. The past three downcycles

have ranged from 21 to 28 months.

Declining real retail sales trends and ongoing destocking

remain the primary headwinds to freight volumes, but dynamics are shifting as

real incomes improve and the worst of the destock is in the rearview.”

https://www.cassinfo.com/freight-audit-payment/cass-transportation-indexes/may-2023

Freight doesn’t seem to support the recession call that

many pundits continue to make. This

could change, of course, but for now, recession is not in sight.

BEARISH TREND PLAYING OUT (Heritage Capital)

“I do not believe the bull market has ended. Let’s get

that out of the way. I don’t even think this phase of the rally has ended. As

we all know, the stock market has seen a really nice move over the past month,

especially in the NASDAQ 100. No secrets there. This looks to me like a normal,

healthy and telegraphed mild pullback. And one that I would be a buyer of for

another run to new highs in early July.” - Paul Schatz, President Heritage

Capital. Commentary at...

https://investfortomorrow.com/blog/bearish-trend-playing-out-bonds-need-to-shape-up/

MARKET REPORT / ANALYSIS

-Monday the S&P 500 dropped about 0.5% to 4329.

-VIX rose about 6% to 14.25.

-The yield on the 10-year Treasury dipped to 3.724%.

PULLBACK DATA:

-Drop from Top: 9.8%. 25.4% max (on a closing basis).

-Trading Days since Top: 370-days.

The S&P 500 is 8.4% ABOVE its 200-dMA and 2.9%

ABOVE its 50-dMA.

*I won’t call the correction over until the S&P 500

makes a new-high; however, evidence suggests the bottom was in the 3600 area

and we called a buy on 4 October 2022.

MY TRADING POSITIONS:

I am not trading as much as in the past. You may wish to

use the momentum charts and/or the Monday 40-day gain charts for trading the

Dow stocks and ETFs.

MSFT – Microsoft.

XLK – Technology ETF.

XLY - Consumer Discretionary ETF.

KRE – Regional Banking ETF. This is a very small position

for me. KRE tested the May 4 low of 36.08 on much lower volume 11 &

12 May.

I said earlier that I’ll probably sell this position – it has been

very weak recently. But I forgot to and I haven't sold yet - in my defense, it is a small

position.

SHY – Short term bonds. 30-day yield is 5.04% - 9 June

2023. (Trailing 1-year yield is 3.04%.) Once this weak period ends, I’ll sell

SHY and buy stocks/stock ETFs.

TODAY’S COMMENT:

The close wasn’t pretty (late-day, sell-off) and a couple

of other bear signs popped up, too.

MACD (Moving Average Convergence Divergence) switched to a

bear signal today. The 50-dMA of issues advancing on the NYSE has been down for

more than 3 sessions. That’s my

definition of a correction. Ok, but I still don’t expect a large pullback.

Repeating: While my Friday summary of indicators last Friday was well

to the Bear side, some of the bull indicators are reasonably reliable. This tends to bolster the view that the

current pullback is likely to be small. The markets do not appear to be

starting a major correction, so I’ll stick with my suggestion that the S&P

500 is most likely to decline about 2-3% below today’s close. I’d be surprised if the Index drops below its

50-dMA, but it certainly could happen.

The daily spread of 20 Indicators (Bulls minus Bears) declined

from -8 to -9 (a positive number is bullish; negatives are bearish); the 10-day

smoothed sum that smooths the daily fluctuations declined from +14 to -3.

(The trend direction is more important than the actual number for the 10-day

value.) These numbers sometimes change after I post the blog based on data that

comes in late. Most of these 20 indicators are short-term so they tend to

bounce around a lot.

LONG-TERM INDICATOR: The Long Term NTSM indicator declined

to HOLD: PRICE is positive; SENTIMENT, VIX & VOLUME are neutral.

(The important BUY in this indicator was on 21 October,

7-days after the bottom. For my NTSM overall signal, I suggested that a

short-term buying opportunity occurred on 27 September (based on improved

market internals on the retest), although without market follow-thru, I was

unwilling to call a buy; however, I did close shorts and increased stock

holdings. I issued a Buy-Signal on 4 October, 6-days before the final bottom,

based on stronger market action that confirmed the market internals signal. The

NTSM sell-signal was issued 20 December, 8 sessions before the high of this

recent bear market, based on the bearish “Friday Rundown” of indicators.)

Bottom line: I remain a cautious Bull, expecting a

decline of another 2-3% on the S&P 500.

ETF - MOMENTUM ANALYSIS:

TODAY’S RANKING OF 15 ETFs

(Ranked Daily)

ETF ranking follows:

The top ranked ETF receives

100%. The rest are then ranked based on their momentum relative to the leading

ETF.

*For additional background on

the ETF ranking system see NTSM Page at…

http://navigatethestockmarket.blogspot.com/p/exchange-traded-funds-etf-ranking.html

DOW STOCKS - TODAY’S MOMENTUM RANKING

OF THE DOW 30 STOCKS (Ranked Daily)

DOW 30 momentum ranking

follows:

The top ranked Stock receives

100%. The rest are then ranked based on their momentum relative to the leading Stock.

For more details, see NTSM

Page at…

https://navigatethestockmarket.blogspot.com/p/a-system-for-trading-dow-30-stocks-my_8.html

MONDAY MARKET INTERNALS (NYSE

DATA)

My basket of Market

Internals remained SELL. (My basket of Market Internals

is a decent trend-following analysis of current market action, but should not

be used alone for short term trading. They are most useful when they diverge

from the Index.)

...My current invested

position is about 55% stocks, including stock mutual funds and ETFs. I’m

usually about 50% invested in stocks.

I trade about 15-20% of the

total portfolio using the momentum-based analysis I provide here. If I can see

a definitive bottom, I’ll add a lot more stocks to the portfolio using an

S&P 500 ETF.