“Trade what you see; not what you think.” – The Old Fool,

Richard McCranie, trader extraordinaire.

REPUBLICAN VOTERS SHOULD RETHINK NOMINATING TRUMP

(National Review)

“...Because he couldn’t bear to admit that he’d lost to Joe Biden in 2020 (after trailing him in every national poll), Trump insisted he’d won and did everything he could to overturn the result, including trying to bully his vice president into violating his oath and preventing and delaying the counting of the electoral vote. When a mob, fervently believing Trump’s lies, fought its way into the U.S. Capitol to try to end the count, Trump did little or nothing to try to stop it.

These were infamous presidential acts and represented serious offenses against our constitutional order. Nothing can justify them...It’s impossible to imagine Ron DeSantis or Nikki Haley, whatever their other flaws, engaging in such grotesquely selfish behavior injurious to our republic. On this basis alone, both are vastly preferable to Trump.” Commentary at...

https://www.nationalreview.com/2024/01/republican-voters-can-and-should-rethink-nominating-trump/

“National Review is an American conservative-right-libertarian editorial magazine, focusing on news and commentary pieces on political, social, and cultural affairs. The magazine was founded by the author William F. Buckley Jr. in 1955.” – Wikipedia.

WILL THE SUPREME COURT KEEP TRUMP OFF THE BALLOT? (WSJ)

“Akhil Reed Amar, a Yale law professor and constitutional scholar, remarked in a recent podcast discussion that the court might opt for a minimalist ruling that defers to Colorado but doesn’t bind other states. It could decide that Mr. Trump was permitted to make his case for ballot access and lost, thus upholding the Colorado Supreme Court decision while still allowing other states with different ballot-access qualifications to go their own way.” Opinion at...

https://www.wsj.com/articles/will-the-supreme-court-keep-trump-off-the-ballot-maine-colorado-a9f6834a

My cmt: Overall, this opinion piece did not support removing Trump from the ballot.

CLAUDINE GAY’S “MY TRUTH’” AND THE TRUTH (WSJ)

“In testing the strength of an argument, the presence—and clash—of multiple views is essential. This kind of diversity is central to the purpose of the university, which is why the dominance of a single point of view in the faculty and student body is so damaging to the academic mission. If people with unpopular views are cowed into silence, everyone loses and the search for truth is impeded.” – William A. Galston, WSJ columnist, Senior Fellow, Brookings Institution, Governance Studies Program. Opinion at...

https://www.wsj.com/articles/claudine-gays-my-truth-and-the-truth-academia-real-diversity-55d077bd

CPI / CORE CPI (CNN)

“The Consumer Price Index increased to 3.4% in the last 12 months ending in December.

When removing the more volatile categories of food (which increased 0.2% on the month) and energy (which ticked up 0.4%), core CPI measured 3.9% annually, a step back from November’s 4% reading and the lowest annual increase that index has seen since May 2021.” Story at...

https://www.cnn.com/2024/01/11/economy/cpi-inflation-december/index.html

My cmt: CNN reported that the numbers were in-line with expectations; CNBC said they were higher than expected...pick you poison. CPI was 3% in June. Now, it’s 3.4%. That may worry markets...we’ll see.

JOBLESS CLAIMS (AP News)

“The number of Americans applying for unemployment benefits inched down to its lowest level in nearly three months last week as the U.S. labor market continues to flex its muscle in spite of elevated interest rates. Jobless claim applications fell to 202,000 for the week ending Jan. 6...” Story at...

https://apnews.com/article/unemployment-benefits-jobless-claims-layoffs-labor-086eb9142210f9ea195fcc2212e8017a

MARKET REPORT / ANALYSIS

-Thursday the S&P 500 slipped about 0.1% to 4780.

-VIX dipped about 2% to 12.44.

-The yield on the 10-year Treasury slipped to 3.973

PULLBACK DATA:

-Drop from Top: 0.3%. 25.4% max (on a closing basis).

-Trading Days since All-Time Top: 508-days. (The top was 3 January 2022.)

The S&P 500 is 9% ABOVE its 200-dMA and 4.2% ABOVE its 50-dMA.

*I won’t call the correction over until the S&P 500 makes a new all-time-high; however, the major bear-market bottom of the 25% decline was in the 3600 area and we called a buy on 4 October 2022.

MY TRADING POSITIONS:

XLK – Technology ETF (holding since the October 2022 lows).

XLY - Consumer Discretionary ETF. (Holding since the October 2022 lows - I bought more XLY 8/21/23.)

INTC – Added 12/6/2023.

BA – Added 12/6/2023.

DWCPF - Dow Jones U.S. Completion Total Stock Market Index. – Added 12/7/2023. This is a large position in my retirement account betting on Small Caps.

TODAY’S COMMENT:

Today, there is a Bollinger Squeeze. Investopedia says, “When Bollinger Bands® are far apart, volatility is high. When they are close together, it is low. A Squeeze is triggered when volatility reaches a six-month low and is identified when Bollinger Bands® reach a six-month minimum distance apart.” From...

https://www.investopedia.com/terms/r/rsi.asp

A squeeze precedes a big breakout either up or down. Bollinger said to use RSI and a couple of other indicators I don’t follow to determine the direction of the breakout.

