"This imaginary person out there - Mr. Market - he's

kind of a drunken psycho. Some days he gets very enthused, some days he gets

very depressed. And when he gets really enthused, you sell to him and if he

gets depressed you buy from him. There's no moral taint attached to that."

- Warren

Buffett

“The big money is not in the buying and selling. But in the

waiting.” - Charlie Munger, Vice Chairman, Berkshire Hathaway

BIG TECH CRUSHES EARNINGS (Yahoo News)

“…after the bell

[Thursday], Apple, Alphabet, Facebook and Amazon reported their earnings

results. Each bested expectations, and all but one are up sharply in

after-hours trading.” Story at…

Other than Google, they were up double digits vs. the

same quarter a year ago. Wow! What Pandemic? Apple was up more than 10% on the

day.

PERSONAL INCOME (Pymnts.com)

“Disposable personal income fell by 1.4 percent in June

to $255 billion while personal spending increased $738 billion, a nearly 6

percent rise… ‘The scale and unprecedented nature of the COVID-19-driven

downturn will leave lingering scars during the recovery,” Bloomberg

economists Yelena Shulyatyeva and Eliza Winger said

in a commentary.’” Story at…

PCE PRICES (CNBC)

“Monthly inflation ticked up in June, driven by food and

energy goods and services prices, though the trend remained muted. The personal

consumption expenditures (PCE) price index excluding the volatile food and

energy components rose 0.2%...” Story at…

CHICAGO PMI (MarketWatch)

“A measure of business conditions in the Chicago region

came in at 51.9 in July, after registering 36.6 in June.”

Story at…

UNIVERISTY OF MICHIGAN SENTIMENT (BusinessInsider.com)

“The University of Michigan's consumer-sentiment gauge snapped

a two-month uptrend in July, offering an early sign that new coronavirus

outbreaks are reversing the economic recovery.

The university's index of consumer sentiment fell to 73.2

from June's reading of 78.1.” Story at…

CORONAVIRUS (NTSM)

Here’s the latest from the COVID19 Johns Hopkins website

as of 9:00 PM Friday. The US had about 65,000 new cases today. The curve of total US

cases is still climbing steeply.

-Friday the S&P 500 rose about 0.8% to 3271.

-VIX dipped about 1% to 24.46.

-The yield on the 10-year Treasury slipped to 0.535%.

Today was a surprise all around. We got a weak open after

great tech earnings reports followed by an afternoon bounce that saved the day.

Still, internals were weak at the close as there was nearly 2 to 1 down-volume

to up-volume and declining issues outpaced advancing issues. We probably aren’t

out of this rough patch yet. The S&P 500 has gone sideways for nearly

3-weeks.

The daily sum of 20 Indicators remained -5 (a

positive number is bullish; negatives are bearish). The 10-day smoothed sum

that smooths the daily fluctuations declined from -3 to -7. (These

numbers sometimes change after I post the blog based on data that comes in

late.) Most of these indicators are short-term.

Here’s the Friday run-down of some important indicators.

These tend to be both long-term and short-term so they are somewhat different

than the 20 that I report on daily.

BULL SIGNS

-The percentage of 15-ETFs that are above their

respective 120-dMA was 87% Friday, bullish.

-The 50-dMA of stocks

advancing on the NYSE (Breadth) is above 50%.

-100-dMA of Breadth (advancing stocks on the NYSE) is above

50%.

-The 5-10-20 Timer System remained BUY, because the

5-dEMA and 10-dMA are above the 20-dEMA.

NEUTRAL

- The S&P 500 is outperforming the Utilities ETF

(XLU), but its outperformance is falling so let’s call this one neutral.

-The Fosback High-Low Logic Index dropped to neutral.

- Breadth on the NYSE vs the S&P 500 index diverged

from the S&P 500 index and has been giving a sell signal since 11 May. 31

July it finally turned neutral. This indicator signaled a top at S&P 3207.

-The size of up-moves has been larger than the size of

down-moves over the last month, but for now, it remains in neutral territory.

-VIX is Neutral.

-The S&P 500 is neutral relative to its 200-dMA. It

is not too diverging too far above or below it.

