From Matt Davies Twitter (X) Post

Biden’s mental capacity seems severely compromised. His

age is showing and it scares me. Trump

could get elected. The way to put an end to Trump is for Democrats to cross

party lines and vote in the Republican Primaries. It is allowed in 16 states

with no restrictions including here in Virginia. It is also allowed in a number of other

states, but the rules vary so check your locality.

“Trade what you see; not what you think.” – The Old Fool,

Richard McCranie, trader extraordinaire.

PCE PRICES / PERSONAL INCOME & SPENDING (CNBC)

“Inflation as measured by personal spending increased in

line with expectations... The personal consumption expenditures price index,

excluding food and energy prices, rose 0.2% for the month and 3.5% on a

year-over-year basis... Personal income and spending both rose 0.2% on the

month, also meeting estimates and indicating that consumers are keeping pace

with inflation.” Story at...

https://www.cnbc.com/2023/11/30/pce-inflation-report-october-2023-.html

JOBLESS CLAIMS (ABC News)

“Slightly more Americans filed for jobless claims last

week, but the overall number of people in the U.S. collecting unemployment

benefits rose to its highest level in two years. Applications for unemployment

benefits rose by 7,000 to 218,000 for the week ending Nov. 25...” Story at...

https://abcnews.go.com/Business/wireStory/applications-us-jobless-benefits-rise-modestly-continuing-claims-105270445

CHICAGO PMI (Advisor Perspectives)

“The latest Chicago Purchasing Manager's Index (Chicago Business

Barometer) jumped to 55.8 in November from 44.0 in October, marking the highest

level in the past 17 months. The latest reading is better than the 45.4

forecast and pushes the index into expansion territory for the first time in 15

months.” Story at...

https://www.advisorperspectives.com/dshort/updates/2023/11/30/chicago-pmi-jumps-to-17-month-high-in-november?topic=covid-19-coronavirus-coverage

MARKET REPORT / ANALYSIS

-Thursday the S&P 500 rose about 0.4% to 4568.

-VIX dipped about 0.5% to 12.92.

-The yield on the 10-year Treasury rose to 4.340%.

PULLBACK DATA:

-Drop from Top: 4.8%. 25.4% max (on a closing basis).

-Trading Days since All-Time Top: 480-days. (The top was

3 January 2022.)

The S&P 500 is 6.6% ABOVE its 200-dMA and 4.9% ABOVE

its 50-dMA.

*I won’t call the correction over until the S&P 500

makes a new-high; however, evidence suggests the major bear-market bottom (25%

decline) was in the 3600 area and we called a buy on 4 October 2022.

MY TRADING POSITIONS:

XLK – Technology ETF (holding since the October 2022

lows).

XLY - Consumer Discretionary ETF. (Holding since the

October 2022 lows - I bought more XLY Monday, 8/21.)

I took profits and then reestablished positions as

follows:

SPY – I bought a large position in the S&P 500

Friday, 8/14, in my 401k (it has limited choices).

XLE – Added Tuesday, 8/22.

SSO – 2x S&P 500 ETF. Added 8/24.

MSFT – added 11/16/2023.

TODAY’S COMMENT:

The Rally had been stalled around the 4550 level on the

S&P 500 and has been nerly flat for the last 7 days. Perhaps it broke out

today? Maybe. Maybe not.

The overbought signal from the Overbought/Oversold Index

(Advance/decline Ratio) has been cleared, but other oversold signals remain: RSI

remains overbought - it has been overbought for 10 out of the last 11 trading

sessions; and Last hour action is overbought.

On the bullish side, Breadth is improving and 50-dMA of

issues advancing on the NYSE is now above 50%. That clears 2 bear signals.

Higher prices ahead? I think so. As I’ve suggested previously, I think the

S&P 500 can go up another 5% or so in December and that would push the

Index to new All-Time-Highs and end the Bear Market that has lasted 480 trading-sessions

and counting. At that point, the question will be, “What’s next?” We’ll just

have to check the indicators when the markets get there, if they get there.

A check of the Preliminary Friday Indicator Summary numbers

show that there are now (about) 18 Bull and 6 Bear signals. That’s a good

bullish sign.

Volume was high today, about 10% above this month’s

average. It’s most likely due to money-managers making month-end moves. Unchanged

volume was high, too. As I’ve often

said, many believe that this indicator suggests investor confusion at market

turning points. Since the signal is often wrong, it’s not in my system as an

indicator, so for now, I’ll pay attention, but not worry. As noted above, there

are plenty of reliable bull signs.

The daily spread of 20 Indicators (Bulls minus Bears) declined

from zero to -1 (a positive number is bullish; negatives are bearish); the

10-day smoothed sum that smooths the daily fluctuations declined from +47

to +37. (The trend direction is more important than the actual number for the

10-day value.) These numbers sometimes change after I post the blog based on

data that comes in late. Most of these 20 indicators are short-term so they

tend to bounce around a lot.

LONG-TERM INDICATOR: The Long Term NTSM indicator remained

BUY: PRICE & VIX are bullish; VOLUME & SENTIMENT are neutral.

(The important major BUY in this indicator was on 21

October 2022, 7-days after the bear-market bottom. For my NTSM overall signal,

I suggested that a short-term buying opportunity occurred on 27 September

(based on improved market internals on the retest), although without market

follow-thru, I was unwilling to call a buy; however, I did close shorts and

increased stock holdings. I issued a Buy-Signal on 4 October, 6-days before the

final bottom, based on stronger market action that confirmed the market internals

signal. The NTSM sell-signal was issued 21 December, 9 sessions before the high

of this recent bear market, based on the bearish “Friday Rundown” of

indicators.)

