“Putin blames the west for his genocidal invasion of

Ukraine.” – Michael Ramirez.

https://michaelpramirez.com/index.html

“This thing [Ukrainian war] has to stop, and it’s got to

stop now...The United States should negotiate peace between these two

countries, and I don’t think they should be sending very much...[I’ll] clean

house of all the warmongers and America-Last globalists.” – Former President

Donald Trump.

My cmt: I remember when Nikita Khruschev pounded his shoe on a desk at the UN and screamed, “We will bury you.” America First devotees should consider that standing up to Russia is America First. Supporting Ukraine also sends a message to China regarding their ambitions in Taiwan.

“Trade what you see; not what you think.” – The Old Fool,

Richard McCranie, trader extraordinaire.

PCE PRICES (Benzinga)

“The headline PCE rose 5.4% in January. That's up from a 5.3% gain in December but still well below its 2022 high of a 7% increase in June. The January PCE reading came in well above economist estimates of 4.9%. Core PCE inflation, which excludes volatile food and energy prices, was up 4.7% in January, above economist estimates of 4.3%.” Story at...

https://www.benzinga.com/analyst-ratings/analyst-color/23/02/31049404/big-upside-surprise-experts-react-to-4-7-core-pce-inflation-as-interest-rate-expect

PERSONAL SPENDING (fxStreet)

“Real personal spending shot higher in January, and solid growth in discretionary services suggests continued consumer resilience...Real personal spending got a lift again to start the year, and in jumping 1.1% in January...” Story at...

https://www.fxstreet.com/analysis/january-personal-income-and-spending-signs-of-resilience-beneath-volatility-202302241509

NEW HOME SALES (NY Post)

“Sales of new US single-family homes jumped to a 10-month high in January as prices declined, but a resurgence in mortgage rates could slow a much anticipated housing market turnaround. New home sales increased 7.2%...” Story at...

https://nypost.com/2023/02/24/january-new-home-sales-jump-to-10-month-high-as-prices-fall/

MARKET REPORT / ANALYSIS

-Friday the S&P 500 fell about 1.1% to 3970.

-VIX rose about 3% to 21.67.

-The yield on the 10-year Treasury rose to 3.953%.

PULLBACK DATA:

-Drop from Top: 17.2% as of today. 25.4% max (on a closing basis).

-Trading Days since Top: 283-days.

The S&P 500 is 0.8% ABOVE its 200-dMA & 0.3% BELOW its 50-dMA.

*I won’t call the correction over until the S&P 500 makes a new-high; however, evidence suggests the bottom was in the 3600 area.

MY TRADING POSITIONS:

SSO – 2x S&P 500 (added today)

XLK – Technology ETF.

XLE – Energy Sector ETF. It hasn’t been doing much recently, but Russia is cutting production and that should help the sector. We have a good dividend in the meantime.

BA – (Boeing) I am late on this one, but we’ll see.

XLY - Consumer Discretionary ETF.

SHY – Short term bonds. 30-day yield is 4.2%. (Trailing

1-year yield is 1.3%.) I’ll hold this, but if the market retests the lows, I’ll

sell it and buy stocks.)

TODAY’S COMMENT:

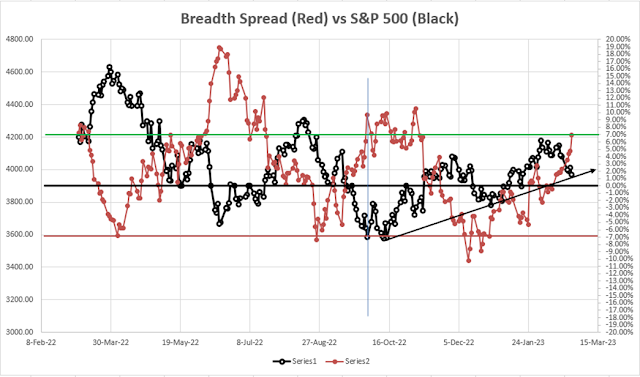

The S&P 500 broke below its 50-dMA, bounced off the 200-dMA and closed just above its lower trend line (black sloping line) in the chart below. In addition, my Breadth Spread (comparing breadth to the S&P 500 in the below chart), Bollinger Bands & RSI are all very close to giving a buy signal. (They were all buy when I checked earlier in the day and I thought they all were at the close - oops.) I did buy SSO (2x S&P 500) near the close.