-Statistically, the S&P 500 gave a panic-signal, 11

June. A panic signal usually suggests more to come. We did not see big negative follow-thru so

I’ll put this one in the negative category.

-Non-crash Sentiment is neutral.

-Bollinger Bands remain neutral, but are approaching an overbought

reading. RSI is neutral.

-Overbought/Oversold Index, a measure of advance-decline

data is neutral.

-Over the last 10 and 20-days, the number of up-days is neutral.

- The Smart Money (late-day action) is trending down, but

only slightly bearish so I’ll put this one in the neutral camp. This indicator

is based on the Smart Money Indicator (a variant of the indicator developed by

Don Hayes).

BEAR SIGNS

-Only 45% of the 15-ETFs that I track have been up over

the last 10-days – bearish.

-My Money Trend indicator is now

headed down.

-Long-term new-high/new-low data is bearish.

-Short-term new-high/new-low data is bearish.

-MACD of S&P 500 price made a bearish crossover 27July.

-MACD of stocks advancing on the NYSE (breadth) made a bearish

crossover 31 July.

- The smoothed advancing volume on the NYSE remained

Bearish.

-Cyclical Industrials (XLI-ETF) are underperforming the

S&P 500 – a bear sign.

On Friday, 21 February, 2 days after the top of this

pullback, there were 10 bear-signs and 1 bull-sign. Now there are 4 bull-signs and

8 bear-signs. Last week there were 10 bull-signs and 3 bear-signs.

It sure feels like we are near a top; however, I don’t

see major divergences in the internals although indicators are leaning bearish. Top Indicators are silent. It looks like the

markets can go higher, but the market has not made up its mind.

MOMENTUM ANALYSIS:

TODAY’S RANKING OF

15 ETFs (Ranked Daily)

The top ranked ETF receives 100%. The rest are then

ranked based on their momentum relative to the leading ETF.

*For additional background on the ETF ranking system see

NTSM Page at…

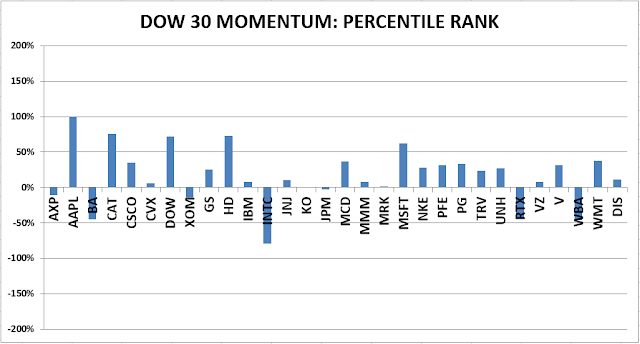

TODAY’S RANKING OF THE DOW 30 STOCKS (Ranked Daily)

The top ranked stock receives 100%. The rest are then

ranked based on their momentum relative to the leading stock.

For more details, see NTSM Page at…

FRIDAY MARKET INTERNALS (NYSE DATA)

Market Internals remained NEUTRAL

on the market.

Market Internals are a decent trend-following analysis of

current market action, but should not be used alone for short term trading.

They are usually right, but they are often late. They are most useful when they diverge from

the Index. In 2014, using these

internals alone would have made a 9% return vs. 13% for the S&P 500 (in on

Positive, out on Negative – no shorting).

Using the Short-term indicator in 2018 in SPY would have

made a 5% gain instead of a 6% loss for buy-and-hold. The methodology was Buy

on a POSITIVE indication and Sell on a NEGATIVE indication and stay out until

the next POSITIVE indication. The back-test included 13-buys and 13-sells, or a

trade every 2-weeks on average.

My current stock allocation is about 40% invested in

stocks. You may wish to have a higher or lower % invested in stocks depending

on your risk tolerance. 40% is a conservative position that I re-evaluate

daily. It is not far below my fully invested position which would be between

50-60%.

As a retiree, 50% in the stock market is about fully

invested for me – it is a cautious and conservative number. If I feel very

confident, I might go to 60%; had we seen a successful retest of the bottom,

80% would not have been out of the question.