“Trade what you see; not what you think.” – The Old Fool,

Richard McCranie, trader extraordinaire.

JOBLESS CLAIMS (YahooFinance)

“Weekly jobless claims rose after setting a more than

five-decade low last week. Still, however, new claims came in near pre-pandemic

levels, highlighting ongoing improvements in the labor market...Initial unemployment claims,

week ended November 27: 222,000 vs. 240,000 expected”

Story at...

IS A CRASH LIKE 2000 POSSIBLE? (RIA)

“The benefit of using the ratio price to sales (P/S)

versus P/E is that sales, or revenue, are not easy to manipulate by

executives...the price to sales ratio (P/S) is now 50% above where it was in

1999...15% of the S&P 500 stocks have a P/S ratio greater than ten. That

compares to 8% in 1999.” [Does 10x sales make sense?]

‘At 10 times revenues, to give you a 10-year payback, I have

to pay you 100% of revenues for 10 straight years in dividends. That assumes I

can get that by my shareholders. It assumes I have zero cost of

goods sold, which is very hard for a computer company. That assumes zero

expenses, which is really hard with 39,000 employees. That assumes I pay no

taxes, which is very hard. And that assumes you pay no taxes on your dividends,

which is kind of illegal. And that assumes with zero R&D for the next 10

years, I can maintain the current revenue run rate. Now, having done that,

would any of you like to buy my stock at $64? Do you realize how ridiculous

those basic assumptions are?’” - Scott McNeely, CEO of Sun

Microsystems, 1999. Commentary at...

https://realinvestmentadvice.com/is-a-stock-market-crash-like-2000-possible

A good bit of the market is working on “The Greater Fool”

theory, i.e., there will always be a bigger fool to buy my stock when I get ready

to sell.

INDICATOR THAT PREDICTED THE 1987 CRASH IS FLASHING RED [Now

Predicting a 10% Correction] (msn.com)

“Pursche, of Wealthspire, said the sentiment imbalance

may well point to a 10% correction but he didn’t believe the current bull

market was close to expiry. The economic backdrop has not yet changed, despite

speculation about the threat from the omicron variant of Covid 19. “Sentiment

matters greatly in the short term, fundamentals matter much more in the long

term,” says. Pursche.” Story at...

A

Stock Market Indicator That Predicted the 1987 Crash Is Flashing Red (msn.com)

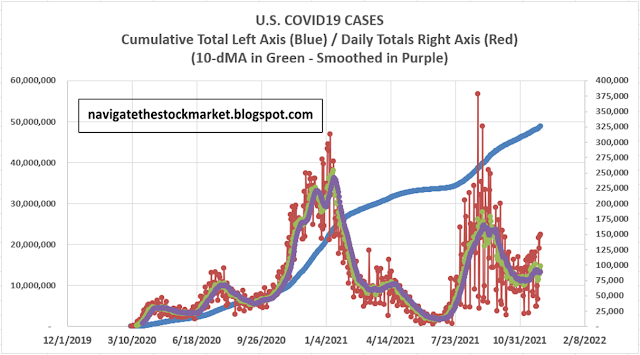

CORONAVIRUS (NTSM)

Here’s the latest from the COVID19 Johns Hopkins website

as of 6:00 PM Thursday. U.S. total case numbers are on the left axis; daily

numbers are on the right side of the graph in Red with the 10-dMA of daily

numbers in Green. I added the smoothed 10-dMA of new cases (in purple) to the

chart.

I have been watching a slight down tick in new cases on

the chart. The problem is that starting

with Monday of this week, new-cases have been between 130,000 and 150,000

(today), well above the smoothed 10-dMA. I suspect the downturn may be a fakeout

that results from weak reporting over the 4 -day Thanksgiving holiday period.

We’ll see.

MARKET REPORT / ANALYSIS

-Thursday the S&P 500 rose about 1.4% to 4577.

-VIX dropped about 11% to 27.73.

-The yield on the 10-year Treasury slipped to 1.431%.