BOTTOM LINE

I remain bullish.

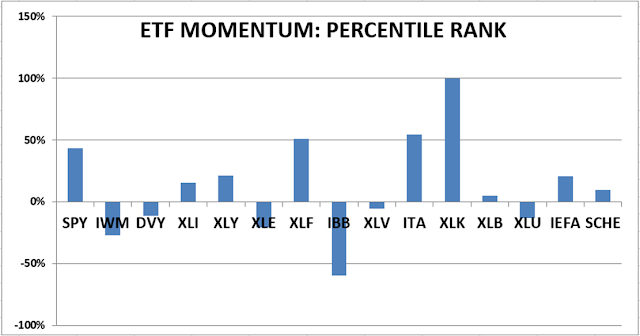

ETF - MOMENTUM ANALYSIS:

TODAY’S RANKING OF 15 ETFs (Ranked Daily)

ETF ranking follows:

The top ranked ETF receives

100%. The rest are then ranked based on their momentum relative to the leading

ETF.

*For additional background on

the ETF ranking system see NTSM Page at…

http://navigatethestockmarket.blogspot.com/p/exchange-traded-funds-etf-ranking.html

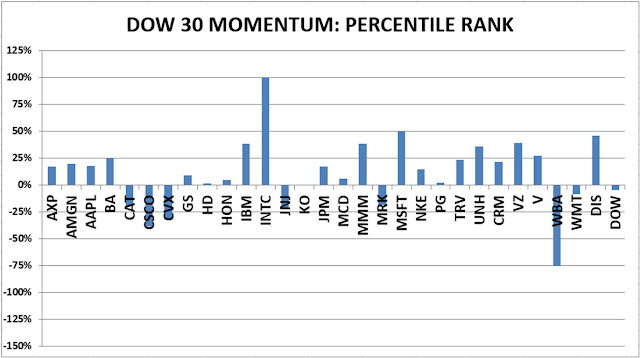

DOW STOCKS - TODAY’S MOMENTUM RANKING

OF THE DOW 30 STOCKS (Ranked Daily)

DOW 30 momentum ranking

follows:

The top ranked Stock receives

100%. The rest are then ranked based on their momentum relative to the leading Stock.

For more details, see NTSM

Page at…

https://navigatethestockmarket.blogspot.com/p/a-system-for-trading-dow-30-stocks-my_8.html

THURSDAY MARKET INTERNALS

(NYSE DATA)

My basket of Market Internals remained HOLD. (My basket of Market

Internals is a decent trend-following analysis of current market action, but

should not be used alone for short term trading. They are most useful when they

diverge from the Index.)

...My current invested

position is about 75% stocks, including stock mutual funds and ETFs. I’m

usually about 50% invested in stocks. I’m “over invested” now expecting new,

all-time highs this year. That burns all the cash. I have about 25% of the portfolio in bonds.

I trade about 15-20% of the

total portfolio using the momentum-based analysis I provide here. When I see a

definitive bottom, I add a lot more stocks to the portfolio using an S&P

500 ETF as I did back in October.

“Trade what you see; not what you think.” – The Old Fool,

Richard McCranie, trader extraordinaire.

“One of the inane things that’s taught in modern

university education is that a vast diversification is absolutely mandatory in

investing in common stocks ...That is an insane idea. It’s not that easy to

have a vast plethora of good opportunities that are easily identified. And if

you’ve only got three, I’d rather be in my best ideas instead of my worst.”

Charlie Munger, vice chairman of Berkshire Hathaway. Charles Munger passed

away, Tuesday at the age of 99.

“Gross Domestic Product (GDP). GDP is

simply the total amount of spending in an economy. GDP, as currently measured,

does not distinguish between “good” spending and “bad” spending. GDP does not

distinguish between consumption spending and investment spending. GDP also does

not distinguish whether spending is generated by existing wealth, by going into

debt temporarily, or by going into debt permanently. In this world, every dollar

spent on education or new means of production, is counted the same as every

dollar spent on epic bachelor parties and video games.” – Michael Lebowitz,

Real Investment Advice

GDP - 2ND ESTIMATE

/ FED BEIGE BOOK (Kiplinger)

“...the U.S. economy grew at a faster pace than

previously thought in the third quarter [ending in September]. Specifically, Q3

gross domestic product (GDP) came in at

5.2% vs the initial 4.9% estimate... The Fed's Beige Book was also released today, and it showed declines in

economic conditions in half of the central bank's 12 districts between October

6 and November 17. ‘Obviously a more somber report than the GDP numbers we saw

this morning," says Alex McGrath,

chief investment officer for NorthEnd Private Wealth. ‘Based on these readings,

it would appear that we have already entered a mild recession that

many have been predicting for a year," even as it runs counter to other

data we've seen.’” Story at...

https://www.kiplinger.com/investing/stocks/stock-market-today-stocks-give-back-gdp-gains-after-beige-book

EIA CRUDE INVENTORIES

U.S. commercial crude oil inventories (excluding those in

the Strategic Petroleum Reserve) increased by 1.6 million barrels from the

previous week. At 449.7 million barrels, U.S. crude oil inventories are

slightly above the five year average for this time of year.

https://ir.eia.gov/wpsr/wpsrsummary.pdf

MARKET REPORT / ANALYSIS

-Wednesday the S&P 500 slipped about 0.1% to 4551.

-VIX rose about 2% to 12.98.

-The yield on the 10-year Treasury slipped to 4.259%.

PULLBACK DATA:

-Drop from Top: 5.1%. 25.4% max (on a closing basis).

