“Trade what you see; not what you think.” – The Old Fool,

Richard McCranie, trader extraordinaire.

“The big money is not in the buying and selling. But in

the waiting.” - Charlie Munger, Vice Chairman, Berkshire Hathaway

JOBLESS CLAIMS (YahooFinance)

“New weekly jobless claims unexpectedly increased last

week, even

as a broadening vaccination program and the return of some high-contact service

jobs took place...Initial jobless claims, week ended March 27: 719,000

vs. 675,000 expected and a revised 658,000 during the prior week...” Story

at...

ISM MANUFACTURING (ISM via PRnewswire)

"The March Manufacturing PMI® registered

64.7 percent, an increase of 3.9 percentage points from the February reading of

60.8 percent. This figure indicates expansion in the overall economy for the

10th month in a row...The manufacturing economy continued its recovery in

March. However, Survey Committee Members reported that their companies and

suppliers continue to struggle to meet increasing rates of demand due to coronavirus

(COVID-19) impacts limiting availability of parts and materials.” Press release

at...

CONSTRUCTION SPENDING (baynews9)

“U.S. construction spending fell in February after

several months of steady gains, likely because of unseasonably cold weather and

winter storms in the south. The Commerce Department said Thursday that spending

on building projects slipped 0.8% in February, after a 1.2% gain in January.”

Story at...

10 TRILLION FOR CLIMATE AND INFRASTRUCTURE (Mish Talk)

“On Monday, Sen. Edward J. Markey (D-Mass.) and Rep.

Debbie Dingell (D-Mich.) unveiled a climate and infrastructure plan that called

for $10 trillion in spending over the next decade.” – April Fools! Not the day;

these politicians. This is real.

“The saving grace of capitalism is failure. Good ideas

are rewarded, bad ideas fail. We don't have failure, we have bank bailouts,

student loan bailouts, housing bailouts, and so many moral hazard market

interventions by the Fed and Congress I cannot even name all the facilities or

tools. And without failure, you don't have capitalism.” – Mish Shedlock. Commentary

at...

My worry is that the spending won’t be covered by

revenues. Even Biden’s proposed increase

in Corporate taxes is short on revenue; it will raise a trillion dollars over

10 years, but his 2-trillion infrastructure spending would be spent in a much

shorter time. More $ to the National Debt that is already at WWII levels.

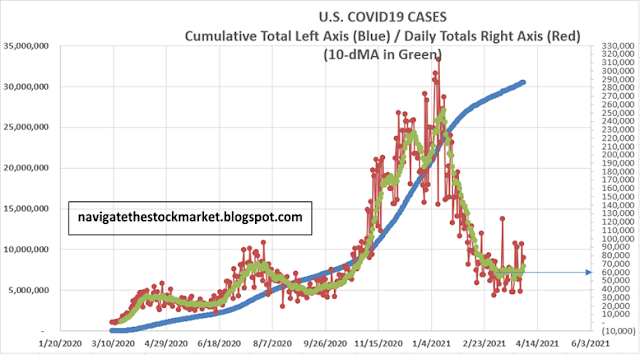

CORONAVIRUS (NTSM)

Here’s the latest from the COVID19 Johns Hopkins website

as of 5:45pm Thursday. US total case numbers are on the left axis; daily numbers

are on the right side of the graph with the 10-dMA of daily numbers in Green.

The trend is heading up, so we can see what CDC was worried about. Let’s hope

it levels off.

MARKET REPORT / ANALYSIS

-Thursday the S&P 500 rose

about 1.2% to 4020.

-VIX dipped about 11% to 17.33.

-The yield on the 10-year

Treasury dipped to 1.676%.

The S&P 500 made another new-high

today and the % of new-highs on the NYSE looks about average which is good. Breadth

improved with the % of issues advancing on the NYSE now at 53.8% over the last

10-days.

The daily sum of 20 Indicators

improved from +1 to +8 (a positive number is bullish; negatives are bearish);

the 10-day smoothed sum that smooths the daily fluctuations improved from -26

to -19 (These numbers sometimes change after I post the blog based on data that

comes in late.) Most of these indicators are short-term and many are trend

following.

The Long Term NTSM indicator

ensemble remained BUY. Price, Volume & VIX are bullish; Sentiment is

neutral.

I remain Bullish.

MOMENTUM ANALYSIS:

TODAY’S RANKING OF 15 ETFs

(Ranked Daily)

The top ranked ETF receives

100%. The rest are then ranked based on their momentum relative to the leading

ETF.

*For additional background on

the ETF ranking system see NTSM Page at…

http://navigatethestockmarket.blogspot.com/p/exchange-traded-funds-etf-ranking.html

TODAY’S RANKING OF THE DOW 30

STOCKS (Ranked Daily)

Here’s the revised DOW 30 and

its momentum analysis. The top ranked stock receives 100%. The rest are then

ranked based on their momentum relative to the leading stock.

For more details, see NTSM

Page at…

https://navigatethestockmarket.blogspot.com/p/a-system-for-trading-dow-30-stocks-my_8.html

THURSDAY MARKET INTERNALS

(NYSE DATA)

Market Internals remained NEUTRAL on the market.

Market Internals are a decent

trend-following analysis of current market action, but should not be used alone

for short term trading. They are usually right, but they are often late. They are most useful when they diverge from

the Index.

Using the Short-term indicator

in 2018 in SPY would have made a 5% gain instead of a 6% loss for buy-and-hold.

The methodology was Buy on a POSITIVE indication and Sell on a NEGATIVE

indication and stay out until the next POSITIVE indication. The back-test

included 13-buys and 13-sells, or a trade every 2-weeks on average.

As of 9 March, my stock-allocation

is about 60% invested in stocks. You may wish to have a higher or lower %

invested in stocks depending on your risk tolerance. 50% is a conservative

position that I consider fully invested for most retirees.

As a retiree, 50% in the stock

market is about fully invested for me – it is a cautious and conservative

number. If I feel very confident, I might go to 60%; if a correction is deep

enough, and I can call a bottom, 80% would not be out of the question.

The markets have not

retested the lows on recent corrections and that left me under-invested on the

bounces. I will need to put less reliance on retests in the future.