“Trade what you see; not what you think.” – The Old Fool,

Richard McCranie, trader extraordinaire.

“The big money is not in the buying and selling. But in

the waiting.” - Charlie Munger, Vice Chairman, Berkshire Hathaway

“In my decades of investing experience, I have not seen

such mindless and uninformed speculation as I have witnessed

recently. Indeed, in nominal dollar terms...it is far in excess of the

dot.com boom.” – Doug Cass.

“I never imagined that I would see the day that the

Chairman of the House Judiciary Committee would step forward to call for raw

court packing. It is a sign of our current political environment where rage

overwhelms reason.” - Professor Jonathan Turley, honorary Doctorate of Law from

John Marshall Law School for his contributions to civil liberties and the

public interest.

HOUSING STARTS (Reuters)

“Housing starts surged 19.4% to a seasonally adjusted

annual rate of 1.739 million units last month, the highest level since June

2006... Permits for future home building rose 2.7% to a rate of 1.766 million

units last month...” Story at...

https://www.reuters.com/business/us-housing-starts-increase-more-than-expected-march-2021-04-16/

UNIV MICHIGAN SENTIMENT (UnivMichigan)

“The Sentiment Index rose to its best level in a year on

the strength of recent gains in current economic conditions, while future

economic prospects remained unchanged from March.” Press release at...

HARD TO FIND NEW BUYS (Heritage Capital)

“I continue to find it challenging to buy new things

without a pullback. Momentum is as strong as I have seen it in my 32 years in

the business, but at some point, there will be a short and sharp pullback where

the last one in will look laughingly foolish. While I have high conviction on

the things we own, I also love to feed the ducks into spikes higher. That

leaves the burning question of where to redeploy the proceeds.” – Paul Schatz,

President, Heritage Capital. Commentary at...

https://investfortomorrow.com/blog/big-market-day-hard-to-find-new-buys/

CORONAVIRUS (NTSM)

Here’s the latest from the COVID19 Johns Hopkins website

as of 7:30pm Friday. US total case numbers are on the left axis; daily numbers

are on the right side of the graph with the 10-dMA of daily numbers in Green.

MARKET REPORT / ANALYSIS

-Friday the S&P 500 rose

about 0.4% to 4185.

-VIX slipped about 2% to 16.25.

-The yield on the 10-year

Treasury rose to 1.584%.

Here’s Friday’s run-down of some important indicators.

These tend to be both long-term and short-term, so they are somewhat different

than the 20 that I report on daily.

BULL SIGNS

-The 10-dMA of issues advancing on the NYSE

(Breadth) is above 50%

-The 50-dMA % of issues advancing on the NYSE (Breadth)

is above 50%.

-The 100-dMA of the % of issues advancing on the

NYSE (Breadth) is above 50%.

-MACD of the percentage of issues advancing on the NYSE

(breadth) made a bullish crossover 5 Apr.

-MACD of S&P 500 price made a bullish crossover 26

Mar. (It had been bearish for a few days.)

-McClellan Oscillator is bullish.

-The Smart Money (late-day action) is now headed up. (This

indicator is based on the Smart Money Indicator developed by Don Hayes).

-The size of up-moves has been larger than the size of

down-moves over the last month.

-VIX is falling sharply - bullish.

-The 5-10-20 Timer System is BUY; the 5-dEMA and 10-dEMA are

both above the 20-dEMA.

-Slope of the 40-dMA of New-highs is rising.

-67% of the 15-ETFs that I track have been up over the

last 10-days.

NEUTRAL

-My Money Trend indicator.

-Short-term new-high/new-low data is flat.

-There have been 3 Statistically-Significant days in the

last 15-days. This signal can be Bearish or Bullish. Now it’s neutral.

-Distribution warnings. There was a follow-thru day 15

April and that cancels all prior Distribution Days.

-Non-crash Sentiment indicator remains neutral, but it is

too bullish and that means it is leaning bearish.

-Bollinger Bands.

-The Fosback High-Low Logic Index is neutral.

-The market has broadened out; 13.2% of all issues

traded on the NYSE made new, 52-week highs when the S&P 500 made a new

all-time-high 16 Apr. (there is no bullish signal for this indicator.)

Currently, the value is above average and suggests that if we do have a correction

from here it would likely be less than 10%.

-There have been 7 up-days over the last 10-days. Neutral,

but close to bearish.

-There have been 12 up-days over the last 20 days.

Neutral

-Statistically, the S&P 500 gave a panic-signal, 27

January. The signal has expired.

-8 Mar, the 52-week, New-high/new-low ratio improved by 3.5

standard deviations very bullish, but the signal has expired.

BEAR SIGNS

-The smoothed advancing volume on the NYSE is falling.

