“Trade what you see; not what you think.” – The Old Fool, Richard McCranie, trader extraordinaire.

The following is breaking news from a reliable reporter at MSNBC: “Persistent rumors that President Joe Biden has died continue to rebound around the internet, and frankly, they may be true. Apparently, the playbook for this likelihood is a 35-year-old movie that starred Andrew McCarthy, Jonathan Silverman and Catherine Mary Stewart. Biden is clearly playing the part of Bernie, as he has for several years – and doing a damn good job at it, I might add.” – from the Rachel Maddog Show. Posted 1 April 2024.

“It’s ethnic discrimination to force Big Apple pizzerias and matzah-makers to cut the smoky pollutants from their wood- and coal-fired ovens, according to a new bill sponsored by a state lawmaker. ‘I’m trying to stop discrimination against ethnic restaurants. These misguided laws go against businesses that cook ethnic cuisine.’” - Assemblyman Sam Pirozzolo (R-Staten Island).

“California boasts one of the highest minimum wages in the entire country, as of April 1, 2024 that minimum wage will be raised to $20 an hour.” Story at...

CA Fast Food Workers Laid Off In Mass As New Minimum Wage Requirement Takes Effect (msn.com)

My cmt: Since a year of work is about 2000 hours, the CA minimum wage is about $40,000 per year. The nationwide average starting salary for teachers is $43,000.

“The Manufacturing PMI® registered 50.3 percent in March, up 2.5 percentage points from the 47.8 percent recorded in February. The overall economy continued in expansion for the 47th month after one month of contraction in April 2020.” Report at...

https://www.ismworld.org/supply-management-news-and-reports/reports/ism-report-on-business/pmi/march/

“Construction spending during February 2024 was estimated at a seasonally adjusted annual rate of $2,091.5 billion, 0.3% below the revised January estimate of $2,096.9 billion, according to the U.S. Census Bureau. The February figure is 10.7% above the February 2023 estimate...” Story at...

https://www.floordaily.net/flooring-news/construction-spending-up-107-yoy-in-february

-Monday the S&P 500 declined about 0.2% to 5244.

-VIX rose about 5% to 13.65.

-The yield on the 10-year Treasury rose to 4.307%.

QLD- Added 2/20/2024

UWM – Added 1/22/2024.

XLK – Technology ETF (holding since the October 2022 lows).

CRM – Added 1/22/2024

DWCPF - Dow Jones U.S. Completion Total Stock Market Index. – Added 12/7/2023 when I sold the S&P 500. This is a large position in my retirement account betting on Smaller Caps.

Indicators moved more sharply to the bull side - .Today there are 6 bear-signs and 17-Bull.

(The Long-Term Indicator is not a good top-indicator. It can signal BUY at a top.)

I am bullish.

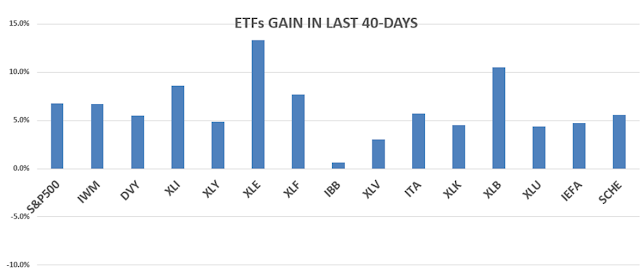

TODAY’S RANKING OF 15 ETFs (Ranked Daily) ETF ranking follows:

*For additional background on the ETF ranking system see NTSM Page at…

http://navigatethestockmarket.blogspot.com/p/exchange-traded-funds-etf-ranking.html

DOW STOCKS - TODAY’S MOMENTUM RANKING OF THE DOW 30 STOCKS (Ranked Daily)

DOW 30 momentum ranking follows:

The top ranked Stock receives 100%. The rest are then ranked based on their momentum relative to the leading Stock.

For more details, see NTSM Page at…

https://navigatethestockmarket.blogspot.com/p/a-system-for-trading-dow-30-stocks-my_8.html

I skipped my rules on Intel and it has been a disappointment. Serves me right! Now, Salesforce (CRM) has fallen out of the top 3. It is an AI play so it is not clear that selling it is the best move. I’ll wait a bit longer.

MONDAY MARKET INTERNALS (NYSE DATA)

My basket of Market Internals remained BUY. (My basket of Market Internals is a decent trend-following analysis of current market action, but should not be used alone for short term trading. They are most useful when they diverge from the Index.)