“Jobless claims hit 6-week high of 231,000, but layoffs

still near lowest level in decades...New claims rose by 3,000 to 231,000...Story at…https://www.marketwatch.com/story/us-jobless-claims-hit-6-week-high-of-231000-but-layoffs-still-near-lowest-level-in-decades-2018-07-05?ns=prod/accounts-mw

ISM SERVICES (KitcoNews)

“U.S. services sector activity picked up in June amid

strong growth in new orders, but trade tariffs and a shortage of workers were

starting to strain the supply chain, which could slow momentum in the coming

months.” Story at…

CRUDE INVENTORIES (OilPrice.com)

“As oil prices continue to press on higher the EIA reported an

inventory build of 1.2 million barrels for the week to June 29. This follows

three consecutive weekly draws of a total of 19.9 million barrels.” Story at…

MARKET REPORT / ANALYSIS

-Thursday the S&P 500 was up about 0.9% to 2737.

-VIX dropped about 7% to 14.97.

-The yield on the 10-year Treasury was little changed at

2.832%.

Money trend is moving up. Breadth has moved above 50% and

is improving. Smart Money is slipping some, but not drastically considering

that the Index has been dropping or flat for a month.

My daily sum of 17 Indicators slipped from +2 to -2, but

the 10-day smoothed version improved from -53 to -50. I wrote yesterday that “We

haven’t seen a bullish move in the indicators in a month.” I meant to say, “We haven’t seen a bullish

move in the indicators THIS BIG in a

month.” The Sum of Indicators is moving up. This is bullish for the market. One

concern: I’ll be watching new-high data – it needs to keep improving if we are

to move higher.

My longer-term indicator system remained neutral. I am

bullish.

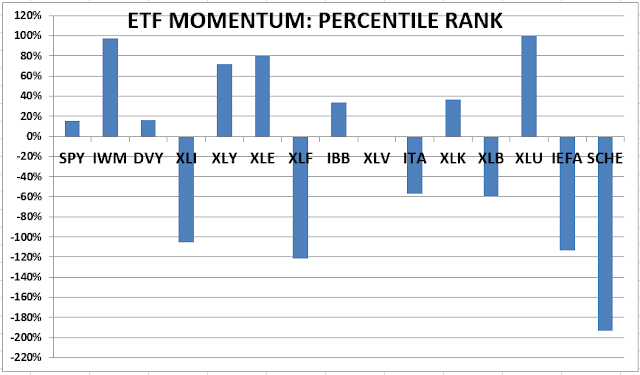

MOMENTUM ANALYSIS:

TODAY’S RANKING OF

15 ETFs (Ranked Daily)

The top ranked ETF receives 100%. The rest are then

ranked based on their momentum relative to the leading ETF. While momentum isn’t stock performance per

se, momentum is closely related to stock performance. For example, over the 4-months

from Oct thru mid-February 2016, the number 1 ranked Financials (XLF) outperformed

the S&P 500 by nearly 20%. In 2017 Technology (XLK) was ranked in the top 3

Momentum Plays for 52% of all trading days in 2017 (if I counted correctly.)

XLK was up 35% on the year while the S&P 500 was up 18%.

*For additional background on the ETF ranking system see

NTSM Page at…

TODAY’S RANKING OF THE DOW 30 STOCKS (Ranked Daily)

The top ranked stock receives 100%. The rest are then

ranked based on their momentum relative to the leading stock. (On 5 Apr 2018 I

corrected a coding/graphing error that had consistently shown Nike

incorrectly.)

*I rank the Dow 30 similarly to the ETF ranking system.

For more details, see NTSM Page at…

I still have GE in my DOW 30 chart. I’ll have to update my calculations to delete

GE and add Walgreens Boots Alliance (WBA) since it has replaced GE in the DOW

30. WBA is best known for operating Walgreens drug stores.

THURSDAY MARKET INTERNALS (NYSE DATA)

Market Internals remained

Neutral on the market.

Market Internals are a decent trend-following analysis of

current market action but should not be used alone for short term trading. They

are usually right, but they are often late.

They are most useful when they diverge from the Index. In 2014, using these internals alone would

have made a 9% return vs. 13% for the S&P 500 (in on Positive, out on

Negative – no shorting).

18 Apr 2018 I

increased stock investments from 35% to 50% based on the Intermediate/Long-Term

Indicator that turned positive on the 17th. (It has since turned Neutral.) For

me, fully invested is a balanced 50% stock portfolio. 50% is my minimum unless

I am in full defense mode.

On 10 May 2018 I

added stock positions to increase Stock investments to 58% based on more

evidence that the correction is over. This is high for me given that we are

late in this cycle (and as a retiree), but it indicates my bullishness after

the correction. I’ll sell these new positions quickly if the market turns down.

INTERMEDIATE / LONG-TERM INDICATOR

Intermediate/Long-Term

Indicator: Thursday, the VIX, Price, Sentiment & Volume indicators were

neutral. Overall this is a NEUTRAL indication.