-Trading Days since All-Time Top: 479-days. (The top was

3 January 2022.)

The S&P 500 is 6.3% ABOVE its 200-dMA and 4.6% ABOVE

its 50-dMA.

*I won’t call the correction over until the S&P 500

makes a new-high; however, evidence suggests the major bear-market bottom (25%

decline) was in the 3600 area and we called a buy on 4 October 2022.

MY TRADING POSITIONS:

XLK – Technology ETF (holding since the October 2022

lows).

XLY - Consumer Discretionary ETF. (Holding since the

October 2022 lows - I bought more XLY Monday, 8/21.)

I took profits and then reestablished positions as

follows:

SPY – I bought a large position in the S&P 500

Friday, 8/14, in my 401k (it has limited choices).

XLE – Added Tuesday, 8/22.

SSO – 2x S&P 500 ETF. Added 8/24.

MSFT – added 11/16/2023.

TODAY’S COMMENT:

The daily spread of 20 Indicators (Bulls minus Bears) declined

from +5 to zero (a positive number is bullish; negatives are bearish); the

10-day smoothed sum that smooths the daily fluctuations declined from +57

to +47. (The trend direction is more important than the actual number for the

10-day value.) These numbers sometimes change after I post the blog based on

data that comes in late. Most of these 20 indicators are short-term so they

tend to bounce around a lot.

LONG-TERM INDICATOR: The Long Term NTSM indicator improved

to BUY: PRICE & VIX are bullish; VOLUME & SENTIMENT are neutral.

(The important major BUY in this indicator was on 21

October 2022, 7-days after the bear-market bottom. For my NTSM overall signal,

I suggested that a short-term buying opportunity occurred on 27 September

(based on improved market internals on the retest), although without market

follow-thru, I was unwilling to call a buy; however, I did close shorts and

increased stock holdings. I issued a Buy-Signal on 4 October, 6-days before the

final bottom, based on stronger market action that confirmed the market internals

signal. The NTSM sell-signal was issued 21 December, 9 sessions before the high

of this recent bear market, based on the bearish “Friday Rundown” of

indicators.)

BOTTOM LINE

I remain bullish.

ETF - MOMENTUM ANALYSIS:

TODAY’S RANKING OF 15 ETFs (Ranked Daily)

ETF ranking follows:

The top ranked ETF receives

100%. The rest are then ranked based on their momentum relative to the leading

ETF.

*For additional background on

the ETF ranking system see NTSM Page at…

http://navigatethestockmarket.blogspot.com/p/exchange-traded-funds-etf-ranking.html

DOW STOCKS - TODAY’S MOMENTUM RANKING

OF THE DOW 30 STOCKS (Ranked Daily)

DOW 30 momentum ranking follows:

The top ranked Stock receives

100%. The rest are then ranked based on their momentum relative to the leading Stock.

For more details, see NTSM

Page at…

https://navigatethestockmarket.blogspot.com/p/a-system-for-trading-dow-30-stocks-my_8.html

WEDNESDAY MARKET INTERNALS

(NYSE DATA)

My basket of Market Internals remained HOLD. (My basket of Market

Internals is a decent trend-following analysis of current market action, but

should not be used alone for short term trading. They are most useful when they

diverge from the Index.)

...My current invested

position is about 75% stocks, including stock mutual funds and ETFs. I’m

usually about 50% invested in stocks. I’m “over invested” now expecting new,

all-time highs this year. That burns all the cash. I have about 25% of the portfolio in bonds.

I trade about 15-20% of the

total portfolio using the momentum-based analysis I provide here. When I see a

definitive bottom, I add a lot more stocks to the portfolio using an S&P

500 ETF as I did back in October.

“Trade what you see; not what you think.” – The Old Fool,

Richard McCranie, trader extraordinaire.

“In their appeal against the Colorado lawsuit [to remove

Trump from the ballot for insurrection] Trump's lawyers [stated] that Trump

technically did not swear an oath to "support" the Constitution.

Instead, during his January 2017 inauguration, Trump swore to "preserve,

protect and defend" the Constitution during his role as president.”

My cmt: No wait, I didn’t say this...

"Wow in a legal proceeding Trump is now arguing he

didn't violate the 14th Amendment by inciting the Jan 6 insurrection because he

'never took an oath to support the Constitution of the United States.' This

treacherous criminal is head of the Republican Party." - Democratic New

Jersey Congressman Bill Pascrell

From...

Donald

Trump Says He Never Swore Oath 'to Support the Constitution' (msn.com)

If you are a Democrat and your state allows you to vote

in the Republican primary (as does Virginia), please crossover and vote for

Nikki Haley in the primary. We need to keep this nut case (Trump) off the

Presidential Ballot. Since Trump would then run as an independent, a Democratic

candidate would then be a shoe-in. Trump would split the Republican vote, thus getting

his revenge on the Rino Republicans (as he calls anyone who doesn’t support him).

I support any move that will get rid of Trump.

FYI: As a Civil Servant working for the Department of

Defense my oath was (in part) ...

“I will support and defend the Constitution of the United

States against all enemies, foreign and domestic; that I will bear true faith

and allegiance to the same; that I take this obligation freely, without any

mental reservation or purpose of evasion; and that I will well and faithfully

discharge the duties of the ...”

Thus, from my perspective, Trump is a domestic enemy of

the Constitution for attempting to overturn an election that he clearly lost -

I can never support him.

CONSUMER CONFIDENCE (Conference Board)

"’Consumer confidence increased in November,

following three consecutive months of decline,’ said Dana Peterson, Chief Economist at The Conference

Board. ‘This improvement reflected a recovery in the Expectations

Index, while the Present Situation Index was largely unchanged.

