“Trade what you see; not what you think.” – The Old Fool,

Richard McCranie, trader extraordinaire.

“Faced with a combination of record speculative extremes

and deteriorating speculative conditions, investors may want to remember that

the best time to panic is before everyone else does.” – John Hussman, Phd.

“I wouldn’t want to keep money in a bank that can’t

access the SWIFT system. Once a bank can’t transfer or receive funds from other

banks, its solvency can be at risk. If I were Russian, I would take my money

out now.” – Bill Ackman, Hedge Fund Manager.

"I’ve stood in lines for an hour [at an ATM machine],

but foreign currency is gone everywhere, just rubles...I got a

late start [Sunday] because I didn’t think this was possible. I’m in shock.” Vladimir,

a 28-year-old Russian programmer who declined to give his last name.

CHICAGO PMI (Advisor perspectives)

“The latest Chicago Purchasing Manager's Index, or the

Chicago Business Barometer, fell to 56.3 in February from 65.2 in December...Values

above 50.0 indicate expanding manufacturing activity.” Commentary at...

CASS FREIGHT INDEX (Cass Information Systems)

“U.S. freight volumes reeled in January from the surge in

Omicron cases, with the shipments component of the Cass Freight Index® down

10.8% from December and down 2.9% y/y. The 7.4% m/m (SA) drop in January in the

shipments component of the Cass Freight Index is about as good an answer as we

have to the question of how big an impact Omicron-related absenteeism and

quarantines had on the freight economy. While these effects are lingering in

February, they are beginning to fade and we expect a rebound in the coming

months as case counts fall sharply.” Report at...

https://www.cassinfo.com/freight-audit-payment/cass-transportation-indexes/january-2022

STEEP AND DEEP – PERHAPS “A” BOTTOM BUT NOT “THE” BOTTOM

(Heritage Capital)

“January 24th was “A” bottom. Now, all of the conditions

have been for a second bottom which may or may not be the ultimate low. Stocks

should rally. The quality of that rally will determine where the market is in

the cycle. We really want to see enormous and relentless buying interest. In

other words, a thrust.” Commentary at...

https://investfortomorrow.com/blog/steep-deep/

RUSSIA INVASION SENDS STOCKS RALLYING? (Real Investment

Advice)

“While everyone remains focused on the Russia invasion of

Ukraine, it is the Fed that remains the most significant risk to stocks. While

we do expect a continued rally over the next few days, primarily from

short-covering and too many “put options,” these strong counter-trend

reflex rallies only exist during more meaningful correction processes. As

Michael Lebowitz shows, since 2000, there are only 5-previous instances of the

Nasdaq opening down 3% but closing up 3%. All of those instances occurred

during the bear markets of 2000 and 2008. Such is one reason why we are

remaining cautious near term.” Commentary at...

https://realinvestmentadvice.com/russia-invasion-sends-stocks-rallying/

MARKET REPORT / ANALYSIS

-Monday the S&P 500 slipped about 0.2% to 4374.

-VIX rose about 9% to 30.02. (No, it’s not a typo – the

Options Folks are worried.)

-The yield on the 10-year Treasury slipped to 1.828%.

Pullback Data:

Days since top: 38 (Avg= 30 days top to bottom for

corrections <10%; 60 days top to bottom for larger, non-crash pullbacks)

Drop from Top: Now 8.8% at close. Max at close: 11.9%

(Avg.= 13% for non-crash pullbacks)

The S&P 500 is 2% BELOW its 200-dMA & 3.9% BELOW

its 50-dMA.

Max Retracement from bottom: 56% 2 Feb.

The slope of the 200-dMA is up.

Markets were down Sunday night with S&P 500 futures

down 2.5%. They improved to around 1.5% down at the open Monday morning; the

S&P 500 finished only 0.2% down. The

markets are working hard to get past a lot of negative data. The number one

issue now might be how are the sanctions going to impact the economy? It could

get quite nasty, but we don’t know. The

markets hate uncertainty.

VIX is still rising sharply and it was up again today. That’s a good indicator that should worry the

bulls.

