“Trade what you see; not what you think.” – The Old Fool,

Richard McCranie, trader extraordinaire.

FOMC RATE DECISION (CNBC)

“The policymaking Federal Open Market Committee drops the

target range for its overnight lending rate to 2% to 2.25%, or 25 basis points

from the previous level.

The Fed cites “implications of global developments for

the economic outlook as well as muted inflation pressures” in its first rate

cut since December 2008.” Story at…

My cmts: Markets didn’t like the news as the stock market

dropped around 2pm and fell sharply around 2:30, presumably during the FED news

conference. It is a bit surprising since a 025% cut was widely expected. This

is probably algorithm trading and may not mean much.

CHICAGO PMI (MarketWatch)

“A measure of business conditions in the Chicago region

dropped further into contraction territory in July. The Chicago PMI business

barometer decreased to 44.4 in July from 49.7 in June…” Story at…

My cmt: Any number below 50 indicates contraction so this

is not good news. The markets fell after 10am (when the news came out), but it

is never a sure thing that the drop was due to the PMI number.

CRUDE OIL INVENTORIES (OilPrice.com)

“A day after yet another bullish oil inventory estimate

from the American Petroleum Institute, the Energy Information Administration

reported another solid decline in inventories, which added fuel to the price

rally.” Story at…

My cmt: One would think that rising oil prices would be

bad for the economy and bad for stocks.

It is generally bad for the economy, but there are so many oil

services stocks that it is often good for the stock market indices.

MARKET REPORT / ANALYSIS

-Wednesday the S&P 500 dipped about 1.1% to 2980.

-VIX rose about 16% to 16.12.

-The yield on the 10-year Treasury slipped to 2.011%.

Here’s another chart with the same point as yesterday.

Can the S&P 500 break convincingly above its trend line defined by the

highs going back to 2018? The odd thing is, I see so many charts that depend on

the scale chosen for the x and y axes. Yesterday’s chart showed the S&P 500

above the trend. This one shows it on

the trend even though the writer uses 3000 as the make or break level. We’ve

had 6 closes in a row above 3000 so one would think the S&P 500 has claimed

the higher ground and one rule confirms it. Another rule of thumb says we need

to break above a trend line by 3% to set a new trend. The 3% rule says we need to get above 3090.

Chart from…

Today’s results weren’t too encouraging; the Index failed

again to hold the 3000 level, even after a number of closes higher. Not a good

sign, but the news wasn't all bad.

Today, the drop in the S&P 500 cleared one of our

negative signs: The S&P 500 was too far ahead of its 200-day average

w/sentiment, but not now. This is a

top-indicator, but it may be too sensitive since the 200-dMA has been nearly

flat due to the prior correction. In addition, the Internals I track suprisingly turned positive.

Today was a statistically-significant down-day. That just

means that the price-volume move exceeded my statistical parameters. Statistics

show that a statistically significant down-day is followed by an up-day about

60% of the time.

Overall, my daily sum of 20 Indicators slipped from zero

to -1 (a positive number is bullish; negatives are bearish) while the 10-day

smoothed version that negates the daily fluctuations improved from -4 to -3.

(These numbers sometimes change after I post the blog based on data that comes

in late.) Most of these indicators are short-term.

Are we starting a correction without confirmed top

indicators? We don’t know; we’ll just

have to watch the market a bit more. Top indicators improved from -3 to -2.

TOP / BOTTOM INDICATOR SCALE OF 1 TO 10 (Zero is a

neutral reading.)

Today’s Reading: -2

Most Recent Day with a value other than Zero: -2 on 30

July (the S&P 500 is stretched relative to breadth; the Money Trend

Indicator is stretched relative to the S&P 500.)

(1) +10 Max Bullish / -10 Max Bearish)

(2) -4 or below is a Sell sign. +4 or better is a Buy

Sign.

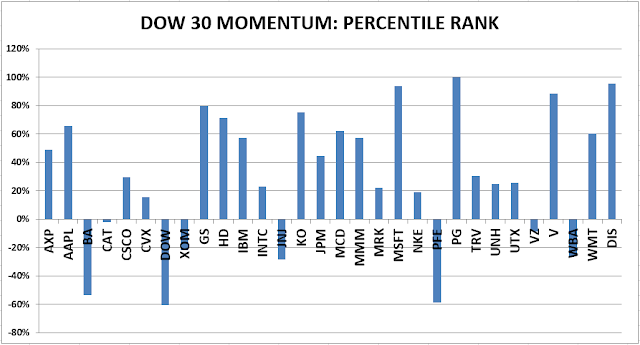

MOMENTUM ANALYSIS:

TODAY’S RANKING OF

15 ETFs (Ranked Daily)

*For additional background on the ETF ranking system see

NTSM Page at…

TODAY’S RANKING OF THE DOW 30 STOCKS (Ranked Daily)

The top ranked stock receives 100%. The rest are then

ranked based on their momentum relative to the leading stock.

*I rank the Dow 30 similarly to the ETF ranking system.

For more details, see NTSM Page at…

WEDNESDAY MARKET INTERNALS (NYSE DATA)

Market Internals improved

to POSITIVE on the market.

Market Internals are a decent trend-following analysis of

current market action but should not be used alone for short term trading. They

are usually right, but they are often late.

They are most useful when they diverge from the Index. In 2014, using these internals alone would

have made a 9% return vs. 13% for the S&P 500 (in on Positive, out on

Negative – no shorting).

Using the Short-term indicator in 2018 in SPY would have

made a 5% gain instead of a 6% loss for buy-and-hold. The methodology was Buy

on a POSITIVE indication and Sell on a NEGATIVE indication and stay out until

the next POSITIVE indication. The back-test included 13-buys and 13-sells, or a

trade every 2-weeks on average.

My current stock allocation is about 55% invested in

stocks as of 4 June 2019. This is based on the improved indicators 3 June and

my recommendation to increase stock holdings if we saw strong buying on 4 June.

As a retiree, I am conservatively positioned with a balanced portfolio. You may be comfortable with a higher % invested

in stocks – that’s OK.

INTERMEDIATE / LONG-TERM INDICATOR

Wednesday, the PRICE indicator was positive; the

SENTIMENT, VIX and VOLUME indicators were neutral. Overall, the Long-Term

Indicator is HOLD.