CHICAGO PMI (Advisor Perspectives)

The latest Chicago Purchasing Manager's Index, or the

Chicago Business Barometer, rose to 50.4 in August from 44.4 in July…” Story

at…

My cmt: The Chicago PMI is back into expansion, but

barely.

PERSONAL SPENDING / PCE PRICE INDEX (MarketWatch)

"Americans boosted spending in July on recreational goods

and vehicles as well as energy to run their air conditioners, but inflation

remained low enough to give the Federal Reserve room to cut interest rates next

month. Consumer spending jumped 0.6% last month…Inflation as measured by the

Fed’s preferred PCE price index rose 0.2% in July, nudging the yearly rate up

to 1.4% from 1.3%.” Story at…

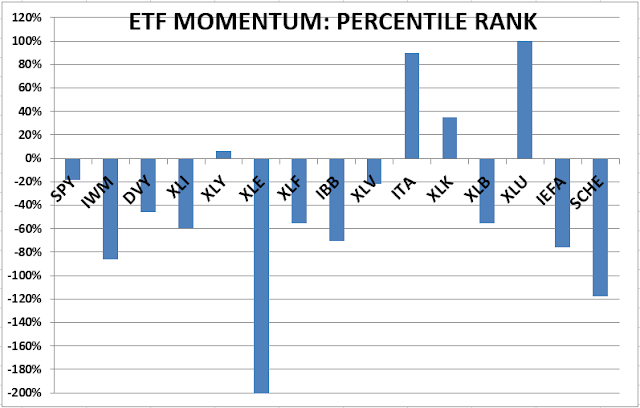

The top ranked ETF receives 100%. The rest are then

ranked based on their momentum relative to the leading ETF. While momentum isn’t stock performance per

se, momentum is closely related to stock performance. For example, over the

4-months from Oct thru mid-February 2016, the number 1 ranked Financials (XLF)

outperformed the S&P 500 by nearly 20%. In 2017 Technology (XLK) was ranked

in the top 3 Momentum Plays for 52% of all trading days in 2017 (if I counted

correctly.) XLK was up 35% on the year while the S&P 500 was up 18%.

“The University of Michigan’s final print on its consumer

sentiment index came in at 89.8 for August…The index was at 98.4 in July,

making this the largest monthly decline since December 2012.” Story at…

My cmt: Consumer sentiment tends to follow the stock

market. As the market goes higher we’ll see sentiment improve.

HERITAGE CAPITAL COMMENTARY EXCERPT (Heritage Capital)

“While the past few days did nothing to clear up the

four-week trading range, I still give the nod to the bulls as I have been

saying for weeks…I believe we will see the bulls resolve the market to all-time

highs and Dow 28,000 by year-end. For now, we want to see where leadership

unfolds.” Commentary at…

TOP FOR STOCKS MONTHS AWAY (McClellan Publications)

MARKET REPORT / ANALYSIS

-Friday the S&P 500 rose about 0.1% to 2926.

-VIX rose about 6% to 18.98.

-The yield on the 10-year Treasury rose to 1.500%.

My daily sum of 20 Indicators improved from +2 to

+4 (a positive number is bullish; negatives are bearish) while the 10-day

smoothed version that negates the daily fluctuations improved from -6 to

+3. (These numbers sometimes change after I post the blog based on data that

comes in late.)

-MACD of S&P 500 price is bullish.

-Money Trend is bullish.

-New-high/new-low data is trending bullish.

-Money Trend is bullish.

-High-volume days gave us a buy signal Thursday and that’s

a “correction over” call.

-MACD of Breadth is bearish. This indicator has been good recently – longer

term, its record is not all that great.

TOP / BOTTOM INDICATOR SCALE OF 1 TO 10 (Zero is a

neutral reading.)

Today’s Reading: -1

-The Long-term Fosback Logic Index indicator was bearish,

but this indicator isn’t valid now because the McClellan Oscillator is

positive.

- Most Recent Day with a value other than Zero: -1 on 30

August.

(1) +10 Max Bullish / -10 Max Bearish)

(2) -4 or below is a Sell sign. +4 or better is a Buy

Sign.

MOMENTUM ANALYSIS:

Just a reminder…During corrections, momentum is

generally not giving a very accurate picture, or at least it is giving a

correction picture – it will change significantly when the correction ends.

During the correction, Utilities will generally outperform as will similar Dow

stocks, like Verizon. Momentum here is a short-term call.

TODAY’S RANKING OF

15 ETFs (Ranked Daily)

*For additional background on the ETF ranking system see

NTSM Page at…

TODAY’S RANKING OF THE DOW 30 STOCKS (Ranked Daily)

The top ranked stock receives 100%. The rest are then

ranked based on their momentum relative to the leading stock.

*I rank the Dow 30 similarly to the ETF ranking system.

For more details, see NTSM Page at…

FRIDAY MARKET INTERNALS (NYSE DATA)

Market Internals

remained POSITIVE on the market.

Market Internals are a decent trend-following analysis of

current market action but should not be used alone for short term trading. They

are usually right, but they are often late.

They are most useful when they diverge from the Index. In 2014, using these internals alone would

have made a 9% return vs. 13% for the S&P 500 (in on Positive, out on

Negative – no shorting).

Using the Short-term indicator in 2018 in SPY would have

made a 5% gain instead of a 6% loss for buy-and-hold. The methodology was Buy

on a POSITIVE indication and Sell on a NEGATIVE indication and stay out until

the next POSITIVE indication. The back-test included 13-buys and 13-sells, or a

trade every 2-weeks on average.

My current stock allocation is about 55% invested in

stocks as of 20 August 2019. This is a conservative balanced position

appropriate for a retiree.

INTERMEDIATE / LONG-TERM INDICATOR

Friday,

the VIX indicator was negative; VOLUME, SENTIMENT and PRICE Indicators were

neutral. Overall, the Long-Term Indicator improved to HOLD.