“The Conference Board Consumer Confidence Index® decreased

in June, following an increase in May. The Index now stands at 126.4

(1985=100), down from 128.8 in May…’Consumer confidence declined in June after

improving in May,’ said Lynn Franco, Director of Economic Indicators at The

Conference Board. ‘Consumers’ assessment of present-day conditions was

relatively unchanged, suggesting that the level of economic growth remains

strong. While expectations remain high by historical standards, the modest

curtailment in optimism suggests that consumers do not foresee the economy

gaining much momentum in the months ahead.’” Press release at…

CHICAGO FED NATIONAL ACTIVITY INDEX (Nasdaq.com)

“The Chicago Fed's National Activity Index (CFNAI) for

May delivered a surprise for markets [Monday], dropping by a sharp 0.57 index

points. The series declined from +0.42 in the previous month to -0.15 in May

and subsequently brought its three-month moving average from +0.43 to +0.18.

While forecasts suggested that growth in May could slow compared to that of

April, the real figure released is a large deviation from consensus forecasts.

Still, the index remains above contractionary levels, considered anything below

-0.35.” Story at…

MARKET REPORT / ANALYSIS

-Tuesday the S&P 500 was up about 0.2% to 2723.

-VIX dropped about 8% to 15.92.

-The yield on the 10-year Treasury rose slightly to 2.886%.

My daily sum of 17 Indicators improved from -10 to -7,

while the 10-day smoothed version dropped from -34 to -49. A number below zero

shows most indicators are bearish.

My Money Trend indicator is headed down and that’s bearish.

The Bollinger Band indicator was almost in overbought

territory today; RSI (14-d,SMA) slipped to 31 and 30 is the oversold limit. Perhaps

we can say that’s close enough to be a bullish sign. It should give traders

reason to buy.

Breadth, measured as the % of stocks on the NYSE that

advanced over the last 10-days, fell to 43.6% and it cleared the “oversold”

indication on the overbought/oversold ratio. With RSI and Bollinger Bands

nearly confirming yesterday’s oversold indication in the overbought/oversold

ratio we can be a bit more bullish.

The advancing volume picked up when measured on 10-day basis and that’s a good sign.

The spread between the Cyclical Industrials (XLI-ETF) and

the S&P 500 has narrowed over the last few sessions and the spread

continues to narrow and that’s a bullish sign.

(When investors are worried they sell cyclicals.) XLI is still underperforming

the S&P 500 on every time frame I track, but it is improving (relative to

the S&P 500) and that’s bullish. If it reverses down again I will get

concerned.

The chart still looks ok. The S&P 500 dropped to the

50-dMA yesterday, as we suggested it might do last week, and bounced up from

there. Let’s hope it continues up; I think a significant break of the trend

line/50-dMA would be a bad sign.

Overall, I think we can feel a little more bullish today.

My longer-term indicator system remained neutral. I remain cautiously bullish.

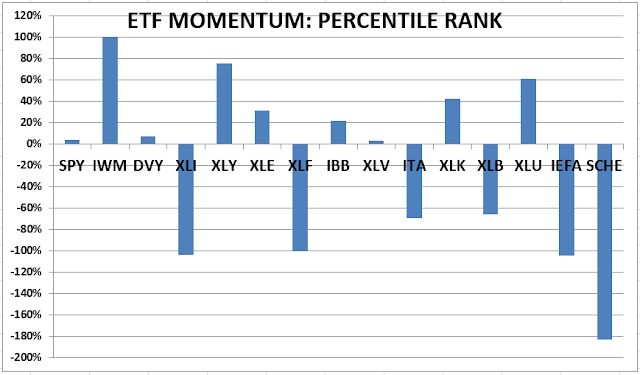

MOMENTUM ANALYSIS:

TODAY’S RANKING OF

15 ETFs (Ranked Daily)

The top ranked ETF receives 100%. The rest are then

ranked based on their momentum relative to the leading ETF. While momentum isn’t stock performance per

se, momentum is closely related to stock performance. For example, over the 4-months

from Oct thru mid-February 2016, the number 1 ranked Financials (XLF) outperformed

the S&P 500 by nearly 20%. In 2017 Technology (XLK) was ranked in the top 3

Momentum Plays for 52% of all trading days in 2017 (if I counted correctly.)

XLK was up 35% on the year while the S&P 500 was up 18%.

*For additional background on the ETF ranking system see

NTSM Page at…

TODAY’S RANKING OF THE DOW 30 STOCKS (Ranked Daily)

The top ranked stock receives 100%. The rest are then

ranked based on their momentum relative to the leading stock. (On 5 Apr 2018 I

corrected a coding/graphing error that had consistently shown Nike

incorrectly.)

*I rank the Dow 30 similarly to the ETF ranking system.

For more details, see NTSM Page at…

I still have GE in my DOW 30 chart. I’ll have to update my calculations to delete

GE and add Walgreens Boots Alliance (WBA) since it has replaced GE in the DOW

30. WBA is best known for operating Walgreens drug stores.

TUESDAY MARKET INTERNALS (NYSE DATA)

Market Internals improved

to Neutral on the market.

Market Internals are a decent trend-following analysis of

current market action but should not be used alone for short term trading. They

are usually right, but they are often late.

They are most useful when they diverge from the Index. In 2014, using these internals alone would

have made a 9% return vs. 13% for the S&P 500 (in on Positive, out on

Negative – no shorting).

18 Apr 2018 I

increased stock investments from 35% to 50% based on the Intermediate/Long-Term

Indicator that turned positive on the 17th. (It has since turned Neutral.) For

me, fully invested is a balanced 50% stock portfolio. 50% is my minimum unless

I am in full defense mode.

On 10 May 2018 I

added stock positions to increase Stock investments to 58% based on more

evidence that the correction is over. This is high for me given that we are

late in this cycle (and as a retiree), but it indicates my bullishness after

the correction. I’ll sell these new positions quickly if the market turns down.

INTERMEDIATE / LONG-TERM INDICATOR

Intermediate/Long-Term

Indicator: Tuesday, the VIX, Price, Sentiment & Volume indicators were

neutral. Overall this is a NEUTRAL indication.