I’ll be posting late for the next few days. It’s a busy time.

“The Senate has approved the Trump administration's $9 billion rescission package aimed at clawing back money already allocated for public radio and television — a major step toward winding down nearly six decades of federal funding for the Corporation for Public Broadcasting.” Story at...

https://www.npr.org/2025/07/17/nx-s1-5469904/npr-pbs-cuts-rescission-senate-vote

My cmt: Regular readers know that I dislike Criminal Trump. However, I am a staunch fan of the truth. During the conflicts and demonstrations regarding the Confederate statues in Charlottesville, VA, Trump said "You had some very bad people in that group, but you also had people that were very fine people, on both sides". That is a true statement. There were good people on both sides. There were also racists, Nazis and other white supremacist organizations present. But Trump’s statement was true; it may have been imprudent, but that’s Trump’s calling card. To the issue at hand – Judy Woodruff (Anchor and managing editor of the PBS NewsHour NPR at the time) called Trump a rascist in her newscast covering the demonstrations. That’s where NPR has failed. “News” is reporting what Trump said. Putting a spin on the news by calling Trump a rascist was anti-Trump editorializing.

“Following the devastating and destructive flash flooding in central Texas on July 4, 2025, users online claimed that U.S. President Donald Trump's administration was ultimately to blame for the flood's 100 deaths due to staffing cuts at the National Weather Service [but according to Snopes, these claims were spurious]. The weather service issued a series of timely alerts: a flood watch early in the afternoon on July 3, a flash flood warning at 1:14 a.m. July 4, and a flash flood emergency at 4:03 a.m. July 4, before any in-person reports of flooding had been received.” Story at...

Trump's NWS cuts were blamed for Texas flood deaths. Here are the facts

My cmt: There are plenty of Trump administration issues that are concerning; I find it silly that so many fools continue to lie.

"Thinking is the hardest work there is, which is the probable reason why so few engage in it.” - Henry Ford

“The Federal Reserve Bank of Philadelphia released a report on Thursday showing manufacturing activity in the region unexpectedly expanded overall in the month of July. The Philly Fed said its diffusion index for current general activity surged to a positive 15.9 in July from a negative 4.0 in June...” Story at...

https://www.rttnews.com/3554603/philly-fed-index-surges-to-five-month-high-in-july.aspx

“Retail sales rose a better-than-expected 0.6% in June...” Story at...

https://abcnews.go.com/Business/wireStory/retail-sales-surprising-06-june-after-pullback-consumers-123829497

“The Labor Department reported Thursday that jobless claims for the week ending July 12 fell by 7,000 to 221,000, the fifth straight weekly decline and the fewest since mid-April.” Story at...

https://abcnews.go.com/Business/wireStory/us-applications-jobless-benefits-fall-straight-week-hitting-123829495

“This is not the recession you are looking for. You can go about your business. Move along.”

-Thursday the S&P 500 rose about 0.5% to 6297.

-VIX declined about 4% to 16.52.

-The yield on the 10-year Treasury declined to 4.443% (compared to about this time prior market day).

SPY – added 6/5/2025 & 6/27/2025

XLK – added 6/27/2025

Today, of the 50-Indicators I track, 14 gave Bear-signs and 8 were Bullish. The rest are neutral. (It is normal to have a lot of neutral indicators since many of the indicators are top or bottom indicators that will signal only at extremes.)

The daily, bull-bear spread of 50-indicators improved to a Neutral position at zero (Equal numbers of Bear indicators and Bull indicators). I consider +5 to -5 the neutral zone. The 10-dMA curve of the spread remained heading down – a bearish sign.

I am neutral, watching indicators.

TODAY’S RANKING OF 15 ETFs (Ranked Daily) ETF ranking follows:

*For additional background on the ETF ranking system see NTSM Page at…

http://navigatethestockmarket.blogspot.com/p/exchange-traded-funds-etf-ranking.html

For more details, see NTSM Page at…

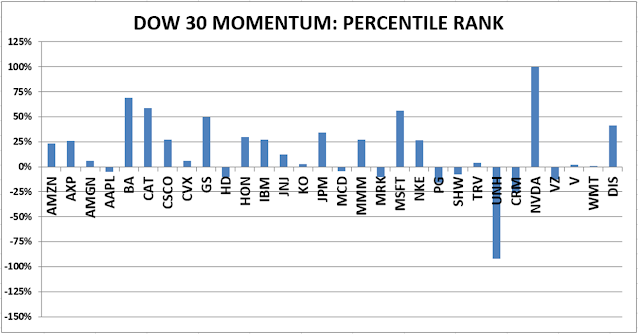

https://navigatethestockmarket.blogspot.com/p/a-system-for-trading-dow-30-stocks-my_8.html

My basket of Market Internals remained SELL. (My basket of Market Internals is a decent trend-following analysis that is most useful when it diverges from the Index.)

I trade about 15-20% of the total portfolio using the momentum-based analysis I provide here. When I see bullish signs, I add a lot more stocks to the portfolio, usually by using an S&P 500 ETF as I did back in October 2022 and 2023.