-Breadth on the NYSE compared to the S&P 500 index is

bearish – the Index is too far ahead of stocks advancing on the NYSE.

-The S&P 500 is 16.1% above its 200-dMA (Sell point

is 12%.); when Sentiment is considered, the signal is also bearish. This value

was 15.9% above the 200-dMA when the 10% correction occurred in Sep 2020.

-Overbought/Oversold Index (Advance/Decline Ratio) is

overbought.

-RSI.

-Long-term new-high/new-low data is falling.

-Cyclical Industrials (XLI-ETF) are have been under-performing

the S&P 500.

-The S&P 500 is under-performing Utilities ETF (XLU).

On Friday, 21 February, 2 days after the top of the

Coronavirus pullback, there were 10 bear-signs and 1 bull-sign. Now there are 8

bear-signs and 12 bull-signs. Last week, there were 6 bear-signs and 10

bull-signs.

The Bull-signs outnumbered the

Bear-signs, but all is not well. Top

Indicators that are currently warning: (1) The Index is too far above its 200-dMA;

(2) RSI is overbought; (3) the Index is too far ahead of breadth; (4) and the

Index is too far ahead of Money Trend.

If Bollinger bands were

overbought, I’d say we were at a top. As it is, maybe, maybe not. Late day

action is still bullish, so it appears that the Pros haven’t given up on the

rally yet.

The daily sum of 20 Indicators

improved from +3 to +4 (a positive number is bullish; negatives are bearish);

the 10-day smoothed sum that smooths the daily fluctuations dipped from +67 to

+63 (These numbers sometimes change after I post the blog based on data that

comes in late.) Most of these indicators are short-term and many are trend

following.

The Long Term NTSM indicator

ensemble remained BUY. Price, VIX & Volume are bullish; Sentiment is

neutral.

I remain cautiously Bullish, but I did reduce my

%-invested in stocks to 50% on Monday and I took profits in Intel (INTC)

Wednesday. That cut my %-invested to about 45%. (INTC has been weak recently

even though its momentum is still comparably good.) We are getting close to a

pullback of some kind.

MOMENTUM ANALYSIS:

TODAY’S RANKING OF 15 ETFs

(Ranked Daily)

The top ranked ETF receives

100%. The rest are then ranked based on their momentum relative to the leading

ETF.

*For additional background on

the ETF ranking system see NTSM Page at…

http://navigatethestockmarket.blogspot.com/p/exchange-traded-funds-etf-ranking.html

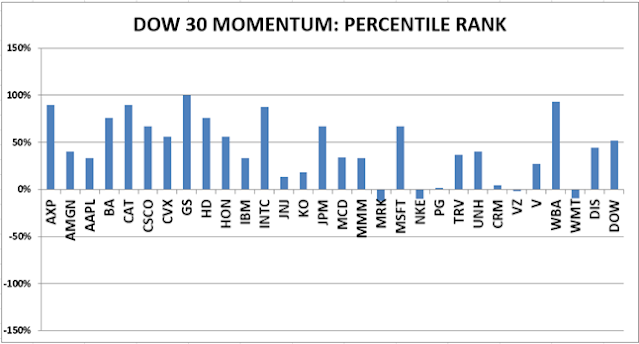

TODAY’S RANKING OF THE DOW 30

STOCKS (Ranked Daily)

Here’s the revised DOW 30 and

its momentum analysis. The top ranked stock receives 100%. The rest are then

ranked based on their momentum relative to the leading stock.

For more details, see NTSM

Page at…

https://navigatethestockmarket.blogspot.com/p/a-system-for-trading-dow-30-stocks-my_8.html

FRIDAY MARKET INTERNALS (NYSE DATA)

Market Internals remained NEUTRAL on the market.

Market Internals are a decent

trend-following analysis of current market action, but should not be used alone

for short term trading. They are usually right, but they are often late. They are most useful when they diverge from

the Index.

Using the Short-term indicator in 2018 in SPY would have made a 5% gain instead of a 6% loss for buy-and-hold. The methodology was Buy on a POSITIVE indication and Sell on a NEGATIVE indication and stay out until the next POSITIVE indication. The back-test included 13-buys and 13-sells, or a trade every 2-weeks on average.

As of 12 April, my

stock-allocation is about 45% invested in stocks. You may wish to have a higher

or lower % invested in stocks depending on your risk tolerance. 50% is a

conservative position that I consider fully invested for most retirees.

As a retiree, 50% in the stock

market is about fully invested for me – it is a cautious and conservative

number. If I feel very confident, I might go to 60%; if a correction is deep

enough, and I can call a bottom, 80% would not be out of the question.

The markets have not

retested the lows on recent corrections and that left me under-invested on the

bounces. I will need to put less reliance on retests in the future.