November's increase in consumer confidence was concentrated primarily among

householders aged 55 and up; by contrast, confidence among householders aged

35-54 declined slightly. General improvements were seen across the spectrum of

income groups surveyed in November. Nonetheless, write-in responses revealed

consumers remain preoccupied with rising prices in general, followed by

war/conflicts and higher interest rates.’" Press release at...

https://www.prnewswire.com/news-releases/us-consumer-confidence-increased-in-november-301999321.html

MARKET REPORT / ANALYSIS

-Tuesday the S&P 500 rose about 0.1% to 4555.

-VIX was unchanged at 12.69.

-The yield on the 10-year Treasury slipped to 4.323%.

PULLBACK DATA:

-Drop from Top: 5%. 25.4% max (on a closing basis).

-Trading Days since All-Time Top: 478-days. (The top was

3 January 2022.)

The S&P 500 is 6.4% ABOVE its 200-dMA and 4.7% ABOVE

its 50-dMA.

*I won’t call the correction over until the S&P 500

makes a new-high; however, evidence suggests the major bear-market bottom (25%

decline) was in the 3600 area and we called a buy on 4 October 2022.

MY TRADING POSITIONS:

XLK – Technology ETF (holding since the October 2022

lows).

XLY - Consumer Discretionary ETF. (Holding since the

October 2022 lows - I bought more XLY Monday, 8/21.)

I took profits and then reestablished positions as

follows:

SPY – I bought a large position in the S&P 500

Friday, 8/14, in my 401k (it has limited choices).

XLE – Added Tuesday, 8/22.

SSO – 2x S&P 500 ETF. Added 8/24.

MSFT – added 11/16/2023.

TODAY’S COMMENT:

Not much different today: The Smart Money overbought

indicator, RSI, and the # up-days over the last month all remain

overbought. (As of today, the

Overbought/Oversold index is not overbought.) These are still suggesting

weakness could last a bit longer. There are still plenty of bullish indicators,

so I am not concerned. It looks like a normal pause or a flattening of the

uptrend.

Today, (Tuesday) unchanged volume was very high. As I’ve

often said, many believe that this indicator suggests investor confusion at

market turning points. It is suggesting some downside ahead, but the signal is

often wrong. It’s not in my system as an indicator, so for now, I’ll pay

attention, but not worry. As noted above, there are still reliable bull signs

in the indicators.

The daily spread of 20 Indicators (Bulls minus Bears) remained

+5 (a positive number is bullish; negatives are bearish); the 10-day smoothed

sum that smooths the daily fluctuations declined from +58 to +57. (The

trend direction is more important than the actual number for the 10-day value.)

These numbers sometimes change after I post the blog based on data that comes

in late. Most of these 20 indicators are short-term so they tend to bounce

around a lot.

LONG-TERM INDICATOR: The Long Term NTSM indicator remained

HOLD: VOLUME & VIX are bullish; PRICE & SENTIMENT are neutral.

(The important major BUY in this indicator was on 21

October 2022, 7-days after the bear-market bottom. For my NTSM overall signal,

I suggested that a short-term buying opportunity occurred on 27 September

(based on improved market internals on the retest), although without market

follow-thru, I was unwilling to call a buy; however, I did close shorts and

increased stock holdings. I issued a Buy-Signal on 4 October, 6-days before the

final bottom, based on stronger market action that confirmed the market internals

signal. The NTSM sell-signal was issued 21 December, 9 sessions before the high

of this recent bear market, based on the bearish “Friday Rundown” of

indicators.)

BOTTOM LINE

I remain bullish.

ETF - MOMENTUM ANALYSIS:

TODAY’S RANKING OF 15 ETFs (Ranked Daily)

ETF ranking follows:

The top ranked ETF receives

100%. The rest are then ranked based on their momentum relative to the leading

ETF.

*For additional background on

the ETF ranking system see NTSM Page at…

http://navigatethestockmarket.blogspot.com/p/exchange-traded-funds-etf-ranking.html

DOW STOCKS - TODAY’S MOMENTUM RANKING

OF THE DOW 30 STOCKS (Ranked Daily)

DOW 30 momentum ranking

follows:

The top ranked Stock receives

100%. The rest are then ranked based on their momentum relative to the leading Stock.

For more details, see NTSM

Page at…

https://navigatethestockmarket.blogspot.com/p/a-system-for-trading-dow-30-stocks-my_8.html

TUESDAY MARKET INTERNALS (NYSE

DATA)

My basket of Market Internals remained HOLD. (My basket of Market

Internals is a decent trend-following analysis of current market action, but

should not be used alone for short term trading. They are most useful when they

diverge from the Index.)

...My current invested

position is about 75% stocks, including stock mutual funds and ETFs. I’m

usually about 50% invested in stocks. I’m “over invested” now expecting new,

all-time highs this year. That burns all the cash. I have about 25% of the portfolio in bonds.

I trade about 15-20% of the

total portfolio using the momentum-based analysis I provide here. When I see a

definitive bottom, I add a lot more stocks to the portfolio using an S&P

500 ETF as I did back in October.

“Trade what you see; not what you think.” – The Old Fool,

Richard McCranie, trader extraordinaire.

MORE FAKE ELECTOR CHARGES FOR TRUMP? (The Independent)

“Four swing-states are reportedly still investigating the

slates of so-called ‘fake electors’ which Donald Trump allegedly

hoped to use to falsely certify that he had won the 2020 election...

