“People always ask me what is going on in the markets. It

is simple. Greatest Speculative Bubble of All Time in All Things. By two orders

of magnitude.” – Michael “Big Short” Burry.

"If I was Darth Vader and I wanted to destroy the US

economy, I would do aggressive spending in the middle of an already hot

economy...This is the biggest bubble I've seen in my career." - Stanley

Druckenmiller, billionaire investor.

PAYROLL REPORT / (CNBC)

“Initial filings for unemployment insurance fell last

week to their lowest levels since March 2020 in another sign that the labor

market is gradually improving from the Covid-19 era, the Labor Department

reported Thursday. First-time jobless claims totaled 340,000 for the week ended

Aug. 28... The level of continuing claims, the measure of ongoing benefits, was

2.75 million, a decrease of 160,000...” Story at...

https://www.cnbc.com/2021/09/02/us-weekly-jobless-claims.html

PAYROLL REPORT / UNEMPLOYMENT RATE (YahooFinance)

“The U.S. economy

added back jobs at a far slower pace in August following an

early-summer jump in employment, as an initial wave of reopening hiring waned

and concerns over the Delta variant increased.

-Change in non-farm payrolls: +235,000 vs.

+733,000 expected and a revised +1.053 million in July

-Unemployment rate, August: 5.2% vs.

5.2% expected and 5.4% in July...” Story at...

ISM NON-MANUFACTURING INDEX (ISM via prnewswire)

"According to the Services PMI®, 17 services

industries reported growth. The composite index indicated growth for the 15th

consecutive month after a two-month contraction in April and May 2020. There was a pullback in the rate of expansion

in the month of August; however, growth remains strong for the services sector.

The tight labor market, materials shortages, inflation and logistics issues

continue to cause capacity constraints," Press release at...

CORONAVIRUS (NTSM)

Here’s the latest from the COVID19 Johns Hopkins website as

of 9:00 PM Friday. U.S. total case numbers are on the left axis; daily numbers

are on the right side of the graph in Red with the 10-dMA of daily numbers in

Green.

Same as yesterday, the smoothed 10-dMA of new cases rose

to a new-high of over 160,000 cases today.

US numbers continue to climb sharply.

MARKET REPORT / ANALYSIS

-Friday the S&P 500 was down about 2pts to 4535.

-VIX was unchanged at 16.41.

-The yield on the 10-year Treasury rose to 1.326%.

The Friday run-down of some important indicators remains

on the Bull side (5-bear and 14-bull) – a good sign for the bulls. These

indicators tend to be both long-term and short-term, so they are different than

the 20 that I report on daily. Details follow:

BULL SIGNS

-The 10-dMA % of issues advancing on the NYSE

(Breadth) is above 50%.

-The 50-dMA % of issues advancing on the NYSE (Breadth)

is above 50%.

-The 100-dMA of the % of issues advancing on the

NYSE (Breadth) is above 50%.

-The 5-10-20 Timer System is BUY; the 5-dEMA and 10-dEMA are

both above the 20-dEMA.

-MACD of S&P 500 price made a bullish crossover, 25

August.

-McClellan Oscillator.

-The smoothed advancing volume on the NYSE is rising.

-MACD of the percentage of issues advancing on the NYSE

(breadth) made a bullish crossover 27 August.

-Short-term new-high/new-low data is rising.

-Long-term new-high/new-low data is rising.

-My Money Trend indicator.

-There was a Follow-thru day on 27 Aug. This cancels any prior Distribution days.

-Slope of the 40-dMA of New-highs is up. This is one of

my favorite trend indicators.

-59% of the 15-ETFs that I track have been up over the

last 10-days.

NEUTRAL

-Distribution Days.

There have been 2 in the last 25-days. Cancelled by FT Day.

-Bollinger Bands

-RSI.

-Statistically, the S&P 500 gave a panic-signal, 18

June, but the signal has expired.

-Non-crash Sentiment indicator remains neutral, but it is

very bullish and that means the signal is leaning bearish.

-The Fosback High-Low Logic Index is neutral.

-VIX.

-The size of up-moves has been smaller than the size of

down-moves over the last month, but not enough to give a signal.

-29 July, the 52-week, New-high/new-low ratio improved by

0.4 standard deviations, somewhat bullish, but neutral.