The spread of the Summary of Indicators ensemble moved up

to +2. This ensemble includes about 50

indicators. They are now 12-bull, 10-Bear; the rest are neutral. +2 is close to

neutral so this ensemble isn’t helping us much.

RSI is 64 and is closer to overbought than oversold, but

not by a huge amount. Bollinger Bands are now very close to “overbought” so it

looks like the break out is most likely to be down. The charts would also

indicate that down would be more likely than up for future market moves.

The daily spread of 20 Indicators (Bulls minus Bears) declined

from -4 to -6 (a positive number is bullish; negatives are bearish); the 10-day

smoothed sum that smooths the daily fluctuations declined from -6 to -18.

(The trend direction is more important than the actual number for the 10-day

value.) These numbers sometimes change after I post the blog based on data that

comes in late. Most of these 20 indicators are short-term so they tend to

bounce around a lot.

LONG-TERM INDICATOR: The Long Term NTSM indicator

remained HOLD: PRICE is bullish; VIX, VOLUME & SENTIMENT are neutral.

(One warning: The Long-Term Indicator is not a good

top-indicator. It can signal BUY at a top.)

(The important major BUY in this indicator was on 21

October 2022, 7-days after the bear-market bottom. For my NTSM overall signal,

I suggested that a short-term buying opportunity occurred on 27 September

(based on improved market internals on the retest), although without market

follow-thru, I was unwilling to call a buy; however, I did close shorts and

increased stock holdings. I issued a Buy-Signal on 4 October, 6-days before the

final bottom, based on stronger market action that confirmed the market internals

signal. The NTSM sell-signal was issued 21 December, 9 sessions before the high

of this recent bear market, based on the bearish “Friday Rundown” of

indicators.)

BOTTOM LINE

I don’t try to time the market for small short-term pullbacks so I remain bullish. I expect a routine pullback to the lower trend line. A decline of about 4% from Thursday’s close would be perfectly normal.

ETF - MOMENTUM ANALYSIS:

TODAY’S RANKING OF 15 ETFs (Ranked Daily)

ETF ranking follows:

The top ranked ETF receives 100%. The rest are then ranked based on their momentum relative to the leading ETF.

*For additional background on the ETF ranking system see NTSM Page at…

http://navigatethestockmarket.blogspot.com/p/exchange-traded-funds-etf-ranking.html

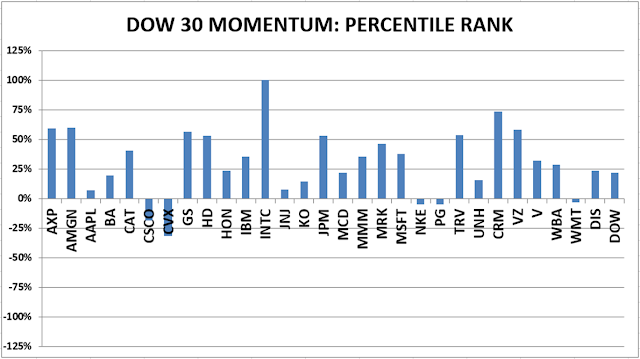

DOW STOCKS - TODAY’S MOMENTUM RANKING

OF THE DOW 30 STOCKS (Ranked Daily)

DOW 30 momentum ranking follows:

The top ranked Stock receives 100%. The rest are then ranked based on their momentum relative to the leading Stock.

For more details, see NTSM Page at…

https://navigatethestockmarket.blogspot.com/p/a-system-for-trading-dow-30-stocks-my_8.html

THURSDAY MARKET INTERNALS

(NYSE DATA)

My basket of Market Internals remained SELL. (My basket of Market Internals is a decent trend-following analysis of current market action, but should not be used alone for short term trading. They are most useful when they diverge from the Index.)

...My current invested

position is about 65% stocks, including stock mutual funds and ETFs. I’m

usually about 50% invested in stocks. I’m “over invested” now expecting new,

all-time sooner rather than later. I have about 25% of the portfolio in bonds.

I trade about 15-20% of the total portfolio using the

momentum-based analysis I provide here. When I see a definitive bottom, I add a

lot more stocks to the portfolio using an S&P 500 ETF as I did back in

October.

“...Because he couldn’t bear to admit that he’d lost to Joe Biden in 2020 (after trailing him in every national poll), Trump insisted he’d won and did everything he could to overturn the result, including trying to bully his vice president into violating his oath and preventing and delaying the counting of the electoral vote. When a mob, fervently believing Trump’s lies, fought its way into the U.S. Capitol to try to end the count, Trump did little or nothing to try to stop it.

