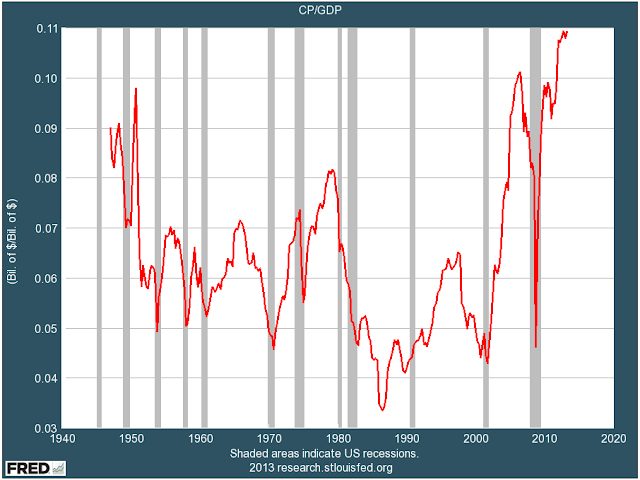

The following chart from the St Louis Fed indicates that Corporate Profits are at an all time high relative to GDP. This is an anomaly that can’t last and shows an absolute tendency for mean reversion.

John Hussman approaches this as an economist and says that high

corporate profits are the direct result of low savings by households (debt) and

the Government (deficits)….[Regarding

the implications for the stock market]…”We can demonstrate in a century of

evidence that…profit margins are mean-reverting and inversely related to

subsequent earnings growth…John Hussman, PhD, Weekly Market Commentary for 25

November 2013 from Hussman Funds at...

http://www.hussmanfunds.com/

John Hussman’s

analysis contained in his 25 November 2013 Weekly Market Commentary, “An Open

Letter to the FOMC” notes that Corporate Profits as a percentage of GDP are at

an all-time high and must revert to the mean.

A reversion to the mean predicts corporate earnings will decline.

This naturally

raises the question, “How have declines in this statistic affected the stock

market in the past?” Surprisingly, the

answer isn’t as clear as I expected.

Here is a chart of the S&P 500 and Corporate Profits (as a percent

of GDP) from 1964 through April 2013 (most recent data from FRED).

Most recently,

during the dot.com era profits were falling from 1997 to 2000, but the S&P

500 advanced dramatically. We can discount

the dot.com era, because investors were sure that “profits-didn’t-matter”. (The Fed burst the dot.com bubble with

repeated rate hikes starting about 6-months before the top.)

Another case

where profits fell while the S&P advanced was from 1978 thru 1985. During that period, profits as a %-of GDP

were cut by more than half while the S&P 500 more than doubled. That was during the late-stages of the 1966-1982

bear market and the beginning of the secular bull that lasted from 1982 until

the dot.com bust in 2000. I plotted

another chart (below) focusing on the 1966-1985 period.

The Cyclically

adjusted PE (PE10) was near all-time lows in the late 70’s (it had only been

lower in the 1920’s and 1930’s) and it encompasses the end of the 1966-1982

bear and the beginning of the 1982-2000 Bull market. One can surmise that investors anticipated

improving economic conditions and, with stock prices at generational lows,

began bidding up stock prices in the late 70’s.

This has little in common with current conditions since PE’s based on

operating earnings are above average (per FactSet) and the PE10 is now

significantly elevated (Hussman et al). Valuations are now at levels associated

with the beginning of a bear market rather than its end (dShort.com).

Another point to

remember: the “profit” considered in this analysis is “Profit as a percent of

GDP”. If GDP is rising, the “profit as a

percent of GDP” number will be falling unless corporate profits are rising at the

same or a faster rate than GDP.

To conclude,

falling profits as a percent of GDP have generally been a significant issue for

the markets, but the lag time (or lead time) has sometimes been years. My point is simply that if profits start

falling now, the market could continue its advance for some time – possibly as

long as the Fed continues to prop it up. – Meade Stith

CONSUMER CONFIDENCE IN US DECLINES TO 7-MONTH LOW (Bloomberg)

“The Conference Board’s index fell to 70.4 from

a revised 72.4 a month earlier that was stronger than initially estimated, the

New York-based private research group said today…’The economy just has not

performed very well this year and has been disappointing relative to what most

people were hoping for and expecting through the course of the year,’ said Stephen Stanley, chief economist at Pierpont Securities LLC

inStamford, Connecticut.”http://www.bloomberg.com/news/2013-11-26/consumer-confidence-index-in-u-s-decreased-to-70-4-in-november.html

MORE ON CONSUMER CONFIDENCE

For details, analysis and charts regarding the decline in consumer

confidence see Advisor perspectives at…http://advisorperspectives.com/dshort/updates/Conference-Board-Consumer-Confidence-Index.php

MARKET REPORT

Tuesday, the S&P was up for most of the day, but finished unchanged at 1803 (rounded) on surprisingly high volume (15% above the norm for the month). I guess all of the traders sold positions late in the day and left town for the holiday.

VIX was up 0.2%

to 12.81.Tuesday, the S&P was up for most of the day, but finished unchanged at 1803 (rounded) on surprisingly high volume (15% above the norm for the month). I guess all of the traders sold positions late in the day and left town for the holiday.

MARKET INTERNALS (NYSE DATA)

The 10-day moving average of stocks advancing rose to 54%

at the close Tuesday. (A number above 50%

for the 10-day average is generally good news for the market.) New-highs outpaced new-lows Tuesday, leaving the spread (new-hi minus new-low) at +179 (it was +176 Monday). The 10-day moving average of change in the spread was plus 3. In other words over the last 10-days, on average, the spread has increased by 3 each day.

Advancing volume is trending down, so this trend

following indicator is neutral on the market in the short term.

Market Internals are a decent trend-following analysis of current market action, but in 2013 (so far), if I had been buying the positive ratings and selling negative ratings I would have under-performed a buy-and-hold strategy.

NTSM ANALYSIS

Sentiment is EXTREME

negative ( Should I say absurd extreme?) at 76%-bulls for the 5-day indicator

for the third day ion a row. (Three out

of four investors in Rydex/Guggenheim funds I track are betting long.) Overall, NTSM is neutral. (I am mostly out of the market already.)

MY INVESTED POSITION (NO CHANGE)

I remain about 20% invested in stocks as of 5 March

(S&P 500 -1540). The NTSM system

sold at 1575 on 16 April. (This is just

another reminder that I should follow the NTSM analysis and not act emotionally

– I am under-performing my own system by about 2%!) I have no problems leaving 20% or 30%

invested. If the market is cut in half

(worst case) I’d only lose 10%-15% of my investments. It also hedges the bet if I am wrong since I

will have some invested if the market goes up.

No system is perfect.

I still lean toward getting back in, after a pullback, to

speculate on a final ride to the top.

NTSM did give several buy signals over the weeks of 14 and 21 Oct, but

the market just looks too frothy to rush back in…we’ll see if the market will

pullback so I can join the insanity. If

not, cash is fine.