“Trade what you see; not what you think.” – The Old Fool,

Richard McCranie, trader extraordinaire.

“Faced with a combination of record speculative extremes

and deteriorating speculative conditions, investors may want to remember that

the best time to panic is before everyone else does.” – John Hussman, Phd.

Kandiss Taylor received just 3.4% of the vote in the GOP

primary for Georgia governor...Taylor is refusing to concede and claims the

election was rigged. What planet is this woman from? Needless to say, she is a

Trumpette.

CHICAGO PMI (MarketWatch)

“The Chicago Business Barometer, also known as the

Chicago PMI, rose to 60.3 in May from 56.4 in the prior month. Economists

polled by the Wall Street Journal forecast a 55.9 reading.” Story at...

https://www.marketwatch.com/story/chicago-pmi-jumps-in-may-beating-expectations-11654005362

CONSUMER CONFIDENCE (Conference Board via prnewswire.com)

“The Conference Board Consumer Confidence Index® decreased slightly in May,

following a small increase in April... "Consumer confidence dipped

slightly in May, after rising modestly in April," said Lynn Franco, Senior Director of Economic Indicators at

The Conference Board. "The decline in the Present Situation Index was

driven solely by a perceived softening in labor market conditions. By contrast,

views of current business conditions—which tend to move ahead of trends in

jobs—improved.” Press release at...

https://www.prnewswire.com/news-releases/consumer-confidence-declined-slightly-in-may-301557849.html

DEPARTMENT OF JUSTICE STUDY ON THE EFFECTIVNESS OF THE ASSAULT

WEAPONS (AW) BAN IN 1994 (factcheck.org)

The 2004 study led by Christopher S. Koper was titled, “An Updated

Assessment of the Federal Assault Weapons Ban: Impacts on Gun Markets and Gun

Violence, 1994-2003.” That report was the final of three studies of

the ban, which was enacted in 1994 as part of the Violent Crime

Control and Law Enforcement Act of 1994. It concluded:

“Although the ban has been successful in reducing crimes

with AWs [Assault Weapons], any benefits from this reduction are likely to have

been outweighed by steady or rising use of non-banned semiautomatics with LCMs

[large-capacity magazines], which are used in crime much more frequently than

AWs. Therefore, we cannot clearly credit the ban with any of the nation’s

recent drop in gun violence. And, indeed, there has been no discernible

reduction in the lethality and injuriousness of gun violence, based on

indicators like the percentage of gun crimes resulting in death or the share of

gunfire incidents resulting in injury, as we might have expected had the ban

reduced crimes with both AWs and LCMs.” Fact check at...

My cmt: (I don’t own an AW nor do have a desire to; I just

thought this piece was interesting. As a numbers guy, I would rather have

decisions made on the basis of measurable results rather than emotional

reactions. Keeping guns out of the hands of crazy people would be far more

effective than banning a specific type of gun. In Virginia, a judge can issue

an Extreme Risk Protective Order, enabling the

police to temporarily confiscate the firearms of a person deemed to be at high

risk of harming themselves or others. It would be interesting to see how often

this has occurred. For more, including case studies where mass shootings were

prevented around the country, see here...

https://efsgv.org/learn/policies/extreme-risk-laws/

MARKET REPORT / ANALYSIS

-Tuesday the S&P 500 rose about 0.6% to 4132 stopping

at the upper trend-line.

-VIX rose about 2% to 26.19. (The Options Crowd didn’t

get too excited over today’s decline.)

-The yield on the 10-year Treasury rose to 2.853%.

PULLBACK DATA:

-Drop from Top: 13.9% as of today. 18.7% max. (Avg.= 13%

for non-crash pullbacks)

-Days from Top to Bottom: 102-days. (Avg= 30 days top to

bottom for corrections <10%; 60 days top to bottom for larger, non-crash

pullbacks)

The S&P 500 is 7.2% BELOW its 200-dMA & 3.2%

BELOW its 50-dMA.

*I won’t call the correction over until the S&P 500

makes a new-high; however, we hope to be able to call the bottom when we see

it...and...we did call the market a trading “Buy” one day after the recent

trading-bottom on 12 May...

MY TRADING POSITIONS:

QQQ*

UWM*

XLE

DOW

*Sell when the markets make it to the 50-dMA. I may break

this rule too...we’ll see. I still suspect this is just a Bear Market Rally.

TODAY’S COMMENT:

Since 2002 there have been only 4 corrections that

exceeded 15% on the S&P 500. A 19% correction in 2011; a 34% Coronavirus correction

in 2020; a 57% Financial correction in 2009; and the current “Everything”

Correction (19% max so far).

From top to bottom, the previous 3 corrections lasted

108-days; 23-days and more than 200-days respectively. The current correction

is already past the very short Coronavirus bear market. Currently, the 2011,

19% correction compares well to the ongoing downturn. If the S&P 500 can make a new high, then

the current correction will have lasted 95 days and dropped 19%.