I am still bullish – I’ll get very worried if the S&P 500 breaks lower and closes below the 200-dMA on successive days.

It’s Friday so it’s time to do the Friday indicator

rundown. Some of these indicators may appear simple-minded, but together they

do seem to indicate market conditions. For review, here’s the Friday/Monday

update (on 20 December 2021). This post was 8 sessions before the top of the

current, Bear Market/Pullback:

“Friday there were 5 bull indicators:

-The 10-dMA % of issues advancing on the NYSE (Breadth) is above 50%.

-Short-term new-high/new-low data is rising.

-The 5-10-20 Timer System is BUY; the 5-dEMA and 10-dEMA are both ABOVE the 20-dEMA.

Today [Monday, 20 December 2021], none of those indicators are bullish. It looks like today’s count would be 21 bear and zero bull. That’s the worst count since I started keeping these numbers a couple years ago.” As you might imagine, I reduced stock holdings 20 December 2021. Enough about the past...

Here’s this week’s Friday review:

The Friday rundown of indicators was a little more bearish than last week (now 11-bear and 9-bull), but not far from neutral. (These indicators tend to be both long-term and short-term, so they are different than the 20 that I report on daily.)

BULL SIGNS

-The smoothed advancing volume on the NYSE is falling.

-The 50-dMA percentage of issues advancing on the NYSE (Breadth) is above 50%.

-The 100-dMA percentage of issues advancing on the NYSE (Breadth) is above 50%.

-Long-term new-high/new-low data.

-The long-term, 50-dEMA, Fosback Hi-Low Logic Index is bullish.

-On average, the size of up-moves has been larger than the size of down-moves over the last month.

-90% up-volume days - the last one was 31 Jan. and before that, 30 November. That’s pretty far apart, but I’ll still put this in the bullish column. We have not seen a 90% down-volume day since the 2 up-volume days.

-XLI-ETF (Cyclical Industrials) is outperforming the S&P 500. The Long-term value is turning down sharply, but the short-term value is up today. Let’s call it Bullish.

-S&P 500 is outperforming Utilities (XLU-ETF).

NEUTRAL

-Bollinger Bands. (Very close to bullish.)

-RSI (Very close to bullish.)

-Issues advancing on the NYSE (Breadth) compared to the S&P 500. – Very close to a bullish indication.

-There was a Distribution Day 9 & 21 Feb, however, it’s only 2 since the last Follow-thru day.

-There have only been 2 Statistically-Significant days (big moves in price-volume) in the last 15-days.

-Sentiment.

-The short-term, 10-dayEMA, Fosback Hi-Low Logic Index is neutral.

-Overbought/Oversold Index (Advance/Decline Ratio).

-There was a Zweig Breadth Thrust 12 January. That’s a rare, very-bullish sign. - Expired

-There have been 4 up-days over the last 10 sessions – neutral.

-There have been 9 up-days over the last 20 sessions - neutral.

-The graph of the 100-day Count (the 100-day sum of up-days) is flat.

-The 50-dMA percentage of issues advancing on the NYSE (Breadth) has been above 50%, for 3 days in a row ending the “correction-now” signal.

-The Calm-before-the-Storm/Panic Indicator flashed a panic-buying signal 10 November - expired.

-VIX indicator.

-The S&P 500 is 0.8% above its 200-dMA. (Bear indicator is 12% above the 200-day.)

-There was a Hindenburg Omen signal 8 April 2022 – expired.