It hinged on then-Vice President Mike Pence choosing to certify the slates of

Trump-loyalist ‘fake’ electors in swing-states... On the day of the

certification, 6 January 2021, Mr. Pence penned a letter refusing to go along

with the plot, saying his ‘oath to support and defend the Constitution

constrains me from claiming unilateral authority to determine which electoral

votes should be counted and which should not.’” Story at...

Trump

could face more criminal charges over ‘fake electors’ scam, report says

(msn.com)

My cmt: This was the real insurrection - a seditious

conspiracy to steal the election. Can you imagine if the Democrats had tried a

scheme like this? Hannity, Clay Travis and Buck Sexton and the rest of the

right-wing, media wackos would be apoplectic. I find this all depressing since

I lean to the right and voted for Trump in 2020 – never again! Trump is a

criminal. Given that some of Trump’s co-conspirators have already pled guilty

in Georgia, Trump may be inaugurated in jail.

"You lost. You're guilty. Welcome to Columbia,

Donald. - Sponsored by the league of radical leftist vermin - Jay Bender

Instigator.” Billboards in Columbia, SC greeting “The Donald” on his visit.

NEW HOME SALES (CNN)

“New home sales in the United States fell in October as

typical mortgage rates reached their highest levels this year. Sales of newly

constructed homes fell 5.6% in October... Sales were up 17.7% from a year ago.”

Story at...

https://www.cnn.com/2023/11/27/business/new-home-sales-drop-in-october-amid-higher-mortgage-rates/index.html

MARKET REPORT / ANALYSIS

-Monday the S&P 500 dipped about 0.2% to 4550.

-VIX rose about 2% to 12.69.

-The yield on the 10-year Treasury rose to 4.398%.

PULLBACK DATA:

-Drop from Top: 5.1%. 25.4% max (on a closing basis).

-Trading Days since All-Time Top: 477-days. (The top was

3 January 2022.)

The S&P 500 is 6.4% ABOVE its 200-dMA and 4.7%

ABOVE its 50-dMA.

*I won’t call the correction over until the S&P 500

makes a new-high; however, evidence suggests the major bear-market bottom (25%

decline) was in the 3600 area and we called a buy on 4 October 2022.

MY TRADING POSITIONS:

XLK – Technology ETF (holding since the October 2022

lows).

XLY - Consumer Discretionary ETF. (Holding since the

October 2022 lows - I bought more XLY Monday, 8/21.)

I took profits and then reestablished positions as

follows:

SPY – I bought a large position in the S&P 500

Friday, 8/14, in my 401k (it has limited choices).

XLE – Added Tuesday, 8/22.

SSO – 2x S&P 500 ETF. Added 8/24.

MSFT – added 11/16/2023.

TODAY’S COMMENT:

Breadth continues to slowly improve. The 100-dMA of issues advancing on the NYSE

popped above zero today, canceling another one of our bear indicators.

Today, there was a Bearish Outside Reversal signal on the

S&P 500. Today’s high and low both exceeded Friday’s high and low. This can

sometime signal a reversal down since today’s close was lower. Friday was a very low-volume, trading-day

without much range. I think this signal is skewed by the low range on Friday

and is probably not signaling a significant trend change now; I’ll ignore it.

The Smart Money overbought indicator, RSI, and the #

up-days over the last month all remain overbought. (As of today, the Overbought/Oversold index

is not overbought.) These are still suggesting weakness could last a bit

longer. There are still plenty of bullish indicators, so I am not concerned

about a normal flattening of the uptrend.

The daily spread of 20 Indicators (Bulls minus Bears) declined

from +8 to +5 (a positive number is bullish; negatives are bearish); the 10-day

smoothed sum that smooths the daily fluctuations declined from +59 to +58.

(The trend direction is more important than the actual number for the 10-day

value.) These numbers sometimes change after I post the blog based on data that

comes in late. Most of these 20 indicators are short-term so they tend to

bounce around a lot.

LONG-TERM INDICATOR: The Long Term NTSM indicator slipped

to HOLD: VOLUME & VIX are bullish; PRICE & SENTIMENT are neutral.

(The important major BUY in this indicator was on 21

October 2022, 7-days after the bear-market bottom. For my NTSM overall signal,

I suggested that a short-term buying opportunity occurred on 27 September

(based on improved market internals on the retest), although without market

follow-thru, I was unwilling to call a buy; however, I did close shorts and

increased stock holdings. I issued a Buy-Signal on 4 October, 6-days before the

final bottom, based on stronger market action that confirmed the market internals

signal. The NTSM sell-signal was issued 21 December, 9 sessions before the high

of this recent bear market, based on the bearish “Friday Rundown” of

indicators.)

BOTTOM LINE

I remain bullish.

ETF - MOMENTUM ANALYSIS:

TODAY’S RANKING OF 15 ETFs (Ranked Daily)

ETF ranking follows:

The top ranked ETF receives

100%. The rest are then ranked based on their momentum relative to the leading

ETF.

*For additional background on

the ETF ranking system see NTSM Page at…

http://navigatethestockmarket.blogspot.com/p/exchange-traded-funds-etf-ranking.html

DOW STOCKS - TODAY’S MOMENTUM RANKING

OF THE DOW 30 STOCKS (Ranked Daily)

DOW 30 momentum ranking

follows:

The top ranked Stock receives

100%. The rest are then ranked based on their momentum relative to the leading Stock.

For more details, see NTSM

Page at…

https://navigatethestockmarket.blogspot.com/p/a-system-for-trading-dow-30-stocks-my_8.html

MONDAY MARKET INTERNALS (NYSE

DATA)

My basket of Market Internals declined to HOLD. (My basket of Market

Internals is a decent trend-following analysis of current market action, but

should not be used alone for short term trading. They are most useful when they

diverge from the Index.)