Unfortunately, we can’t foretell the future; the 57% drop

that we saw in the Financial Crisis is still on the table as is the 37% drop

during the 2000-2002 DotCom Crash.

Pop Quiz: What ended the stock market drop during the Financial

Crisis? Ans. A simple accounting rule. Specifically, it was the suspension of

Mark-to-Market accounting rules that required assets to be valued at fair-market-value.

A new accounting rule allowed more lenient valuation of illiquid securities,

swaps, housing, etc. By allowing more liberal asset valuations, the banks essentially

got a massive increase in reserves and it eliminated the risk of Bank failures. The stock market bottomed.

I point this out to suggest that markets are likely to

fall until the Fed become more accommodative either by ending rate hikes or Balance

Sheet reductions. For now, I suspect the counter-trend rally will continue. Today

just proved that markets don’t go up forever.

Tuesday, there was high unchanged-volume. Many believe

that this indicator suggests investor confusion at market turning points.

Recent history shows this indicator has indicated a reversal of some kind,

either now, or near future. My problem is that it is frequently a false signal.

At this point if the indicator is sending a decent signal, the direction of reversal

would be down. As I write this, futures are up, so perhaps this time the

unchanged-indicator signal will be wrong.

Market internals were in line with what would be expected

for a down day like today, except that there were 105 new-highs and only 33

new-lows. That continues a steady improvement in the new-high/new-low data and

suggests we’re still in rally mode.

Today, the daily sum of 20 Indicators declined from +15

to +13 (a positive number is bullish; negatives are bearish); the 10-day

smoothed sum that smooths the daily fluctuations improved from +76 to +80. (The

trend direction is more important than the actual number for the 10-day value.)

These numbers sometimes change after I post the blog based on data that comes

in late. Most of these 20 indicators are short-term so they tend to bounce

around a lot.

LONG-TERM INDICATOR: The Long

Term NTSM indicator was HOLD: SENTIMENT & VOLUME are bullish; VIX is

bearish; and PRICE is hold. Only 46 days

out of the last 100 have been up-days; that leans bullish.

I am Bullish in the short-term and Bearish longer-term. I

expect a rally in the 7-9% range. Around 4300 is as good a target as any. We’ll

see when we get there.

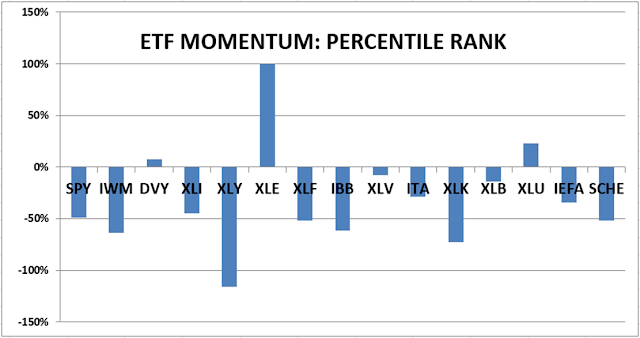

BEST ETFs - MOMENTUM ANALYSIS:

TODAY’S RANKING OF 15 ETFs

(Ranked Daily)

The top ranked ETF receives

100%. The rest are then ranked based on their momentum relative to the leading ETF.

*For additional background on the ETF ranking system see NTSM Page at…

http://navigatethestockmarket.blogspot.com/p/exchange-traded-funds-etf-ranking.html

BEST DOW STOCKS - TODAY’S MOMENTUM

RANKING OF THE DOW 30 STOCKS (Ranked Daily)

Here’s the revised DOW 30 and

its momentum analysis. The top ranked stock receives 100%. The rest are then

ranked based on their momentum relative to the leading stock.

For more details, see NTSM Page at…

https://navigatethestockmarket.blogspot.com/p/a-system-for-trading-dow-30-stocks-my_8.html

TUESDAY MARKET INTERNALS (NYSE

DATA)

My basket of Market Internals slipped to HOLD.

Market Internals are a decent

trend-following analysis of current market action, but should not be used alone

for short term trading. They are usually right, but they are often late. They are most useful when they diverge from

the Index.

My stock-allocation in the

portfolio is now roughly 45% invested in stocks, but some percentage includes

trading-positions that I will exit if a rally fails to materialize. This is

slightly below my “normal” fully invested stock-allocation of 50%.

I trade about 15-20% of the

total portfolio using the momentum-based analysis I provide here. If I can see

a definitive bottom, I’ll add a lot more stocks to the portfolio using an

S&P 500 ETF.

You may wish to have a higher

or lower % invested in stocks depending on your risk tolerance. 50% is a

conservative position that I consider fully invested for most retirees.

As a general rule, some

suggest that the % of portfolio invested in the stock market should be one’s

age subtracted from 100. So, a

30-year-old person would have 70% of the portfolio in stocks, stock mutual

funds and/or stock ETFs. That’s ok, but

for older investors, I usually don’t recommend keeping less than 50% invested

in stocks (as a fully invested position) since most people need some growth in

the portfolio to keep up with inflation.