-2.8% of all issues traded on the NYSE made new, 52-week highs when the S&P 500 made a new all-time-high, 3 January 2022. (There is no bullish signal for this indicator.) This indicated that the advance was too narrow and a correction was likely to be >10%. It proved correct, but is now Expired

-The 52-week, New-high/new-low ratio improved by 3.5 standard deviations. More simply, the spread between new-highs and new-lows improved by 716 on 14 October. That’s a solid bottom sign at a retest. – Expired.

-13 & 21 Oct were Bullish Outside Reversal Days with no Bearish Outside Reversal days since then - expired.

-46% of the 15-ETFs that I track have been up over the last 10-days. Neutral.

BEAR SIGNS

-The 10-dMA percentage of issues advancing on the NYSE (Breadth) is below 50%.

-MACD of the percentage of issues advancing on the NYSE (breadth) made a bearish crossover 6 Feb.

-Smoothed Buying Pressure minus Selling Pressure is falling.

-MACD of S&P 500 price made a bearish crossover 10 Feb.

-My Money Trend indicator is falling.

-Short-term new-high/new-low data.

-McClellan Oscillator.

-Slope of the 40-dMA of New-highs is falling.

-The Smart Money (late-day action) is bearish.

-The 5-10-20 Timer System is SELL; the 5-dEMA and 10-dEMA are both below the 20-dEMA.

-The 5-day EMA is below the 10-day EMA so short-term momentum is bearish.

On Friday, 21 February, 2 days after the top before the

Coronavirus pullback, there were 10 bear-signs and 1 bull-sign. Now there

are 11 bear-signs and 9-Bull. Last week, there were 10 bear-sign and 13

bull-signs.

The Friday rundown is slightly bearish, but

remains a near neutral indication.

Today, the daily spread of 20 Indicators (Bulls minus

Bears) improved from -2 to zero (a positive number is bullish; negatives are

bearish); the 10-day smoothed sum that smooths the daily fluctuations declined

from +8 to +6. (The trend direction is more important than the actual number

for the 10-day value.) These numbers sometimes change after I post the blog

based on data that comes in late. Most of these 20 indicators are short-term so

they tend to bounce around a lot.

LONG-TERM INDICATOR: The Long Term NTSM indicator

remained HOLD: PRICE is positive; VIX & SENTIMENT are neutral. VOLUME was negative.

(The important BUY in this indicator was on 21 October,

7-days after the bottom. For my NTSM overall signal, I suggested that a

short-term buying opportunity occurred on 27 September (based on improved

market internals on the retest), although without market follow-thru, I was

unwilling to call a buy; however, I did close shorts and increased stock

holdings. I issued a Buy-Signal on 4 October, 6-days before the final bottom,

based on stronger market action that confirmed the market internals signal.)

Bottom line: I remain a BULL, although somewhat more

cautious.

ETF - MOMENTUM ANALYSIS:

TODAY’S RANKING OF 15 ETFs (Ranked Daily)

ETF ranking follows:

The top ranked ETF receives 100%. The rest are then ranked based on their momentum relative to the leading ETF.

*For additional background on the ETF ranking system see NTSM Page at…

http://navigatethestockmarket.blogspot.com/p/exchange-traded-funds-etf-ranking.html

BEST DOW STOCKS - TODAY’S MOMENTUM

RANKING OF THE DOW 30 STOCKS (Ranked Daily)

DOW 30 momentum ranking follows:

The top ranked Stock receives 100%. The rest are then ranked based on their momentum relative to the leading Stock.

For more details, see NTSM Page at…

https://navigatethestockmarket.blogspot.com/p/a-system-for-trading-dow-30-stocks-my_8.html

FRIDAY MARKET INTERNALS (NYSE

DATA)

My basket of Market Internals improved to HOLD. (Market Internals are a decent trend-following analysis of current market action, but should not be used alone for short term trading. They are most useful when they diverge from the Index.)

...My current invested

position is about 70% stocks, including stock mutual funds and ETFs. I’m

usually about 50% invested in stocks.