These were infamous presidential acts and represented serious offenses against our constitutional order. Nothing can justify them...It’s impossible to imagine Ron DeSantis or Nikki Haley, whatever their other flaws, engaging in such grotesquely selfish behavior injurious to our republic. On this basis alone, both are vastly preferable to Trump.” Commentary at...

https://www.nationalreview.com/2024/01/republican-voters-can-and-should-rethink-nominating-trump/

“National Review is an American conservative-right-libertarian editorial magazine, focusing on news and commentary pieces on political, social, and cultural affairs. The magazine was founded by the author William F. Buckley Jr. in 1955.” – Wikipedia.

“Akhil Reed Amar, a Yale law professor and constitutional scholar, remarked in a recent podcast discussion that the court might opt for a minimalist ruling that defers to Colorado but doesn’t bind other states. It could decide that Mr. Trump was permitted to make his case for ballot access and lost, thus upholding the Colorado Supreme Court decision while still allowing other states with different ballot-access qualifications to go their own way.” Opinion at...

https://www.wsj.com/articles/will-the-supreme-court-keep-trump-off-the-ballot-maine-colorado-a9f6834a

My cmt: Overall, this opinion piece did not support removing Trump from the ballot.

“In testing the strength of an argument, the presence—and clash—of multiple views is essential. This kind of diversity is central to the purpose of the university, which is why the dominance of a single point of view in the faculty and student body is so damaging to the academic mission. If people with unpopular views are cowed into silence, everyone loses and the search for truth is impeded.” – William A. Galston, WSJ columnist, Senior Fellow, Brookings Institution, Governance Studies Program. Opinion at...

https://www.wsj.com/articles/claudine-gays-my-truth-and-the-truth-academia-real-diversity-55d077bd

“The Consumer Price Index increased to 3.4% in the last 12 months ending in December.

When removing the more volatile categories of food (which increased 0.2% on the month) and energy (which ticked up 0.4%), core CPI measured 3.9% annually, a step back from November’s 4% reading and the lowest annual increase that index has seen since May 2021.” Story at...

https://www.cnn.com/2024/01/11/economy/cpi-inflation-december/index.html

My cmt: CNN reported that the numbers were in-line with expectations; CNBC said they were higher than expected...pick you poison. CPI was 3% in June. Now, it’s 3.4%. That may worry markets...we’ll see.

“The number of Americans applying for unemployment benefits inched down to its lowest level in nearly three months last week as the U.S. labor market continues to flex its muscle in spite of elevated interest rates. Jobless claim applications fell to 202,000 for the week ending Jan. 6...” Story at...

https://apnews.com/article/unemployment-benefits-jobless-claims-layoffs-labor-086eb9142210f9ea195fcc2212e8017a

-Thursday the S&P 500 slipped about 0.1% to 4780.

-VIX dipped about 2% to 12.44.

-The yield on the 10-year Treasury slipped to 3.973

-Drop from Top: 0.3%. 25.4% max (on a closing basis).

-Trading Days since All-Time Top: 508-days. (The top was 3 January 2022.)

The S&P 500 is 9% ABOVE its 200-dMA and 4.2% ABOVE its 50-dMA.

*I won’t call the correction over until the S&P 500 makes a new all-time-high; however, the major bear-market bottom of the 25% decline was in the 3600 area and we called a buy on 4 October 2022.

XLK – Technology ETF (holding since the October 2022 lows).

XLY - Consumer Discretionary ETF. (Holding since the October 2022 lows - I bought more XLY 8/21/23.)

INTC – Added 12/6/2023.

DWCPF - Dow Jones U.S. Completion Total Stock Market Index. – Added 12/7/2023. This is a large position in my retirement account betting on Small Caps.

Today, there is a Bollinger Squeeze. Investopedia says, “When Bollinger Bands® are far apart, volatility is high. When they are close together, it is low. A Squeeze is triggered when volatility reaches a six-month low and is identified when Bollinger Bands® reach a six-month minimum distance apart.” From...

https://www.investopedia.com/terms/r/rsi.asp

A squeeze precedes a big breakout either up or down. Bollinger said to use RSI and a couple of other indicators I don’t follow to determine the direction of the breakout.

I don’t try to time the market for small short-term pullbacks so I remain bullish. I expect a routine pullback to the lower trend line. A decline of about 4% from Thursday’s close would be perfectly normal.

TODAY’S RANKING OF 15 ETFs (Ranked Daily)

ETF ranking follows:

The top ranked ETF receives 100%. The rest are then ranked based on their momentum relative to the leading ETF.

*For additional background on the ETF ranking system see NTSM Page at…

http://navigatethestockmarket.blogspot.com/p/exchange-traded-funds-etf-ranking.html

DOW 30 momentum ranking follows:

The top ranked Stock receives 100%. The rest are then ranked based on their momentum relative to the leading Stock.

For more details, see NTSM Page at…

https://navigatethestockmarket.blogspot.com/p/a-system-for-trading-dow-30-stocks-my_8.html

My basket of Market Internals remained SELL. (My basket of Market Internals is a decent trend-following analysis of current market action, but should not be used alone for short term trading. They are most useful when they diverge from the Index.)