...My current invested

position is about 75% stocks, including stock mutual funds and ETFs. I’m

usually about 50% invested in stocks. I’m “over invested” now expecting new,

all-time highs this year. That burns all the cash. I have about 25% of the portfolio in bonds.

I trade about 15-20% of the

total portfolio using the momentum-based analysis I provide here. When I see a

definitive bottom, I add a lot more stocks to the portfolio using an S&P

500 ETF as I did back in October.

S&P GLOBAL COMPOSITE PMI (S&P Global)

“US businesses signalled a further marginal expansion in

output during November, with the rate of growth in business activity in line

with that seen in October. Although manufacturers and service providers

registered another monthly rise in activity, paces of expansion were only

slight overall. Total new orders returned to growth, thereby ending a

three-month sequence of contraction. That said, demand conditions at

manufacturers were unchanged on the month.

Relatively subdued demand conditions and dwindling

backlogs led firms to cut their workforce numbers for the first time since June

2020, as service providers joined goods producers in reducing headcounts... The

headline S&P Global Flash US PMI Composite Output Index posted at 50.7 in

November, matching the figure seen in October. This indicated a marginal rise

in business activity that was the joint-fastest since July.” Press release

at...

https://www.pmi.spglobal.com/Public/Home/PressRelease/b72b9c19b3bd48e78027009aad143044

MARKET REPORT / ANALYSIS

-Friday the S&P 500 rose about 0.1% to 4559.

-VIX dipped about 2% to 12.66.

-The yield on the 10-year Treasury rose to 4.476%.

PULLBACK DATA:

-Drop from Top: 4.9%. 25.4% max (on a closing basis).

-Trading Days since All-Time Top: 476-days. (The top was

3 January 2022.)

The S&P 500 is 6.7% ABOVE its 200-dMA and 4.9%

ABOVE its 50-dMA.

*I won’t call the correction over until the S&P 500

makes a new-high; however, evidence suggests the major bear-market bottom (25%

decline) was in the 3600 area and we called a buy on 4 October 2022.

MY TRADING POSITIONS:

XLK – Technology ETF (holding since the October 2022

lows).

XLY - Consumer Discretionary ETF. (Holding since the

October 2022 lows - I bought more XLY Monday, 8/21.)

I took profits and then reestablished positions as

follows:

SPY – I bought a large position in the S&P 500

Friday, 8/14, in my 401k (it has limited choices).

XLE – Added Tuesday, 8/22.

SSO – 2x S&P 500 ETF. Added 8/24.

MSFT – added 11/16/2023.

TODAY’S COMMENT:

The NYSE closed at 1PM today. Trading was light.

The Overbought/Oversold index, Smart Money overbought

indicator, RSI, and the # of up-days over the last month are all overbought. These

are suggesting at least a down-day Monday and some weakness could last a bit

longer. It’s not a big deal though; the

Friday Summary remains very bullish.

We look at a summary of indicators on Friday. (These

indicators tend to be both long-term and short-term, so they are different than

the 20 that I report on daily.) The weekly rundown of indicators remained

bullish this week: now 8-bear and 20-bull.

BULL SIGNS

-There was a Follow-thru Day 14 November. This cancels all

Distribution Days.

-The smoothed advancing volume on the NYSE is rising.

-The 10-dMA percentage of issues advancing on

the NYSE (Breadth) is above 50%.

-MACD of the percentage of issues advancing on the NYSE

(breadth) made a bullish crossover 12 October.

-Smoothed Buying Pressure minus Selling Pressure.

-MACD of S&P 500 price made a bullish crossover 2

Nov.

-Long-term new-high/new-low data.

-Short-term new-high/new-low data.

-My Money Trend indicator is rising.

-Slope of the 40-dMA of New-highs is rising.

-McClellan Oscillator.

-The graph of the 100-day Count (the 100-day sum of

up-days).

-The Smart Money (late-day action).

-On average, the size of up-moves has been larger than

the size of down-moves over the last month.

-VIX indicator.

-There was a high up-volume day on 14 November. In addition,

there were back-to-back, high up-volume days (80%+) on the NYSE 2 & 3 Nov.

-The 5-day EMA is above the 10-day EMA, so short-term

momentum is bullish.

-The 5-10-20 Timer System is BUY.

-There was a Zweig Breadth Thrust 3 November. That’s a

rare, very-bullish sign, that will remain bullish until the McClellan

Oscillator turns negative.

-75% of the 15-ETFs that I track have been up over the

last 10-days. (45-55% is neutral.)

NEUTRAL

-There have been 2 Statistically-Significant days (big

moves in price-volume) in the last 15-days.

-Sentiment.

-Bollinger Band Squeeze 28 April - expired.

-Bollinger Bands.

-The 50-dMA percentage of issues advancing on the NYSE

(Breadth) has not been below 50%, for more than 3 days in a row.

-Issues advancing on the NYSE (Breadth) compared to the

S&P 500.

-9 November there was a Bearish Outside Reversal Day, but

since the McClellan Oscillator is bullish, I’ll call this one neutral.

-There was a New-high/New-low spread reversal on 4 October

(based on std deviation of spread). - Expired

-The S&P 500 is 6.7% above its 200-dMA. (Bear

indicator is 12% above the 200-day.)

-The short-term, 10-day EMA, Fosback Hi-Low Logic Index.

-The long-term, 50-dEMA, Fosback Hi-Low Logic Index.

-There were Hindenburg Omen signals 11 & 12 Sept 2023

– expired. The McClellan Oscillator turned positive.