I trade about 15-20% of the

total portfolio using the momentum-based analysis I provide here. If I can see

a definitive bottom, I’ll add a lot more stocks to the portfolio using an

S&P 500 ETF.

https://michaelpramirez.com/index.html

My cmt: I remember when Nikita Khruschev pounded his shoe on a desk at the UN and screamed, “We will bury you.” America First devotees should consider that standing up to Russia is America First. Supporting Ukraine also sends a message to China regarding their ambitions in Taiwan.

“The headline PCE rose 5.4% in January. That's up from a 5.3% gain in December but still well below its 2022 high of a 7% increase in June. The January PCE reading came in well above economist estimates of 4.9%. Core PCE inflation, which excludes volatile food and energy prices, was up 4.7% in January, above economist estimates of 4.3%.” Story at...

https://www.benzinga.com/analyst-ratings/analyst-color/23/02/31049404/big-upside-surprise-experts-react-to-4-7-core-pce-inflation-as-interest-rate-expect

“Real personal spending shot higher in January, and solid growth in discretionary services suggests continued consumer resilience...Real personal spending got a lift again to start the year, and in jumping 1.1% in January...” Story at...

https://www.fxstreet.com/analysis/january-personal-income-and-spending-signs-of-resilience-beneath-volatility-202302241509

“Sales of new US single-family homes jumped to a 10-month high in January as prices declined, but a resurgence in mortgage rates could slow a much anticipated housing market turnaround. New home sales increased 7.2%...” Story at...

https://nypost.com/2023/02/24/january-new-home-sales-jump-to-10-month-high-as-prices-fall/

-Friday the S&P 500 fell about 1.1% to 3970.

-VIX rose about 3% to 21.67.

-The yield on the 10-year Treasury rose to 3.953%.

-Drop from Top: 17.2% as of today. 25.4% max (on a closing basis).

-Trading Days since Top: 283-days.

The S&P 500 is 0.8% ABOVE its 200-dMA & 0.3% BELOW its 50-dMA.

*I won’t call the correction over until the S&P 500 makes a new-high; however, evidence suggests the bottom was in the 3600 area.

SSO – 2x S&P 500 (added today)

XLE – Energy Sector ETF. It hasn’t been doing much recently, but Russia is cutting production and that should help the sector. We have a good dividend in the meantime.

BA – (Boeing) I am late on this one, but we’ll see.

XLY - Consumer Discretionary ETF.

The S&P 500 broke below its 50-dMA, bounced off the 200-dMA and closed just above its lower trend line (black sloping line) in the chart below. In addition, my Breadth Spread (comparing breadth to the S&P 500 in the below chart), Bollinger Bands & RSI are all very close to giving a buy signal. (They were all buy when I checked earlier in the day and I thought they all were at the close - oops.) I did buy SSO (2x S&P 500) near the close.

I am still bullish – I’ll get very worried if the S&P 500 breaks lower and closes below the 200-dMA on successive days.

“Friday there were 5 bull indicators:

-The 10-dMA % of issues advancing on the NYSE (Breadth) is above 50%.

-Short-term new-high/new-low data is rising.

-The 5-10-20 Timer System is BUY; the 5-dEMA and 10-dEMA are both ABOVE the 20-dEMA.

Today [Monday, 20 December 2021], none of those indicators are bullish. It looks like today’s count would be 21 bear and zero bull. That’s the worst count since I started keeping these numbers a couple years ago.” As you might imagine, I reduced stock holdings 20 December 2021. Enough about the past...

The Friday rundown of indicators was a little more bearish than last week (now 11-bear and 9-bull), but not far from neutral. (These indicators tend to be both long-term and short-term, so they are different than the 20 that I report on daily.)

-The smoothed advancing volume on the NYSE is falling.

-The 50-dMA percentage of issues advancing on the NYSE (Breadth) is above 50%.

-The 100-dMA percentage of issues advancing on the NYSE (Breadth) is above 50%.

-Long-term new-high/new-low data.

-The long-term, 50-dEMA, Fosback Hi-Low Logic Index is bullish.

-On average, the size of up-moves has been larger than the size of down-moves over the last month.

