“The NFIB said that small business earnings were the

highest in the history of its survey, which dates back to 1973, and also noted

that small business optimism increased in April to a level in the top 95th

percentile of its all-time average.” Story at…

JOLTS (Reuters)

“U.S. job openings surged to a record high in March,

suggesting that a recent slowdown in hiring was probably the result of

employers having difficulties finding qualified workers. Job openings, a

measure of labor demand, increased by 472,000 to a seasonally adjusted 6.6

million…” Story at…

MARKET REPORT / ANALYSIS

-Tuesday the S&P 500 was a down a point to 2672.

-VIX dropped about 0.3% to 14.71.

-The yield on the 10-year Treasury was little changed to

2.977%.

My daily sum of 17 Indicators remained unchanged at +3;

the 10-day smoothed version improved from -41 to -33. The basket of Market Internals I track

remained Positive on the markets.

Indicators are a repeat of yesterday:

Money Trend is positive. Smart Money (late-day trading)

is neutral. NYSE Breadth is improving faster than the S&P 500 index and

that’s bullish. The Industrial cyclical ETF (XLI) turned up today; over the

last 10-days it’s improving vs. the S&P 500 – that’s bullish.

New-high/new-low data is improving. Bollinger Bands and RS are neutral. Not too

many indicators are Bearish. Most are bullish or neutral.

The Index remained slightly below the 50-day moving

average (50-dMA). We’re still waiting for a close above the 50-day. That should

bring on some more buyers.

My plan ahead remains: If the S&P 500 drops to its

prior low of 2581 and there is an unsuccessful retest, I will probably cut stock

holdings again. If we see a successful test I’ll be adding to stocks. Breadth

is improving

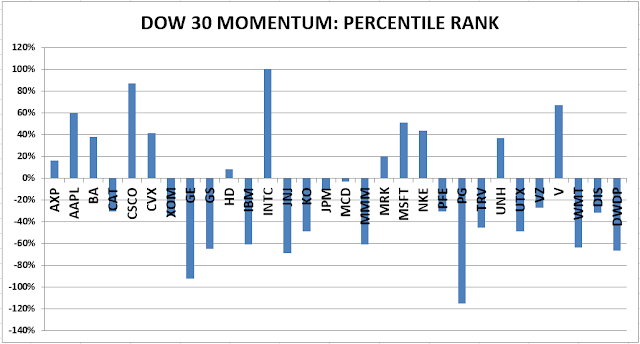

MOMENTUM ANALYSIS IS STILL QUESTIONABLE. As one can see

below in both momentum charts, there are still a lot of issues in negative

territory, i.e., they have weak upward momentum. That’s just an indication that

the market is in correction mode and most stocks have been headed down.

Momentum has gotten worse in the last week or so. Today, conditions were more

positive. 100% of the ETFs were up – it has been a month since we saw all the

ETF’s up on a day.

TODAY’S RANKING OF

15 ETFs (Ranked Daily)

The top ranked ETF receives 100%. The rest are then

ranked based on their momentum relative to the leading ETF. While momentum isn’t stock performance per

se, momentum is closely related to stock performance. For example, over the 4-months

from Oct thru mid-February 2016, the number 1 ranked Financials (XLF) outperformed

the S&P 500 by nearly 20%. In 2017 Technology (XLK) was ranked in the top 3

Momentum Plays for 52% of all trading days in 2017 (if I counted correctly.)

XLK was up 35% on the year while the S&P 500 was up 18%.

*For additional background on the ETF ranking system see

NTSM Page at…

TODAY’S RANKING OF THE DOW 30 STOCKS (Ranked Daily)

The top ranked stock receives 100%. The rest are then

ranked based on their momentum relative to the leading stock. (On 5 Apr 2018 I

corrected a coding/graphing error that has consistently shown Nike

incorrectly.)

*I rank the Dow 30 similarly to the ETF ranking system.

For more details, see NTSM Page at…

Apple (AAPL) has moved up 17 positions in the last 10-days.

It has a PE of 18 vs. the DOW PE of 41. The DOW PE is high due to a couple of

non-earners in the DOW, but at 18, AAPL has one of the lower PE’s in the DOW. I

may buy it if the S&P 500 can break above its 50-dMA.

TUESDAY MARKET INTERNALS (NYSE DATA)

Market Internals

remained Positive on the market.

Market Internals are a decent trend-following analysis of

current market action but should not be used alone for short term trading. They

are usually right, but they are often late.

They are most useful when they diverge from the Index. In 2014, using these internals alone would

have made a 9% return vs. 13% for the S&P 500 (in on Positive, out on

Negative – no shorting).

18 Apr 2018 I

increased stock investments from 35% to 50% based on the Intermediate/Long-Term

Indicator that turned positive on the 17th. (It has since turned Neutral.) For

me, fully invested is a balanced 50% stock portfolio. 50% is my minimum unless

I am in full defense mode.

INTERMEDIATE / LONG-TERM INDICATOR

Intermediate/Long-Term

Indicator: Tuesday, the Volume, VIX, Price and Sentiment indicators were

neutral. Overall this is a NEUTRAL indication.