-There have been 8 up-days over the last 10 sessions.

-The Calm-before-the-Storm/Panic Indicator flashed a top

warning signal 15 Sept., but it may well have been a bottom signal. - Expired

-2.8% of all issues traded on the NYSE made new, 52-week

highs when the S&P 500 made a new all-time-high, 3 January 2022. (There is

no bullish signal for this indicator.) This indicated that the advance was too

narrow and a correction was likely to be >10%. It proved correct, but is now

Expired.

BEAR SIGNS

-Overbought/Oversold Index (Advance/Decline Ratio).

-The 50-dMA percentage of issues advancing on the NYSE

(Breadth) is below 50%

-The 100-dMA percentage of issues advancing on

the NYSE (Breadth) is below 50%

-RSI.

-There have been 16 up-days over the last 20 sessions –

overbought.

-Smart Money is bullish, but overbought

-S&P 500 spread vs. Utilities (XLU-ETF).

-XLI-ETF (Cyclical Industrials) vs the S&P 500.

On Monday’s update of the Friday summary of indicators (20

December 2021), 9 days before the top of the current 25% correction, there were

21 bear-signs and zero bull-signs. Now there are 8 bear-signs and 20-Bull.

Last week, there were 7 bear-sign and 17 bull-signs.

I have worked on automating the Friday Summary of

Indicators, but some of them are difficult to code and I haven’t finished yet.

Here’s a preliminary chart of the Friday Summary plotted on a daily basis. The

red curve is the spread of indicators (bulls minus bears) and the green curve

is a 10-dMA. We can see that the indicators “called the bottom” as they

diverged and made higher lows (green circles) while the S&P 500 made a

lower low (black circles).

The daily spread of 20 Indicators (Bulls minus Bears) improved

from +6 to +8 (a positive number is bullish; negatives are bearish); the 10-day

smoothed sum that smooths the daily fluctuations improved from +55 to +59.

(The trend direction is more important than the actual number for the 10-day

value.) These numbers sometimes change after I post the blog based on data that

comes in late. Most of these 20 indicators are short-term so they tend to

bounce around a lot.

LONG-TERM INDICATOR: The Long Term NTSM indicator slipped

to HOLD: VOLUME & VIX are bullish; PRICE & SENTIMENT are neutral.

(The important major BUY in this indicator was on 21

October 2022, 7-days after the bear-market bottom. For my NTSM overall signal,

I suggested that a short-term buying opportunity occurred on 27 September

(based on improved market internals on the retest), although without market

follow-thru, I was unwilling to call a buy; however, I did close shorts and

increased stock holdings. I issued a Buy-Signal on 4 October, 6-days before the

final bottom, based on stronger market action that confirmed the market internals

signal. The NTSM sell-signal was issued 21 December, 9 sessions before the high

of this recent bear market, based on the bearish “Friday Rundown” of

indicators.)

BOTTOM LINE

I remain bullish.

ETF - MOMENTUM ANALYSIS:

TODAY’S RANKING OF 15 ETFs (Ranked Daily)

ETF ranking follows:

The top ranked ETF receives

100%. The rest are then ranked based on their momentum relative to the leading

ETF.

*For additional background on

the ETF ranking system see NTSM Page at…

http://navigatethestockmarket.blogspot.com/p/exchange-traded-funds-etf-ranking.html

DOW STOCKS - TODAY’S MOMENTUM RANKING

OF THE DOW 30 STOCKS (Ranked Daily)

DOW 30 momentum ranking

follows:

The top ranked Stock receives

100%. The rest are then ranked based on their momentum relative to the leading Stock.

For more details, see NTSM

Page at…

https://navigatethestockmarket.blogspot.com/p/a-system-for-trading-dow-30-stocks-my_8.html

FRIDAY MARKET INTERNALS (NYSE

DATA)

My basket of Market Internals remained BUY. (My basket of Market

Internals is a decent trend-following analysis of current market action, but

should not be used alone for short term trading. They are most useful when they

diverge from the Index.)

...My current invested

position is about 75% stocks, including stock mutual funds and ETFs. I’m

usually about 50% invested in stocks. I’m “over invested” now expecting new,

all-time highs this year. That burns all the cash. I have about 25% of the portfolio in bonds.

I trade about 15-20% of the

total portfolio using the momentum-based analysis I provide here. When I see a

definitive bottom, I add a lot more stocks to the portfolio using an S&P

500 ETF as I did back in October.

“The Biden administration releases $10 billion to Iran

while talks to release 50 of the 240 hostages that Hamas is holding continue.”

Michael Ramirez. Commenary at...

https://michaelpramirez.com/index.html

HAVE A GREAT THANKSGIVING HOLIDAY!

“Trade what you see; not what you think.” – The Old Fool,

Richard McCranie, trader extraordinaire.

JOBLESS CLAIMS (Reuters)

“The number of Americans filing new claims for

unemployment benefits fell more than expected last week, but that likely does

not change the view that the labor market is gradually slowing as higher

interest rates cool demand in the economy... Initial claims for state

unemployment benefits dropped 24,000 to a seasonally adjusted 209,000 for the

week ended Nov. 18.” Story at...

https://www.reuters.com/markets/us/us-weekly-jobless-claims-fall-labor-market-still-slowing-2023-11-22/

DURABLE ORDERS (RTT News)

“After reporting a spike in new orders for U.S.

manufactured durable goods in the previous month, the Commerce Department

released a report on Wednesday showing durable goods orders pulled back by much

more than expected in the month of October. The Commerce Department said

durable goods orders plunged by 5.4 percent in October...” Story at...

https://www.rttnews.com/3407142/u-s-durable-goods-orders-tumble-amid-sharp-pullback-in-aircraft-demand.aspx

CRUDE INVENTORIES (EIA)

“U.S. commercial crude oil inventories (excluding those

in the Strategic Petroleum Reserve) increased by 8.7 million barrels from the

previous week. At 448.1 million barrels, U.S. crude oil inventories are about

1% below the five year average for this time of year.” Report at...

https://ir.eia.gov/wpsr/wpsrsummary.pdf

MARKET REPORT / ANALYSIS

-Wednesday the S&P 500 rose about 0.4% to 4557.

