“Trade what you see; not what you think.” – The Old Fool,

Richard McCranie, trader extraordinaire.

“People always ask me what is going on in the markets. It

is simple. Greatest Speculative Bubble of All Time in All Things. By two orders

of magnitude.” – Michael “Big Short” Burry.

"If I was Darth Vader and I wanted to destroy the US

economy, I would do aggressive spending in the middle of an already hot

economy...This is the biggest bubble I've seen in my career." - Stanley

Druckenmiller, billionaire investor.

“Inflation is not going to be transitory; I’ve been

pretty certain in my mind about three prior calls. This is the fourth one.” -

Mohamed El-Erian, Chief economic adviser at Allianz SE

FACTORY ORDERS (Reuters)

“New orders for U.S.-made goods increased more than

expected in June, while business spending on equipment was solid, pointing to

sustained strength in manufacturing even as spending is shifting away from

goods to services. The Commerce Department said on Tuesday that factory orders

rose 1.5% in June...” Story at...

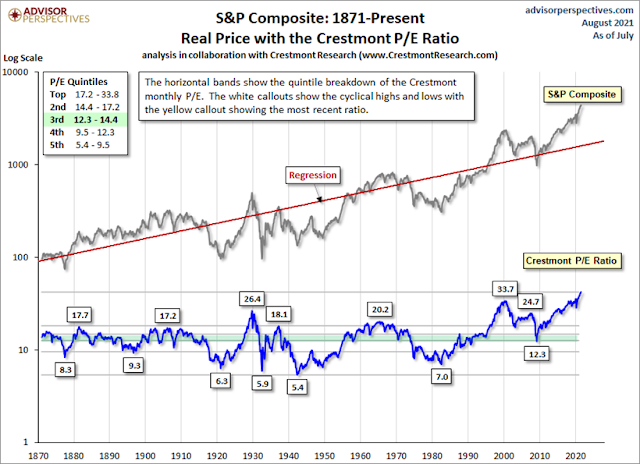

CRESTMONT PE (Advisor Perspectives)

“The Crestmont P/E of 42.2 is 188% above its average

(arithmetic mean) and at the 100th percentile of this fourteen-plus-decade

series. We've highlighted a couple more level-driven periods in this chart: the

current rally, which started in early 2014, and the two months in 1929 with P/E

above the 25 level. Note the current period is within the same neighborhood as

both the tech bubble and the 1929 periods, all with P/E above 25 and is

certainly in the zone of "irrational exuberance". Commentary

at...

My cmt: PE is not an indicator to use for timing the

market. It can remain irrationally high for years. Since there are now fewer

stocks and more investors, the demand exceeds the supply. Higher stock prices,

and thus PEs, are to be expected. How high is too high? Apparently, the markets

are not there yet.

JOHN RADCLIFF – CHINA COVID COVERUP (FOX News)

“I had access to all of the U.S. government’s most

sensitive intelligence related to the pandemic. My informed opinion is that the

lab leak theory isn’t just a "possibility," at the very least it is

more like a probability, if not very close to a certainty.” - John Ratcliffe,

former Director of National Intelligence. From...

https://www.foxnews.com/opinion/china-olympics-2022-covid-cover-up-games-john-ratcliffe

BOMBSHELL COVID REPORT (MSN.com)

“The minority staff of the House Foreign Affairs

Committee released a bombshell report this morning, concluding for the first

time that “the preponderance of the evidence suggests SARS-CoV-2 was

accidentally released from a Wuhan Institute of Virology (WIV) laboratory

sometime prior to September 12, 2019." Story at...

Following

bombshell COVID-19 report, will Democrats force Daszak to testify? (msn.com)

CORONAVIRUS (NTSM)

Here’s the latest from the COVID19 Johns Hopkins website as

of 7:00 PM Tuesday. US total case numbers are on the left axis; daily numbers

are on the right side of the graph with the 10-dMA of daily numbers in Green.

MARKET REPORT / ANALYSIS

-Tuesday the S&P 500 rose about 0.8% to 4423.

-VIX dropped about 7% to 18.04.

-The yield on the 10-year Treasury slipped to 1.175%.

5.0% of all issues traded on the NYSE made new, 52-week

highs when the S&P 500 made a new all-time-high today, 3 August. This is below

average, but not low enough to send a bear signal – something to watch.

Today was a statistically significant up-day. That just means

that the price-volume move exceeded my statistical parameters. Statistics show

that a statistically-significant, up-day is followed by a down-day about 60% of

the time. Statistically-significant,

up-days almost always coincide with tops, but not all

statistically-significant, up-days occur at tops. Today could be a top, but

there are only 3 top indicators warning and that is not a strong top signal.

The daily sum of 20 Indicators declined from -1 to -5 (a

positive number is bullish; negatives are bearish); the 10-day smoothed sum

that smooths the daily fluctuations improved from -40 to -35. (These numbers

sometimes change after I post the blog based on data that comes in late.) Most

of these indicators are short-term and many are trend following.

The Short-term, market-internals ensemble indicator declined

to NEUTRAL.

The Long Term NTSM indicator

remained HOLD. Volume, VIX, Price & Sentiment are neutral.

I am cautiously bullish.

MOMENTUM ANALYSIS:

TODAY’S RANKING OF 15 ETFs (Ranked

Daily)

The top ranked ETF receives

100%. The rest are then ranked based on their momentum relative to the leading

ETF.

*For additional background on

the ETF ranking system see NTSM Page at…

http://navigatethestockmarket.blogspot.com/p/exchange-traded-funds-etf-ranking.html

TODAY’S RANKING OF THE DOW 30

STOCKS (Ranked Daily)

Here’s the revised DOW 30 and

its momentum analysis. The top ranked stock receives 100%. The rest are then

ranked based on their momentum relative to the leading stock.

For more details, see NTSM

Page at…

https://navigatethestockmarket.blogspot.com/p/a-system-for-trading-dow-30-stocks-my_8.html

TUESDAY MARKET INTERNALS (NYSE

DATA)

Market Internals slipped to NEUTRAL on the market.

Market Internals are a decent

trend-following analysis of current market action, but should not be used alone

for short term trading. They are usually right, but they are often late. They are most useful when they diverge from

the Index.

Using the Short-term indicator

in 2018 in SPY would have made a 5% gain instead of a 6% loss for buy-and-hold.

The methodology was Buy on a POSITIVE indication and Sell on a NEGATIVE

indication and stay out until the next POSITIVE indication. The back-test

included 13-buys and 13-sells, or a trade every 2-weeks on average.

My stock-allocation is about 50%

invested in stocks. I am not super bullish (or bearish) and I am watching the

markets closely.

You may wish to have a higher

or lower % invested in stocks depending on your risk tolerance. 50% is a

conservative position that I consider fully invested for most retirees. As a

retiree, 50% in the stock market is about fully invested for me – it is a

cautious and conservative number. If I feel very confident, I might go to 60%;

if a correction is deep enough, and I can call a bottom, 80% would not be out

of the question.