“Trade what you see; not what you think.” – The Old Fool, Richard McCranie, trader extraordinaire.

“...the U.S. economy grew at a faster pace than previously thought in the third quarter [ending in September]. Specifically, Q3 gross domestic product (GDP) came in at 5.2% vs the initial 4.9% estimate... The Fed's Beige Book was also released today, and it showed declines in economic conditions in half of the central bank's 12 districts between October 6 and November 17. ‘Obviously a more somber report than the GDP numbers we saw this morning," says Alex McGrath, chief investment officer for NorthEnd Private Wealth. ‘Based on these readings, it would appear that we have already entered a mild recession that many have been predicting for a year," even as it runs counter to other data we've seen.’” Story at...

https://www.kiplinger.com/investing/stocks/stock-market-today-stocks-give-back-gdp-gains-after-beige-book

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) increased by 1.6 million barrels from the previous week. At 449.7 million barrels, U.S. crude oil inventories are slightly above the five year average for this time of year.

https://ir.eia.gov/wpsr/wpsrsummary.pdf

-Wednesday the S&P 500 slipped about 0.1% to 4551.

-VIX rose about 2% to 12.98.

-The yield on the 10-year Treasury slipped to 4.259%.

-Drop from Top: 5.1%. 25.4% max (on a closing basis).

-Trading Days since All-Time Top: 479-days. (The top was 3 January 2022.)

The S&P 500 is 6.3% ABOVE its 200-dMA and 4.6% ABOVE its 50-dMA.

*I won’t call the correction over until the S&P 500 makes a new-high; however, evidence suggests the major bear-market bottom (25% decline) was in the 3600 area and we called a buy on 4 October 2022.

XLK – Technology ETF (holding since the October 2022 lows).

XLY - Consumer Discretionary ETF. (Holding since the October 2022 lows - I bought more XLY Monday, 8/21.)

SPY – I bought a large position in the S&P 500 Friday, 8/14, in my 401k (it has limited choices).

XLE – Added Tuesday, 8/22.

SSO – 2x S&P 500 ETF. Added 8/24.

MSFT – added 11/16/2023.

The daily spread of 20 Indicators (Bulls minus Bears) declined from +5 to zero (a positive number is bullish; negatives are bearish); the 10-day smoothed sum that smooths the daily fluctuations declined from +57 to +47. (The trend direction is more important than the actual number for the 10-day value.) These numbers sometimes change after I post the blog based on data that comes in late. Most of these 20 indicators are short-term so they tend to bounce around a lot.

I remain bullish.

TODAY’S RANKING OF 15 ETFs (Ranked Daily)

ETF ranking follows:

The top ranked ETF receives 100%. The rest are then ranked based on their momentum relative to the leading ETF.

*For additional background on the ETF ranking system see NTSM Page at…

http://navigatethestockmarket.blogspot.com/p/exchange-traded-funds-etf-ranking.html

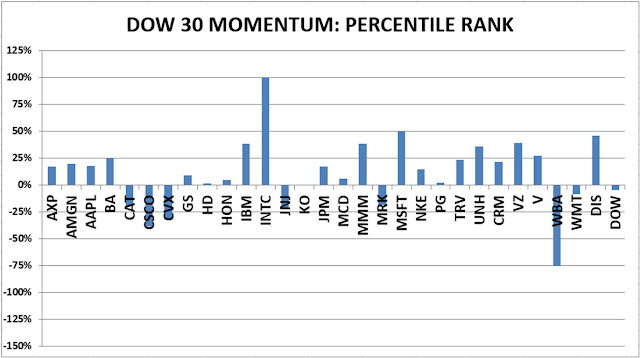

DOW 30 momentum ranking follows:

For more details, see NTSM Page at…

https://navigatethestockmarket.blogspot.com/p/a-system-for-trading-dow-30-stocks-my_8.html

My basket of Market Internals remained HOLD. (My basket of Market Internals is a decent trend-following analysis of current market action, but should not be used alone for short term trading. They are most useful when they diverge from the Index.)