-VIX dipped about 4% to 12.85.

-The yield on the 10-year Treasury rose slightly to 4.408%.

PULLBACK DATA:

-Drop from Top: 5%. 25.4% max (on a closing basis).

-Trading Days since All-Time Top: 475-days. (The top was

3 January 2022.)

The S&P 500 is 6.6% ABOVE its 200-dMA and 4.9%

ABOVE its 50-dMA.

*I won’t call the correction over until the S&P 500

makes a new-high; however, evidence suggests the major bear-market bottom (25%

decline) was in the 3600 area and we called a buy on 4 October 2022.

MY TRADING POSITIONS:

XLK – Technology ETF (holding since the October 2022

lows).

XLY - Consumer Discretionary ETF. (Holding since the

October 2022 lows - I bought more XLY Monday, 8/21.)

I took profits and then reestablished positions as

follows:

SPY – I bought a large position in the S&P 500

Friday, 8/14, in my 401k (it has limited choices).

XLE – Added Tuesday, 8/22.

SSO – 2x S&P 500 ETF. Added 8/24.

MSFT – added 11/16/2023.

TODAY’S COMMENT:

Pundits keep cautioning about the narrow advance in the

stock markets and that the markets are being carried by the magnificent seven.

I suspect those investors are looking at the number of issues making new-highs.

Over the last 10 trading sessions, on average, only 2.4% of issues on the NYSE

are making new all-time, 52-week highs.

That’s a low number and it certainly would be concerning if the S&P 500 was

also making a new-all-time high. Since the S&P 500 isn’t, and we know there

has been significant weakness not too long ago, I prefer to look at other

measures of breadth.

The 150-dMA of issues advancing on the NYSE has been

headed higher and is now 50%, meaning that half of the issues on the NYSE have

been going up over the last 7-1/2 months.

That tends to approximate the advance-decline line and it is suggesting

that conditions aren’t as bad as the new-high numbers would have us believe.

Other shorter-term measures (50-dMA and the 100-dMA) are improving. If that

continues, markets will make new, all-time highs. A Santa Clause rally, starting

now, should get us there. The S&P 500 is only 5% below its all-time high.

If new-52-week high numbers remain low while markets are

making new, all-time-highs, then we have an issue to worry about.

The daily spread of 20 Indicators (Bulls minus Bears) remained

+6 (a positive number is bullish; negatives are bearish); the 10-day smoothed

sum that smooths the daily fluctuations declined from +57 to +55. (The

trend direction is more important than the actual number for the 10-day value.)

These numbers sometimes change after I post the blog based on data that comes

in late. Most of these 20 indicators are short-term so they tend to bounce

around a lot.

LONG-TERM INDICATOR: The Long Term NTSM indicator

remained BUY: PRICE, VOLUME & VIX are bullish; SENTIMENT is neutral.

(The important major BUY in this indicator was on 21

October 2022, 7-days after the bear-market bottom. For my NTSM overall signal,

I suggested that a short-term buying opportunity occurred on 27 September

(based on improved market internals on the retest), although without market

follow-thru, I was unwilling to call a buy; however, I did close shorts and

increased stock holdings. I issued a Buy-Signal on 4 October, 6-days before the

final bottom, based on stronger market action that confirmed the market internals

signal. The NTSM sell-signal was issued 21 December, 9 sessions before the high

of this recent bear market, based on the bearish “Friday Rundown” of

indicators.)

BOTTOM LINE

I remain bullish.

ETF - MOMENTUM ANALYSIS:

TODAY’S RANKING OF 15 ETFs (Ranked Daily)

ETF ranking follows:

The top ranked ETF receives

100%. The rest are then ranked based on their momentum relative to the leading

ETF.

*For additional background on

the ETF ranking system see NTSM Page at…

http://navigatethestockmarket.blogspot.com/p/exchange-traded-funds-etf-ranking.html

DOW STOCKS - TODAY’S MOMENTUM RANKING

OF THE DOW 30 STOCKS (Ranked Daily)

DOW 30 momentum ranking

follows:

The top ranked Stock receives

100%. The rest are then ranked based on their momentum relative to the leading Stock.

For more details, see NTSM

Page at…

https://navigatethestockmarket.blogspot.com/p/a-system-for-trading-dow-30-stocks-my_8.html

WEDNESDAY MARKET INTERNALS

(NYSE DATA)

My basket of Market Internals remained BUY. (My basket of Market

Internals is a decent trend-following analysis of current market action, but

should not be used alone for short term trading. They are most useful when they

diverge from the Index.)

...My current invested

position is about 75% stocks, including stock mutual funds and ETFs. I’m

usually about 50% invested in stocks. I’m “over invested” now expecting new,

all-time highs this year. That burns all the cash. I have about 25% of the portfolio in bonds.

I trade about 15-20% of the

total portfolio using the momentum-based analysis I provide here. When I see a

definitive bottom, I add a lot more stocks to the portfolio using an S&P

500 ETF as I did back in October.