(Perhaps the Bond Gurus are not convinced the downturn is over?)

Yesterday, we got lower volume on the NYSE (indicating

reduced selling), but internals were little improved so I was not convinced

that Wednesday was a bottom. The reversal in price was bearish, too, but after

today’s bullish move, maybe we should look again. Was Wednesday the bottom of another

quick downturn?

Looking at the market we see some bull signs Thursday:

-The S&P 500 closed 0.7% above its 50-dMA.

-Utilities were strong, but they did underperform the

S&P 500.

-Cyclical Industrials outperformed by a lot today.

-83% of volume was up-volume

But a lot of bear signs remain...

-Moving averages of Breadth (issues advancing on the

NYSE) remained in bear territory, but these naturally lag.

-The 40-dMA of new-highs is still falling, another

lagging indicator.

-New-high/new-low data continues to look very weak. There were only 9 new-highs today with 175

new-lows. This didn’t even move my scale

for improvement.

-The smart money (late-day action) is still headed down.

The new-high/new-low stats bother more than other

indicators. If Wednesday was a bottom, new-highs/new-lows

should have improved more Thursday.

The action today supports a down day tomorrow. Today

was another statistically significant up-day. That means that the price-volume

move exceeded my statistical parameters. Statistics show that a

statistically-significant, up-day is followed by a down-day about 60% of the

time. Daily indicators didn’t improve by much either.

The daily sum of 20 Indicators improved from -17 to – 15 (a

positive number is bullish; negatives are bearish); the 10-day smoothed sum

that smooths the daily fluctuations declined from -113 to -119 (These numbers

sometimes change after I post the blog based on data that comes in late.) Most

of these indicators are short-term so they tend to bounce around a lot.

The Long Term NTSM indicator ensemble remained SELL. VIX & Volume are bearish; Price & Sentiment are Neutral.

All-in-all, I am not yet convinced

that Wednesday was the bottom. I would

change my mind if we see another strong positive move up accompanied by improvements

in indicators, especially if we have another high up-volume day with up-volume

>80% of total volume.

I remain bearish, but I’ll be

checking the data Friday. Friday’s run-down of indicators will be interesting.

MOMENTUM ANALYSIS:

TODAY’S RANKING OF 15 ETFs

(Ranked Daily)

The top ranked ETF receives

100%. The rest are then ranked based on their momentum relative to the leading

ETF.

*For additional background on

the ETF ranking system see NTSM Page at…

http://navigatethestockmarket.blogspot.com/p/exchange-traded-funds-etf-ranking.html

TODAY’S RANKING OF THE DOW 30

STOCKS (Ranked Daily)

Here’s the revised DOW 30 and

its momentum analysis. The top ranked stock receives 100%. The rest are then

ranked based on their momentum relative to the leading stock.

For more details, see NTSM

Page at…

https://navigatethestockmarket.blogspot.com/p/a-system-for-trading-dow-30-stocks-my_8.html

THURSDAY MARKET INTERNALS

(NYSE DATA)

Market Internals improved to HOLD.

Market Internals are a decent

trend-following analysis of current market action, but should not be used alone

for short term trading. They are usually right, but they are often late. They are most useful when they diverge from the

Index.

I’ll be a buyer when we can

see an end to the current weakness.

My stock-allocation in the

portfolio is now about 35% invested in stocks; this is well below my “normal”

fully invested stock-allocation of 50%.

You may wish to have a higher

or lower % invested in stocks depending on your risk tolerance. 50% is a

conservative position that I consider fully invested for most retirees.

As a general rule, some

suggest that the % of portfolio invested in the stock market should be one’s

age subtracted from 100. So, a

30-year-old person would have 70% of the portfolio in stocks, stock mutual

funds and/or stock ETFs. That’s ok, but

for older investors, I usually don’t recommend keeping less than 50% invested

in stocks (as a fully invested position) since most people need some growth in

the portfolio to keep up with inflation.