PERSONAL INCOME/SPENDING (Reuters)

“U.S. consumer spending barely rose in January and income

increased modestly in February, suggesting the economy was fast losing momentum

after growth slowed in the fourth quarter…Consumer spending, which accounts for

more than two-thirds of U.S. economic activity, edged up 0.1 percent…” Story at…

PCE PRICE INDEX (Breitbart)

“The Fed’s preferred inflation gauge, the price index for

personal-consumption expenditures, fell 0.1 percent in January from December.

Economists had expected prices to remain flat.” Story at…

CHICAGO PMI (MarketWatch)

“Chicago PMI drops sharply in March as order backlogs

fall to contractionary levels. Chicago PMI in March slowed to a reading of 58.7

from 64.7, MNI Indicators said. Any reading above 50 indicates improving

conditions.” Story at…

NEW HOME SALES (Bloomberg)

“Sales of new U.S. homes rebounded to the best pace in

almost a year and exceeded estimates in February, led by the Midwest, as lower

mortgage costs helped buyers afford properties.” Story at…

SENTIMENT (Bloomberg)

“U.S. consumer sentiment climbed in March by more than

initially reported as views grew rosier about current economic conditions. The

University of Michigan's final sentiment index climbed to 98.4 from the prior

month’s 93.8, according to a report Friday.” Story at…

MARKET REPORT / ANALYSIS

-Friday the S&P 500 rose about 0.7% to 2834.

-VIX dropped about 5% to 14.43.

-The yield on the 10-year Treasury rose to 2.407%.

Today’s stock market moves may have been largely due to

end of quarter/month fund, window-dressing and individual 401k inflows (typical

at end and beginning of a month). We may know a little more by mid-week.

Economic news continues to be week. Apparently, the numbers aren’t enough to

spook Wall Street – they are sure the Fed has their back. Even with the Fed

put, one wonders whether the S&P 500 at near all-time highs is justified.

(The Index is 3.3% below all-time highs.)

Not much change from yesterday: Over the last 10-days 53%

of the total volume on the NYSE has been up-volume and 54% of stocks have

advanced (a measure of breadth). Those are decent numbers, but there is a

concern for the bulls; the graph of both are falling. That’s a bearish sign

until we see a reversal. Money Trend, New-high/new-low spreads and MACD are

bearish.

My daily sum of 20 Indicators slipped from -2 to -4 (a

positive number is bullish; negatives are bearish) while the 10-day smoothed version

that negates the daily fluctuations dropped from +18 to +10. Most of these

indicators are short-term.

Bear signs still remain, but none are extreme so we have

to say indicators remain bearish, but not with a lot of conviction. I remain in

the Bear camp, at least in the short-term.

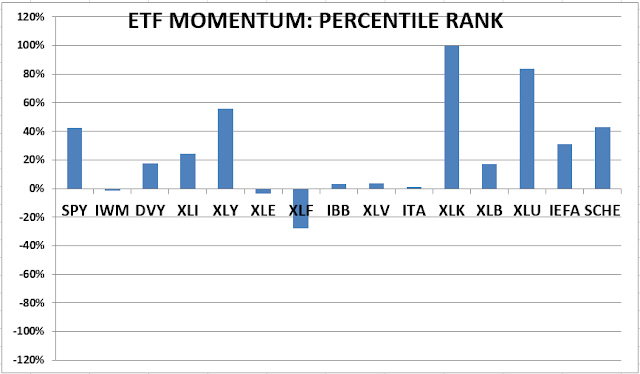

MOMENTUM ANALYSIS:

TODAY’S RANKING OF

15 ETFs (Ranked Daily)

The top ranked ETF receives 100%. The rest are then

ranked based on their momentum relative to the leading ETF. While momentum isn’t stock performance per se,

momentum is closely related to stock performance. For example, over the

4-months from Oct thru mid-February 2016, the number 1 ranked Financials (XLF)

outperformed the S&P 500 by nearly 20%. In 2017 Technology (XLK) was ranked

in the top 3 Momentum Plays for 52% of all trading days in 2017 (if I counted

correctly.) XLK was up 35% on the year while the S&P 500 was up 18%.

*For additional background on the ETF ranking system see

NTSM Page at…

TODAY’S RANKING OF THE DOW 30 STOCKS (Ranked Daily)

The top ranked stock receives 100%. The rest are then ranked

based on their momentum relative to the leading stock.

*I rank the Dow 30 similarly to the ETF ranking system.

For more details, see NTSM Page at…

FRIDAY MARKET INTERNALS (NYSE DATA)

Market Internals

remained NEUTRAL on the market.

Market Internals are a decent trend-following analysis of

current market action but should not be used alone for short term trading. They

are usually right, but they are often late.

They are most useful when they diverge from the Index. In 2014, using these internals alone would

have made a 9% return vs. 13% for the S&P 500 (in on Positive, out on

Negative – no shorting).

My current stock allocation is about 30% invested in

stocks as of 9 January 2019.

INTERMEDIATE / LONG-TERM INDICATOR

Friday, the PRICE indicator

was positive. The VOLUME, VIX and SENTIMENT indicators were neutral. Overall this

remains in a NEUTRAL indication.