-90% up-volume days - the last one was 31 Jan. and before that, 30 November. That’s pretty far apart, but I’ll still put this in the bullish column. We have not seen a 90% down-volume day since the 2 up-volume days.

-XLI-ETF (Cyclical Industrials) is outperforming the S&P 500. The Long-term value is turning down sharply, but the short-term value is up today. Let’s call it Bullish.

-S&P 500 is outperforming Utilities (XLU-ETF).

-Bollinger Bands. (Very close to bullish.)

-RSI (Very close to bullish.)

-Issues advancing on the NYSE (Breadth) compared to the S&P 500. – Very close to a bullish indication.

-There was a Distribution Day 9 & 21 Feb, however, it’s only 2 since the last Follow-thru day.

-There have only been 2 Statistically-Significant days (big moves in price-volume) in the last 15-days.

-Sentiment.

-The short-term, 10-dayEMA, Fosback Hi-Low Logic Index is neutral.

-Overbought/Oversold Index (Advance/Decline Ratio).

-There was a Zweig Breadth Thrust 12 January. That’s a rare, very-bullish sign. - Expired

-There have been 4 up-days over the last 10 sessions – neutral.

-There have been 9 up-days over the last 20 sessions - neutral.

-The graph of the 100-day Count (the 100-day sum of up-days) is flat.

-The 50-dMA percentage of issues advancing on the NYSE (Breadth) has been above 50%, for 3 days in a row ending the “correction-now” signal.

-The Calm-before-the-Storm/Panic Indicator flashed a panic-buying signal 10 November - expired.

-VIX indicator.

-The S&P 500 is 0.8% above its 200-dMA. (Bear indicator is 12% above the 200-day.)

-There was a Hindenburg Omen signal 8 April 2022 – expired.

-2.8% of all issues traded on the NYSE made new, 52-week highs when the S&P 500 made a new all-time-high, 3 January 2022. (There is no bullish signal for this indicator.) This indicated that the advance was too narrow and a correction was likely to be >10%. It proved correct, but is now Expired

-The 52-week, New-high/new-low ratio improved by 3.5 standard deviations. More simply, the spread between new-highs and new-lows improved by 716 on 14 October. That’s a solid bottom sign at a retest. – Expired.

-13 & 21 Oct were Bullish Outside Reversal Days with no Bearish Outside Reversal days since then - expired.

-46% of the 15-ETFs that I track have been up over the last 10-days. Neutral.

-The 10-dMA percentage of issues advancing on the NYSE (Breadth) is below 50%.

-MACD of the percentage of issues advancing on the NYSE (breadth) made a bearish crossover 6 Feb.

-Smoothed Buying Pressure minus Selling Pressure is falling.

-MACD of S&P 500 price made a bearish crossover 10 Feb.

-My Money Trend indicator is falling.

-Short-term new-high/new-low data.

-McClellan Oscillator.

-Slope of the 40-dMA of New-highs is falling.

-The Smart Money (late-day action) is bearish.

-The 5-10-20 Timer System is SELL; the 5-dEMA and 10-dEMA are both below the 20-dEMA.

-The 5-day EMA is below the 10-day EMA so short-term momentum is bearish.

ETF - MOMENTUM ANALYSIS:

TODAY’S RANKING OF 15 ETFs (Ranked Daily)

ETF ranking follows:

The top ranked ETF receives 100%. The rest are then ranked based on their momentum relative to the leading ETF.

*For additional background on the ETF ranking system see NTSM Page at…

http://navigatethestockmarket.blogspot.com/p/exchange-traded-funds-etf-ranking.html

DOW 30 momentum ranking follows:

The top ranked Stock receives 100%. The rest are then ranked based on their momentum relative to the leading Stock.

For more details, see NTSM Page at…

https://navigatethestockmarket.blogspot.com/p/a-system-for-trading-dow-30-stocks-my_8.html

My basket of Market Internals improved to HOLD. (Market Internals are a decent trend-following analysis of current market action, but should not be used alone for short term trading. They are most useful when they diverge from the Index.)