“At this point, before the close on the last day of the

month, all three S&P 500 strategies are signaling "invested" —

unchanged from last month's signal. All five Ivy Portfolio ETFs — Vanguard

Total Stock Market ETF (VTI), Vanguard FTSE All-World ex-US ETF (VEU), and

Vanguard REIT Index ETF (VNQ), and PowerShares DB Commodity Index (DBC) — are

signaling "invested"…” Commentary at…

MARKET REPORT / ANALYSIS

-Friday the S&P 500 was down about 0.5% to 2674. (Almost

the entire drop happened in the last half hour of trading.)

-VIX was up about 8% to 11.04.

-The yield on the 10-year Treasury slipped to 2.411%.

My sum of 17 Indicators was unchanged at +4. On a 10-day

basis, values moved up again. A “+” number means that most indicators are

bullish. Volume picked up a little to about 75% of the

norm for the month.

In the near term I am mildly bullish; longer term I am a

bull, but I recommend caution with the Fed raising rates and shrinking its

balance sheet. This party could end sometime in 2018; further, historically we

are due for a correction in 2018 due to the Presidential election cycle.

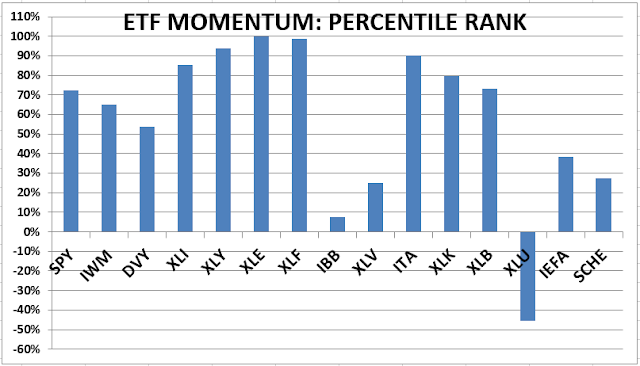

TODAY’S RANKING OF 15 ETFs (Ranked Daily)

The top ranked ETF receives 100%. The rest are then

ranked based on their momentum relative to the leading ETF. While momentum isn’t stock performance per

se, momentum is closely related to stock performance. For example, over the 4-months

from Oct thru mid-February 2016, the number 1 ranked Financials (XLF) outperformed

the S&P 500 by nearly 20%. Every Tech stock on the Dow 30 slipped today so

it is no wonder that XLK has slipped to #4.

*For additional background on the ETF ranking system see

NTSM Page at…

Energy (XLE) and Financials (XLF) were essentially tied

at #1. The markets are due for some reversion so perhaps I’ll get a better

buying opportunity later. I’ll wait

before adding any positions. (I hold XLK, DVY and SPY. DVY is a dividend play.

SPY is a good core holding.)

Under my system in 2017, Technology (XLK) was ranked in

the top 3 Momentum Plays for 52% of all trading days in the year (if I counted

correctly.) XLK is up 35% year to date. Its weighted Average PE is 23.7

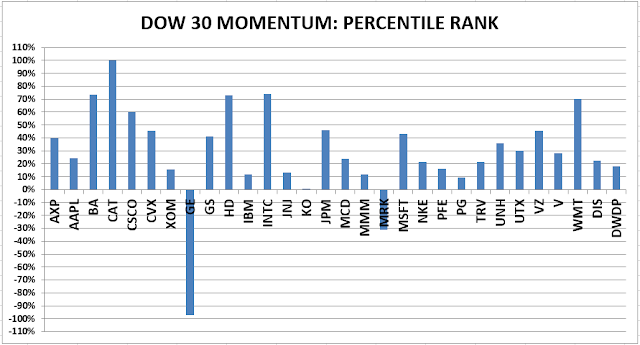

TODAY’S RANKING OF THE DOW 30 STOCKS (Ranked Daily)

The top ranked stock receives 100%. The rest are then

ranked based on their momentum relative to the leading stock.

Caterpillar was #1. (I hold Intel – I’m waiting for a

better entry point before adding other positions.)

Avoid GE and Merck. Their 120-day moving averages are

falling.

*I rank the Dow 30 similarly to the ETF ranking system.

For more details, see NTSM Page at…

FRIDAY MARKET INTERNALS (NYSE DATA)

Market Internals

remained Neutral on the market. (Market Internals are based on a package of

internals and all must be positive to create a positive indication. This

Neutral reading may be the result of low volume overall since low volume makes

up-volume low even if up-volume outpaces down volume. On a percentage basis 58%

of the volume has been up-volume over the last 10-days (same as yesterday) and

that’s reasonably bullish.)

Market Internals are a decent trend-following analysis of

current market action, but should not be used alone for short term trading.

They are usually right, but they are often late. They are most useful when they diverge from

the Index. In 2014, using these

internals alone would have made a 9% return vs. 13% for the S&P 500 (in on Positive,

out on Negative – no shorting).

LONG TERM INDICATOR

Friday, Price indicator was positive; Sentiment was negative; Volume

& VIX indicators were neutral. With VIX recently below 10 for a couple of

days in May, June, July, August, September, October, November and December, VIX

may be prone to incorrect signals. Usually, a rising VIX is a bad market sign;

now it may move up, but that might just signal normalization of VIX, i.e., VIX

and the Index may both rise. As an indicator, VIX is out of the picture for a

while. VIX below 10 last occurred about 4-months before the year 2007 crash and

also several months before the 2001 crash.

MY INVESTED STOCK POSITION:

TSP (RETIREMENT ACCOUNT – GOV EMPLOYEES) ALLOCATION

I increased

stock allocation to 50% stocks in the S&P 500 Index fund (C-Fund) 24 March

2017 in my long-term accounts, based on short-term indicators. The remainder

is 50% G-Fund (Government securities). This is a conservative retiree

allocation, but I consider it fully invested for my situation.