“U.S. industrial production increased in June, boosted by

a sharp rebound in manufacturing and further gains in mining output, the latest

sign of robust economic growth in the second quarter…Manufacturing output

surged 0.8 percent in June…” Story at…

JEFFREY SAUT COMMENTARY (Raymond James)

“…there is the chance we have entered a “buying

stampede.” Recall that buying stampedes typically last 17-25 sessions, with

only one- to three-session pauses/pullbacks, before they exhaust themselves on

the upside. It appears to be the rhythm of the thing in that it takes that long

to get everybody bullish enough to throw in the towel and “buy ‘em” just in

time for a trading top to arrive. While it is true some stampedes have lasted

25-30 sessions, it is rare for one to go more than 30 sessions. If this is such

a stampede, today is session 11.” Jeffrey Saut. Commentary at…

MARKET REPORT / ANALYSIS

-Tuesday the S&P 500 was up about 0.4% to 2810.

-VIX dropped about 6% to 12.06.

-The yield on the 10-year Treasury we up slightly to 2.862%.

Volume improved today, but it was still about 5% below

the monthly average. Perhaps investors don’t believe the rally. There are a lot of shorts on some of the

trader boards I visit. When I look at %-Bulls in the Guggenheim/Rydex long/short

funds, it shows sentiment stands at 84%-bulls.

That’s a high value but not presently high enough to give a bearish

warning. Sentiment suggests this rally can go higher.

RSI and Bollinger bands still have room to run before

they give a bearish warning.

My daily sum of 17 Indicators improved from -4 to +1

while the 10-day smoothed version that negates the daily fluctuations climbed

from +7 to +14. The Sum of Indicators is moving up. This is still bullish for

the market.

Market Internals looked good today except that the Advancing

volume is falling on a 10-day basis.

This may not be correctly reflecting the data since I use actual

advancing volume. That means when overall

volume is low, advancing volume is also low; this can give a bearish signal

when one may not be warranted. On a percentage basis, advancing volume is up

58% over the last 10-days and that’s reasonably bullish.

The Bear signs I mentioned yesterday remain, but again, there

aren’t yet enough bear signs to get me too worried; therefore, I remain

bullish.

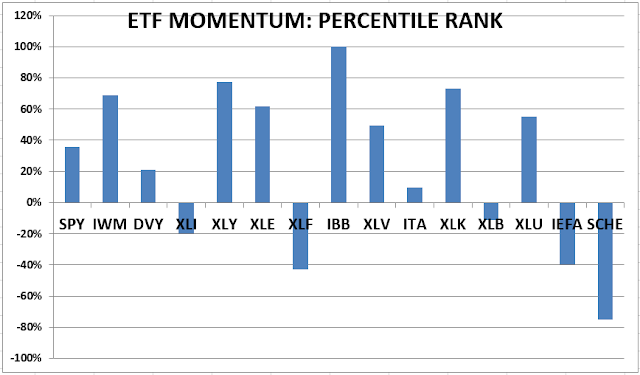

MOMENTUM ANALYSIS:

TODAY’S RANKING OF

15 ETFs (Ranked Daily)

The top ranked ETF receives 100%. The rest are then

ranked based on their momentum relative to the leading ETF. While momentum isn’t stock performance per

se, momentum is closely related to stock performance. For example, over the 4-months

from Oct thru mid-February 2016, the number 1 ranked Financials (XLF) outperformed

the S&P 500 by nearly 20%. In 2017 Technology (XLK) was ranked in the top 3

Momentum Plays for 52% of all trading days in 2017 (if I counted correctly.)

XLK was up 35% on the year while the S&P 500 was up 18%.

*For additional background on the ETF ranking system see

NTSM Page at…

TODAY’S RANKING OF THE DOW 30 STOCKS (Ranked Daily)

The top ranked stock receives 100%. The rest are then

ranked based on their momentum relative to the leading stock. (On 5 Apr 2018 I

corrected a coding/graphing error that had consistently shown Nike

incorrectly.)

*I rank the Dow 30 similarly to the ETF ranking system.

For more details, see NTSM Page at…

GE has been removed from my DOW 30 chart and Walgreens

Boots Alliance (WBA) has been added to match the official DOW 30. WBA is best known for operating Walgreens

drug stores.

TUESDAY MARKET INTERNALS (NYSE DATA)

Market Internals

remained Neutral on the market.

Market Internals are a decent trend-following analysis of

current market action but should not be used alone for short term trading. They

are usually right, but they are often late.

They are most useful when they diverge from the Index. In 2014, using these internals alone would

have made a 9% return vs. 13% for the S&P 500 (in on Positive, out on

Negative – no shorting).

18 Apr 2018 I

increased stock investments from 35% to 50% based on the Intermediate/Long-Term

Indicator that turned positive on the 17th. (It has since turned Neutral.) For

me, fully invested is a balanced 50% stock portfolio. 50% is my minimum unless

I am in full defense mode.

On 10 May 2018 I

added stock positions to increase Stock investments to 58% based on more

evidence that the correction is over. This is high for me given that we are

late in this cycle (and as a retiree), but it indicates my bullishness after

the correction. I’ll sell these new positions quickly if the market turns down.

INTERMEDIATE / LONG-TERM INDICATOR

Intermediate/Long-Term

Indicator: Tuesday, the Volume, VIX, Price & Sentiment indicators were

neutral. Overall this is a NEUTRAL indication.