-There have been 4 Statistically-Significant days in the

last 15-days. This can be a bull or bear signal. 4 is neutral.

-The S&P 500 is 11.6% above its 200-dMA (Bear

indicator is 12%.). This value was 15.9% above the 200-dMA when the 10%

correction occurred in Sep 2020.

-There were 5 Hindenburg Omen signals 16-23 Aug. The McClellan Oscillator turned positive so

the Omens have been cancelled.

-7.7% of all issues traded on the NYSE made new, 52-week

highs when the S&P 500 made a new all-time-high 2 September. (There is no

bullish signal for this indicator.) This is above the average for all-time highs.

-There have been 14 up-days over the last 20 days.

Neutral

-There have been 7 up-days over the last 10-days. Neutral

BEAR SIGNS

-Overbought/Oversold Index (Advance/Decline Ratio) is

overbought.

-Breadth on the NYSE compared to the S&P 500 index is

bearish.

-Cyclical Industrials (XLI-ETF) have been under-performing

the S&P 500 recently.

-The S&P 500 is under-performing the Utilities ETF

(XLU).

-The Smart Money (late-day action) indicates the Pros are

selling. (This indicator is based on the Smart Money Indicator developed by Don

Hayes).

On Friday, 21 February, 2 days after the top of the

Coronavirus pullback, there were 10 bear-signs and 1 bull-sign. Now there

are 5 bear-signs and 14 bull-signs. Last week, there were 7 bear-signs and 10

bull-signs.

The daily sum of 20 Indicators slipped from +4 to +1(a

positive number is bullish; negatives are bearish); the 10-day smoothed sum

that smooths the daily fluctuations improved from -25 to -14. (These numbers

sometimes change after I post the blog based on data that comes in late.) Most

of these indicators are short-term and many are trend following.

The Long Term NTSM indicator

ensemble remained HOLD. Volume, Price, VIX & Sentiment indicators are

neutral.

I am cautiously bullish. A top is coming, but not THE TOP.

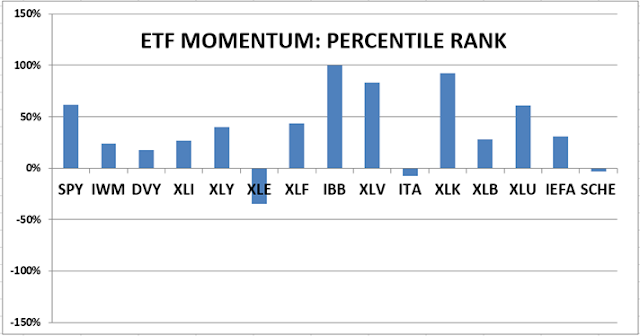

MOMENTUM ANALYSIS:

TODAY’S RANKING OF 15 ETFs

(Ranked Daily)

The top ranked ETF receives

100%. The rest are then ranked based on their momentum relative to the leading

ETF.

*For additional background on

the ETF ranking system see NTSM Page at…

http://navigatethestockmarket.blogspot.com/p/exchange-traded-funds-etf-ranking.html

TODAY’S RANKING OF THE DOW 30

STOCKS (Ranked Daily)

Here’s the revised DOW 30 and

its momentum analysis. The top ranked stock receives 100%. The rest are then

ranked based on their momentum relative to the leading stock.

For more details, see NTSM

Page at…

https://navigatethestockmarket.blogspot.com/p/a-system-for-trading-dow-30-stocks-my_8.html

FRIDAY MARKET INTERNALS (NYSE

DATA)

Market Internals remained BULLISH on the market.

Market Internals are a decent

trend-following analysis of current market action, but should not be used alone

for short term trading. They are usually right, but they are often late. They are most useful when they diverge from

the Index.

My stock-allocation is now about

50% invested in stocks; this is my “normal” 50% allocation.

You may wish to have a higher

or lower % invested in stocks depending on your risk tolerance. 50% is a

conservative position that I consider fully invested for most retirees.

As a general rule, some

suggest that the % of portfolio invested in the stock market should be one’s

age subtracted from 100. So a 30 year

old person would have 70% of the portfolio in stocks, stock mutual funds and/or

stock ETFs. That’s ok, but I usually

don’t recommend keeping less than 50% invested in stocks (as a fully invested

position) since most people need some growth in the portfolio to keep up with

inflation.