“Trade what you see; not what you think.” – The Old Fool,

Richard McCranie, trader extraordinaire.

RETAIL SALES (CNBC)

“Retail sales posted a surprise gain in August despite

fears that escalating Covid cases and supply chain issues would hold back

consumers, the Census Bureau reported Thursday. Sales increased 0.7% for the

month...” Story at...

JOBLESS CLAIMS (Yahoo Finance)

“New weekly jobless claims rose from a pandemic-era low

last week, pointing to sustained improvements in the labor market's recovery...

Initial unemployment claims, week ended

September 11: 332,000 vs. 322,000 expected...” Story at...

https://finance.yahoo.com/news/weekly-jobless-claims-week-ended-september-11-2021-190708680.html

PHILADELPHIA FED INDEX (Reuters)

“Growth in factory activity in the U.S. mid-Atlantic

region slowed for the fourth consecutive month in August after hitting its

highest pace in nearly half a century earlier this spring...The Philadelphia

Federal Reserve Bank said its business activity index fell to 19.4...Any

reading above zero indicates expansion in the region's manufacturing.” Story

at...

CORONAVIRUS (NTSM)

Here’s the latest from the COVID19 Johns Hopkins website as

of 8:30 PM Thursday. U.S. total case numbers are on the left axis; daily

numbers are on the right side of the graph in Red with the 10-dMA of daily

numbers in Green.

I added the smoothed 10-dMA of new cases (in purple) to

the chart. One can see it is off its peak, so perhaps we have seen the worst of

the Delta-variant.

MARKET REPORT / ANALYSIS

-Thursday the S&P 500 slipped about 0.2% to 4474.

-VIX rose about 3% to 18.69.

-The yield on the 10-year Treasury were little changed at

1.335%.

The S&P 500 moved down to near its 50-dMA (now 4433) this

morning around 11 am. It bounced up from there, but sold off in the the last

hour or so of trading. The Index closed about

1.4% below the recent all-time high, so talk of a correction/pullback may be a

bit premature.

The daily sum of 20 Indicators remained -8 (a positive

number is bullish; negatives are bearish); the 10-day smoothed sum that smooths

the daily fluctuations declined from -43 to -55. (These numbers sometimes

change after I post the blog based on data that comes in late.) Most of these

indicators are short-term and many are trend following.

The Long Term NTSM indicator ensemble

remained HOLD. Price is bullish; VIX, Volume & Sentiment indicators are

neutral.

I’m bearish for now, but I can

be swayed if indicators improve enough. Tomorrow’s Friday Indicator run down

should be interesting.

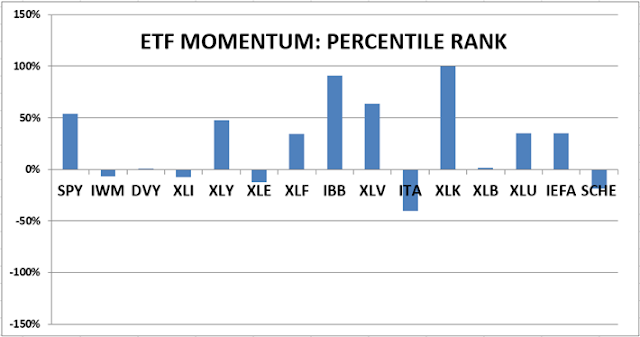

MOMENTUM ANALYSIS:

TODAY’S RANKING OF 15 ETFs

(Ranked Daily)

The top ranked ETF receives

100%. The rest are then ranked based on their momentum relative to the leading

ETF.

*For additional background on

the ETF ranking system see NTSM Page at…

http://navigatethestockmarket.blogspot.com/p/exchange-traded-funds-etf-ranking.html

TODAY’S RANKING OF THE DOW 30

STOCKS (Ranked Daily)

Here’s the revised DOW 30 and

its momentum analysis. The top ranked stock receives 100%. The rest are then

ranked based on their momentum relative to the leading stock.

For more details, see NTSM

Page at…

https://navigatethestockmarket.blogspot.com/p/a-system-for-trading-dow-30-stocks-my_8.html

THURSDAY MARKET INTERNALS

(NYSE DATA)

Market Internals remained BEARISH on the market.

Market Internals are a decent

trend-following analysis of current market action, but should not be used alone

for short term trading. They are usually right, but they are often late. They are most useful when they diverge from

the Index.

My stock-allocation is now

about 45% invested in stocks; this is slightly below my “normal” fully invested

allocation of 50%.

You may wish to have a higher

or lower % invested in stocks depending on your risk tolerance. 50% is a

conservative position that I consider fully invested for most retirees.

As a general rule, some

suggest that the % of portfolio invested in the stock market should be one’s

age subtracted from 100. So a 30 year

old person would have 70% of the portfolio in stocks, stock mutual funds and/or

stock ETFs. That’s ok, but for older

investors, I usually don’t recommend keeping less than 50% invested in stocks

(as a fully invested position) since most people need some growth in the

portfolio to keep up with inflation.