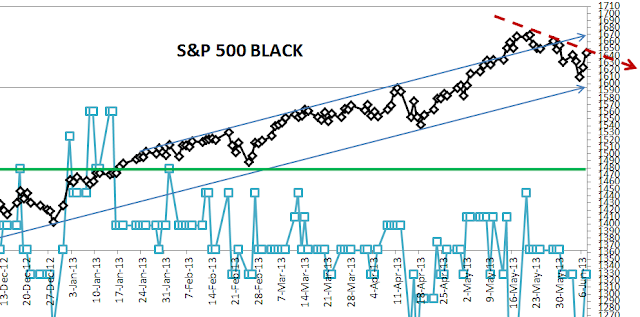

The S&P 500 has bounced to its upper descending

trend-line (shown RED below), if we are indeed in a descending trend. Further upward movement from here will show

that the S&P is not in a down trend.

We’ll have to wait for Monday, but a positive close might

indicate an end to this phase of the correction and drag out the topping

process further. The S&P 500 is

still 9.9% above its 200-day, moving average so any movement upward is not

likely to be long lived. The odds favor that we go

down from here…but we’ll see.

(The BLUE graph with square data points is the daily

output of the NTSM analysis.)