“Trade what you see; not what you think.” – The Old Fool,

Richard McCranie, trader extraordinaire.

"This imaginary person out there - Mr. Market - he's

kind of a drunken psycho. Some days he gets very enthused, some days he gets

very depressed. And when he gets really enthused, you sell to him and if he

gets depressed you buy from him. There's no moral taint attached to that."

- Warren

Buffett

“The big money is not in the buying and selling. But in the

waiting.” - Charlie Munger, Vice Chairman, Berkshire Hathaway

CHICAGO PMI (Advisor Perspectives)

“The Chicago Business Barometer, produced with MNI, rose

to 36.6 in June with business activity picking up as Covid-19 related shutdowns

eased somewhat. Across Q2, business sentiment slipped 11.8 points to 34.8,

hitting the lowest level since Q1 2009.” Commentary and analysis at…

CONSUMER CONFIDENCE (Reuters)

“U.S. consumer confidence rebounded in June as businesses

reopened, strengthening views that the economic downturn was likely over,

though rising COVID-19 infections threaten to derail the budding recovery.”

Story at…

APOCALYPSE NEVER (Environmental Progress.org)

“On behalf of environmentalists everywhere, I would like

to formally apologize for the climate scare we created over the last 30 years.

Climate change is happening. It’s just not the end of the world. It’s not even

our most serious environmental problem.

Here are some facts few people know:

-Humans are not causing a “sixth mass extinction”

-The Amazon is not “the lungs of the world”

-Climate change is not making natural disasters worse

-Fires have declined 25% around the world since 2003

-The amount of land we use for meat — humankind’s biggest

use of land — has declined by an area nearly as large as Alaska

-The build-up of wood fuel and more houses near forests,

not climate change, explain why there are more, and more dangerous, fires in

Australia and California

-Carbon emissions are declining in most rich nations and

have been declining in Britain, Germany, and France since the mid-1970s

-Netherlands became rich not poor while adapting to life

below sea level

-We produce 25% more food than we need and food surpluses

will continue to rise as the world gets hotter

-Habitat loss and the direct killing of wild animals are

bigger threats to species than climate change

-Wood fuel is far worse for people and wildlife than fossil

fuels

-Preventing future pandemics requires more not less

“industrial” agriculture

I know that the above facts will sound like “climate

denialism” to many people. But that just shows the power of climate alarmism…

until last year, I mostly avoided speaking out against the climate scare.

Partly that’s because I was embarrassed. After all, I am as guilty of alarmism

as any other environmentalist. For years, I referred to climate change as an “existential”

threat to human civilization, and called it a “crisis.”

But mostly I was scared. I remained quiet about the

climate disinformation campaign because I was afraid of losing friends and

funding.” Michael Shellenberger. Commentary at…

CORONAVIRUS (NTSM)

Here’s the latest from the COVID19 Johns Hopkins website

as of 9:00 PM Tuesday. Over the last week, new cases have been growing faster

than they were in April. There were about 41,000 new cases today, about 2000

more than yesterday. The steepening curve

is the graphic indication that new-cases are growing at a dramatically faster

rate than we have seen at any time in the US.

While we may not completely shut-down again, it seems

likely to suppress the economic recovery.

MARKET REPORT / ANALYSIS

The daily sum of 20 Indicators declined from -1 to

-3 (a positive number is bullish; negatives are bearish). The 10-day smoothed

sum that smooths the daily fluctuations declined from -38 to -46 (These

numbers sometimes change after I post the blog based on data that comes in

late.) Most of these indicators are short-term.

*For additional background on the ETF ranking system see

NTSM Page at…

-Tuesday the S&P 500 rose about 1.5% to 3100.

-VIX dipped about 4% to 30.43.

(VIX is now lower than the day-by-day comparison to the 2009 recovery after the

March 2009 bottom. This tends to support the argument that we have seen the

final bottom of this correction.)

-The yield on the 10-year Treasury rose to 0.668%.

Over the last 2 weeks, only 46% of stocks on the NYSE

have advanced. With back-to-back days up around 1.5%, I would have expected

higher numbers. The chart below suggests a possible down-trend shown by the Blue

down-sloping lines. If the Index can

break above the blue, upper, down-sloping line it would be a signal that we are

not in a downtrend. The Index is still below the lower trend line shown in red

and that is cause for alarm to the Bulls.

My Long-term indicator remained HOLD today; the

Short-Term Indicator remained Neutral. Since Indicators are not yet giving a

short-term Buy-signal, I am still under-invested. I’ll increase stock holdings if we see some

additional improvement in signals, especially the MACD & Money Trend

indicators.

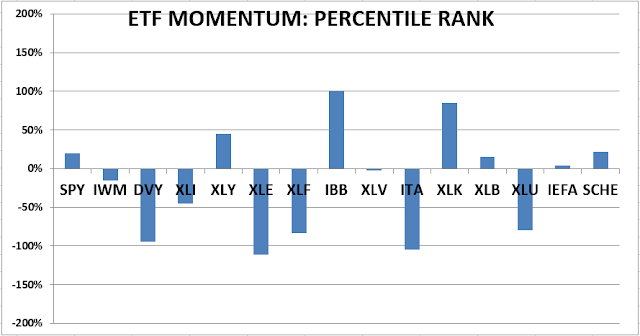

MOMENTUM ANALYSIS:

TODAY’S RANKING OF

15 ETFs (Ranked Daily)

The top ranked ETF receives 100%. The rest are then

ranked based on their momentum relative to the leading ETF.

TODAY’S RANKING OF THE DOW 30 STOCKS (Ranked Daily)

The top ranked stock receives 100%. The rest are then

ranked based on their momentum relative to the leading stock.

For more details, see NTSM Page at…

TUESDAY MARKET INTERNALS (NYSE DATA)

Market Internals remained

NEUTRAL on the market.

Market Internals are a decent trend-following analysis of

current market action, but should not be used alone for short term trading.

They are usually right, but they are often late. They are most useful when they diverge from

the Index. In 2014, using these

internals alone would have made a 9% return vs. 13% for the S&P 500 (in on

Positive, out on Negative – no shorting).

Using the Short-term indicator in 2018 in SPY would have

made a 5% gain instead of a 6% loss for buy-and-hold. The methodology was Buy

on a POSITIVE indication and Sell on a NEGATIVE indication and stay out until

the next POSITIVE indication. The back-test included 13-buys and 13-sells, or a

trade every 2-weeks on average.

My current stock allocation is about 40% invested in

stocks. You may wish to have a higher or lower % invested in stocks depending

on your risk tolerance. 40% is a conservative position that I re-evaluate

daily.

As a retiree, 50% in the stock market is about fully

invested for me – it is a cautious and conservative number. If I feel very

confident, I might go to 60%; had we seen a successful retest of the bottom,

80% would not have been out of the question.