-Thursday the S&P 500 was Up about 1.4% to 2641.

-VIX was Down about 13% to 19.97.

-The yield on the 10-year Treasury slipped to 2.742%.

(Investors were buying bonds driving yields down. Hard to say what this might

mean for stocks.)

Correction Update:

Thursday was trading-day 44 since the prior top. The

S&P 500 was 8.1% below the top and 2.3% above the prior correction

bottom. On average, corrections >10%

last 68-days…<10% last 32-days. Day-40 was the recent retest for the DJI and

the NYSE Composite.

Today was a pre-Holiday trading day which tends to be positive

with lower volume. Exchanges were closed Friday. Volume Friday was about

average for the month which for a holiday is unusually high. The last day of

the month is usually strong along with the first couple of days in the next

month. There was also a lot of position shifting by Fund Managers since it was

the last day of the quarter. All of those may have contributed to the strong up

day. On the other hand, perhaps investors are getting over the correction.

Both the DOW 30 and the 15 ETFs I track have been

improving. 5-days ago when the S&P 500 came within 0.3% of a retest of the

prior low, zero stocks in the Dow 30 were up on the day and only 1 of the ETFs

was up. Today every ETF was up and 25 of the 30 Dow stocks were up. Intel was

up 5%. These are bullish signs.

Generally, indicators are improving too:

-My daily sum of 17 Indicators improved from -4 to +3;

that’s a nice turn-around. The 10-day smoothed version remained flat at -43.

-Money Trend is turning up.

-Smart Money (based on late day action) is basically flat

to slightly down.

-The cyclical industrials are trying to reverse upward

compared to the S&P 500. If it

continues that would be a bullish sign.

-Market Internals remained Neutral, but generally

improved.

My analysis is based on the S&P 500. The S&P 500 almost tested the prior low

on 23 March when it was 2588. That’s

only 0.3% higher than the low of 2581 on 8 February. Interestingly, the NYSE

Composite did make a lower low on 23 March and it was about 0.8% lower than the

prior low. The DOW 30 also made a lower low. We prefer a test based on the

S&P 500 since S&P 500 stocks are stronger and more conservative, but

since it was very close to a retest and the Composite did retest successfully,

I think we should consider leaning to the bullish side and adding to stock

holdings next week if it looks right.

81% of all volume was up-volume in Thursday. That’s a bullish sign. Given the high up

volume and my other somewhat bullish signs, I’ll be watching Monday’s action

and further into next week for clues on changing from defensive position to an

outright BUY.

Basically, I will add to stock holdings if we see strong

buying next week. If it looks weak, I’ll just wait and see if a better entry

point shows up.

Right now, the key is Monday. If we see another very strong day the

correction is probably over. We’ll see,

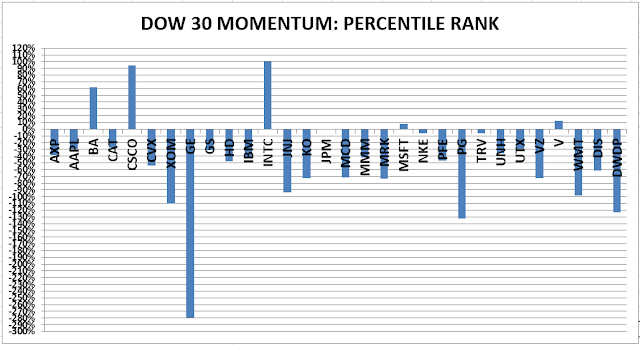

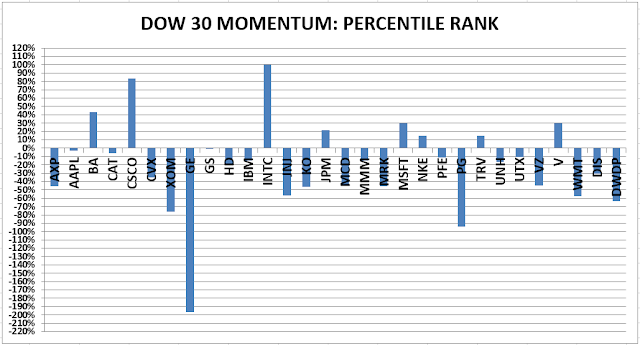

MOMENTUM ANALYSIS IS NOW NEARLY WORTHLESS. As one can see

below in both momentum charts, most of the issues I track are now in negative

territory, i.e., few have any upward momentum. That’s just an indication that

the market is in correction mode and most stocks have been headed down.

TODAY’S RANKING OF

15 ETFs (Ranked Daily)

The top ranked ETF receives 100%. The rest are then

ranked based on their momentum relative to the leading ETF. While momentum isn’t stock performance per

se, momentum is closely related to stock performance. For example, over the 4-months

from Oct thru mid-February 2016, the number 1 ranked Financials (XLF) outperformed

the S&P 500 by nearly 20%. In 2017 Technology (XLK) was ranked in the top 3

Momentum Plays for 52% of all trading days in 2017 (if I counted correctly.)

XLK was up 35% on the year while the S&P 500 was up 18%.

*For additional background on the ETF ranking system see

NTSM Page at…

TODAY’S RANKING OF THE DOW 30 STOCKS (Ranked Daily)

The top ranked stock receives 100%. The rest are then

ranked based on their momentum relative to the leading stock.

*I rank the Dow 30 similarly to the ETF ranking system.

For more details, see NTSM Page at…

THURSDAY MARKET INTERNALS (NYSE DATA)

Market Internals

improved and remained Neutral on the market.

Market Internals are a decent trend-following analysis of

current market action but should not be used alone for short term trading. They

are usually right, but they are often late.

They are most useful when they diverge from the Index. In 2014, using these internals alone would have

made a 9% return vs. 13% for the S&P 500 (in on Positive, out on Negative –

no shorting).

INTERMEDIATE / LONG-TERM INDICATOR

We

may get a BUY signal this week so stay tuned.

21 March, I cut

stock holdings from 50% to 35% with the remainder in a mix of stocks and

(mostly short-term) bonds. I previously reduced stock exposure on 31 Jan.

Intermediate/Long-Term

Model: Thursday, Price was positive; the VIX and Volume indicators were

negative; and Sentiment was neutral.