“Trade what you see; not what you think.” – The Old Fool,

Richard McCranie, trader extraordinaire.

EXISTING HOME SALES (Reuters)

U.S. home sales fell more than expected in September as

the market continues to struggle with a dearth of properties for sale,

especially for cheaper homes. The National Association of Realtors said on

Tuesday that existing home sales fell 2.2%...” Story at…

DECLINES IN PROFIT MARGINS (FACTSET)

“For the third quarter, the S&P 500 is reporting a

year-over-year decline in earnings of -4.7%, but year-over-year growth in

revenues of 2.6%. Given the dichotomy in growth between earnings and revenues,

there are concerns in the market about net profit margins for S&P 500

companies in the third quarter…The blended net profit margin [includes reported

profit margins for those who have reported and estimated data for those that

haven’t] for the S&P 500 for Q3 2019 is 11.3%. If 11.3% is the actual net

profit margin for the quarter, it will mark the first time the index has

reported three straight quarters of year-over-year declines in net profit

margin since Q1 2009 through Q3 2009.” Commentary at

SEASONAL INFLECTION (McClellan Publications)

Chart from…

MARKET REPORT / ANALYSIS

-Tuesday the S&P 500 slipped about 0.4% to 2996.

-VIX rose about 3% to 14.46.

-The yield on the 10-year Treasury slipped to 1.767.

Today was one of those inexplicable days. 59% of stocks

on the NYSE were up today. 59% of the volume was up-volume. 175 issues made new

52-week highs today. It’s been 2 months

since we saw that many new-highs. Yet the major indices were down!? Don’t ask

me to explain it. Tomorrow should be an up-day to correct today’s odd result…at

least that’s what usually happens.

My daily sum of 20 Indicators improved from +4 to

+7 (a positive number is bullish; negatives are bearish) while the 10-day

smoothed sum that negates the daily fluctuations rose from +9 to +26

(These numbers sometimes change after I post the blog based on data that comes

in late.) A reminder: Most of these indicators are short-term.

Late-day is in a bit of confusion. I usually just look at whether late day

action was up or down. On that basis,

late-day-action is bearish. If we examine

what late-day-action is doing on a percentage basis, we see that it is bullish.

So, I guess I should report that late-day-action is neutral. This is important

as an indicator because the Pros trade late-day. This is the basis for the

Smart Money indicator popularized by Don Hays.

The overbought / oversold index is overbought today. It is based on advance-decline numbers, but

as I have noted several times, this indicator is an old one and it tends to be

very early. We’ll ignore it.

It is hard to find any significant bear signs today. The

Overbought-oversold index is overbought, but this older indicator is very early

so I will ignore it for now.

“Bull markets are born on pessimism, grown on skepticism, mature on

optimism, and die on euphoria.” – John Templeton, founder Templeton Growth

Fund. Currently, we don’t have euphoria. We’ve got a way to go before we

see a top that might be a Major Top that would precede a bear market.

I remain bullish.

TOP / BOTTOM INDICATOR SCALE OF 1 TO 10 (Zero is a

neutral reading.)

Today’s Reading: 0

Most Recent Day with a value other than Zero: +2 on 3

October.

(1) +10 Max Bullish / -10 Max Bearish)

(2) -4 or below is a Sell sign. +4 or better is a Buy

Sign.

MOMENTUM ANALYSIS:

TODAY’S RANKING OF

15 ETFs (Ranked Daily)

The top ranked ETF receives 100%. The rest are then

ranked based on their momentum relative to the leading ETF. While momentum isn’t stock performance per

se, momentum is closely related to stock performance. For example, over the

4-months from Oct thru mid-February 2016, the number 1 ranked Financials (XLF)

outperformed the S&P 500 by nearly 20%. In 2017 Technology (XLK) was ranked

in the top 3 Momentum Plays for 52% of all trading days in 2017 (if I counted

correctly.) XLK was up 35% on the year while the S&P 500 was up 18%.

*For additional background on the ETF ranking system see

NTSM Page at…

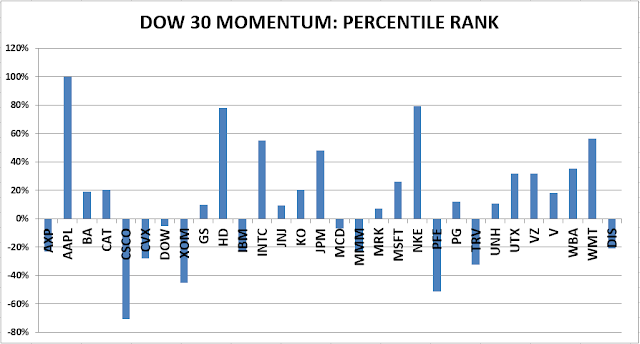

TODAY’S RANKING OF THE DOW 30 STOCKS (Ranked Daily)

The top ranked stock receives 100%. The rest are then

ranked based on their momentum relative to the leading stock.

*I rank the Dow 30 similarly to the ETF ranking system.

For more details, see NTSM Page at…

TUESDAY MARKET INTERNALS (NYSE DATA)

Market Internals

remained POSITIVE on the market.

Market Internals are a decent trend-following analysis of

current market action but should not be used alone for short term trading. They

are usually right, but they are often late.

They are most useful when they diverge from the Index. In 2014, using these internals alone would

have made a 9% return vs. 13% for the S&P 500 (in on Positive, out on

Negative – no shorting).

Using the Short-term indicator in 2018 in SPY would have

made a 5% gain instead of a 6% loss for buy-and-hold. The methodology was Buy

on a POSITIVE indication and Sell on a NEGATIVE indication and stay out until

the next POSITIVE indication. The back-test included 13-buys and 13-sells, or a

trade every 2-weeks on average.

My current stock allocation is about 60% invested in

stocks as of 7 Oct 2019 (up from 50%). This is a conservative balanced position

appropriate for a retiree. You may wish to have a higher or lower % invested in

stocks depending on your risk tolerance.

INTERMEDIATE / LONG-TERM INDICATOR

Tuesday, the VIX, PRICE and VOLUME

indicators were positive; the SENTIMENT Indicator was neutral. Overall, the

Long-Term Indicator improved to BUY. The important BUY was the one we issued

29 August; we reinforced that bullish view again on 3 October. Today’s BUY

signal just means that conditions are good. Sometimes the NTSM will issue a buy-signal

at a top. I don’t think that is the case this time – I remain bullish.