“Producer prices declined for a third consecutive month. The PPI declined 0.1% in November after falling 0.2% in October. The Briefing.com consensus expected the PPI to fall 0.1%...Excluding food and energy, core prices edged up 0.1% in November after increasing 0.2% in October. The consensus expected core PPI to increase 0.1%.” Analysis and details at…

http://www.briefing.com/Investor/Calendars/Economic/Releases/ppi.htm

JP MORGAN – THE BIGGEST BULL ON WALL STREET

“In a note Friday, chief U.S. equity strategist Thomas

Lee rolled out his 2014 forecasts with a year-end target of 2,075 for the

S&P 500, which is one of the most bullish calls out there yet…Lee, says the

index could gain another 20% in 2014, because the current bull market is acting

like a “classic” secular bull market, which is now in its sixth year, and which

has historically been very strong.”

Story at…http://blogs.marketwatch.com/thetell/2013/12/13/29-stocks-j-p-morgan-says-to-consider-for-2014/

Wow. That would be

quite unexpected if it happens. They

think we are still in a secular BULL market.

Not likely. I think the secular

Bear remains and 20% advances next year are highly unlikely. That doesn’t mean the markets can’t go

higher. I just think 20% would be hard

to manage.

BULL to BEAR

Long time bull, Ron Insana, said on CNBC that markets are the verge of a

market correction. He suggested that

technical deterioration in the markets has not confirmed the recent rise in prices. His recommendation: “Take some chips off the

table and look for a better time to get back in.” He too is a believer that the markets are in

a secular bull market and he expects the market to rebound after the correction, but he says, no Santa rally this year.

MARKET REPORT

Friday, the S&P was unchanged at 1775 (rounded).

VIX rose 1% to

15.76. Friday, the S&P was unchanged at 1775 (rounded).

The S&P 500 is slightly less than 1% above the 50-day

moving average. That is about where most

recent dips have ended. I think the market will trend down further, at least

until the Index hits its lower trend line and that would be around 1740-1750. At that point we may have a better idea of the

future direction.

Regarding the taper…I am not sure that the market will

improve even if the FED doesn’t make an announcement on the taper. From recent Fed announcements, it looks like

taper is certain in the next several months, so markets may continue pricing in

future taper even if there is no taper announcement at the December Fed meeting

next week.

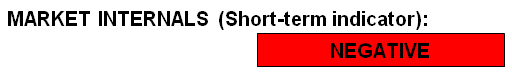

MARKET INTERNALS (NYSE DATA)

The 10-day moving average of stocks advancing remained 42%

at the close Friday. (A number below 50%

for the 10-day average is generally bad news for the market.)

New-lows outpaced new-highs Friday, leaving the spread

(new-hi minus new-low) at minus 55 (it was minus 231 Thursday). The 10-day moving average of change in the

spread was minus 25. In other words, over the last 10-days, on average, the

spread has decreased by 25 each day.

Market internals remain negative on the market.

Market Internals are a decent trend-following analysis of

current market action, but in 2013 (so far), if I had been buying the positive

ratings and selling negative ratings I would have under-performed a

buy-and-hold strategy.

I need a bigger pullback to get back in. Otherwise I will continue to sit out the

party.

MY INVESTED POSITION (NO CHANGE)

I remain about 20% invested in stocks as of 5 March

(S&P 500 -1540). The NTSM system

sold at 1575 on 16 April. (This is just

another reminder that I should follow the NTSM analysis and not act emotionally

– I am now under-performing my own system by about 6%!) I have no problems leaving 20% or 30%

invested. If the market is cut in half

(worst case) I’d only lose 10%-15% of my investments. It also hedges the bet if I am wrong since I

will have some invested if the market goes up.

No system is perfect.

I still lean toward getting back in, after a pullback, to

speculate on a final ride to the top.

NTSM did give several buy signals over the weeks of 14 and 21 Oct, but

the market has looked too frothy to rush back in…we’ll see if the market will

pullback so I can join the insanity. If

not, cash is (grit my teeth and put on a false smile) fine.