On 25 February, the 52-week, New-high/new-low ratio

improved by 4.2 standard deviations. That’s a very Bullish sign, but during the

Coronavirus correction there were 3 new-high/new-low improvements that were

higher and none signaled a bottom. We need to see this indicator supported by

additional bullish signs. The spread (new-highs minus new-lows) got worse today

and the bulls want to see a positive number there. We did see some more positive

numbers in short-term indicators.

The daily sum of 20 Indicators improved from +4 to +7 (a

positive number is bullish; negatives are bearish); the 10-day smoothed sum

that smooths the daily fluctuations improved from -48 to -38 (The trend direction

is more important than the actual number for the 10-day value.) These numbers

sometimes change after I post the blog based on data that comes in late. Most

of these indicators are short-term so they tend to bounce around a lot. Long-term

indicators improved too.

The Long Term NTSM indicator

ensemble improved to HOLD. VIX is bearish; Volume, Price & Sentiment are

Neutral; New-High/New-Low data is bullish based on the 25 Feb swing in

new-high/new-low data.

I like to see a bottom tested at a lower price with lower

volume and improvements in market internals and divergences. The data didn’t meet the criteria at the 23

Feb bottom, so I am left looking for a strong confirmation of the move higher,

especially in volume and breadth. So far, I haven’t seen it. Whether we retest

the low remains to be seen.

I am still hoping to be able to call a bottom.

Until we see more bullish signs, I remain bearish.

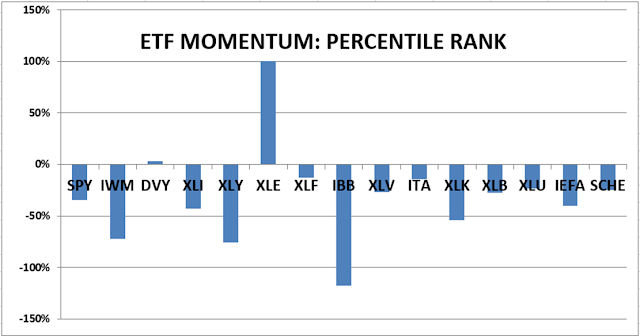

BEST ETFs - MOMENTUM ANALYSIS:

TODAY’S RANKING OF 15 ETFs

(Ranked Daily)

The top ranked ETF receives

100%. The rest are then ranked based on their momentum relative to the leading

ETF.

*For additional background on the ETF ranking system see NTSM Page at…

http://navigatethestockmarket.blogspot.com/p/exchange-traded-funds-etf-ranking.html

BEST DOW STOCKS - TODAY’S MOMENTUM RANKING OF THE DOW 30 STOCKS (Ranked Daily)

Here’s the revised DOW 30 and

its momentum analysis. The top ranked stock receives 100%. The rest are then

ranked based on their momentum relative to the leading stock.

For more details, see NTSM Page at…

https://navigatethestockmarket.blogspot.com/p/a-system-for-trading-dow-30-stocks-my_8.html

MONDAY MARKET INTERNALS (NYSE DATA)

My basket of Market Internals remained HOLD.

Market Internals are a decent

trend-following analysis of current market action, but should not be used alone

for short term trading. They are usually right, but they are often late. They are most useful when they diverge from

the Index.

My stock-allocation in the portfolio is now about 35% invested in stocks. This is below my “normal” fully invested stock-allocation of 50%.

I trade about 15-20% of the

total portfolio using the momentum-based analysis I provide here. If I can see

a definitive bottom, I’ll add a lot more stocks to the portfolio using an

S&P 500 ETF.

You may wish to have a higher

or lower % invested in stocks depending on your risk tolerance. 50% is a

conservative position that I consider fully invested for most retirees.

As a general rule, some

suggest that the % of portfolio invested in the stock market should be one’s

age subtracted from 100. So, a

30-year-old person would have 70% of the portfolio in stocks, stock mutual

funds and/or stock ETFs. That’s ok, but

for older investors, I usually don’t recommend keeping less than 50% invested

in stocks (as a fully invested position) since most people need some growth in

the portfolio to keep up with inflation.