“U.S. home sales increased for a second straight month in

March amid a rebound in activity in the Northeast and Midwest regions, but a

dearth of houses on the market and higher prices remain headwinds as the spring

selling season kicks off… The National Association of Realtors said on Monday

that existing home sales rose 1.1 percent…” Story at…

MARKET REPORT / ANALYSIS

-Monday the S&P 500 was essentially unchanged at

2670.

-VIX was Down about 3% to 16.34.

-The yield on the 10-year Treasury rose to 2.975%.

-My daily sum of 17 Indicators dipped from +1 to -1;

the 10-day smoothed version dipped from +25 to +21. Not much change. Indicators

are generally neutral as these numbers imply.

The S&P 500 remained below its lower trend line and

the 50-dMA for a second day. We don’t like to see that. The Index is 3% above

the correction low so if there is a retest, it won’t have far to fall. Of course, we have to hope the retest, if it

were to occur, would be a successful one.

Smart Money continues buying late in the day even on the

down days, so this indicator has turned positive and is moving sharply up – a bullish

indication. Closing Tick has been positive too. It was +201 today.

Money Trend remains sharply positive.

While some indicators are very bullish, overall, Indicators

are only tipped slightly to the Bull side. I got back in at a fully invested

position because of falling VIX. Naturally,

VIX has been rising since then.

There is still a chance the

S&P 500 will retest the 8 Feb low, but I am following my long-term

indicator. If the 10-year rates continue up, (now 2.975%) this could turn out

to be a mistake. We’ll see.

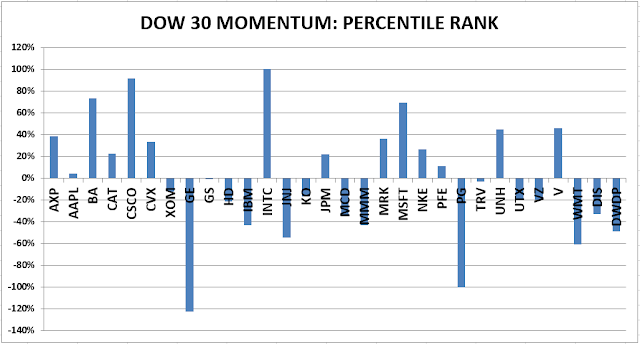

MOMENTUM ANALYSIS IS STILL QUESTIONABLE BUT GETTING

BETTER. As one can see below in both momentum charts, there are still a lot of

issues in negative territory, i.e., they have weak upward momentum. That’s just

an indication that the market is in correction mode and most stocks have been

headed down.

TODAY’S RANKING OF

15 ETFs (Ranked Daily)

The top ranked ETF receives 100%. The rest are then

ranked based on their momentum relative to the leading ETF. While momentum isn’t stock performance per

se, momentum is closely related to stock performance. For example, over the 4-months

from Oct thru mid-February 2016, the number 1 ranked Financials (XLF) outperformed

the S&P 500 by nearly 20%. In 2017 Technology (XLK) was ranked in the top 3

Momentum Plays for 52% of all trading days in 2017 (if I counted correctly.)

XLK was up 35% on the year while the S&P 500 was up 18%.

*For additional background on the ETF ranking system see

NTSM Page at…

TODAY’S RANKING OF THE DOW 30 STOCKS (Ranked Daily)

The top ranked stock receives 100%. The rest are then

ranked based on their momentum relative to the leading stock. (On 5 Apr 2018 I

corrected a coding/graphing error that has consistently shown Nike

incorrectly.)

*I rank the Dow 30 similarly to the ETF ranking system.

For more details, see NTSM Page at…

MONDAY MARKET INTERNALS (NYSE DATA)

Market Internals

remained Neutral on the market.

Market Internals are a decent trend-following analysis of

current market action but should not be used alone for short term trading. They

are usually right, but they are often late.

They are most useful when they diverge from the Index. In 2014, using these internals alone would

have made a 9% return vs. 13% for the S&P 500 (in on Positive, out on

Negative – no shorting).

Wednesday, 18 Apr

2018 I increased stock investments from 35% to 50% based on the

Intermediate/Long-Term Indicator that turned positive on the 17th. For me,

fully invested is a balanced 50% stock portfolio.

INTERMEDIATE / LONG-TERM INDICATOR

Intermediate/Long-Term

Indicator: Monday, the VIX, Volume, Price and Sentiment indicators were

neutral. Overall this is a NEUTRAL indication.