“U.S. retail sales rebounded sharply in October as

purchases of motor vehicles and building materials surged, likely driven by

recovery efforts in areas devastated by Hurricane Florence… Retail sales

increased 0.8 percent last month.” Story at…

JOBLESS CLAIMS (MarketWatch)

“The number of

Americans who applied for unemployment benefits in mid-November rose slightly,

but they remained near historic lows. Initial jobless claims, a rough way to

measure layoffs, edged up by 2,000 to 216,000 in the seven days ended Nov. 10.”

Story at…

EMPIRE MANUFACTURING (FXStreet)

"Business activity continued to grow at a solid clip

in New York State, according to firms responding to the November 2018 Empire

State Manufacturing Survey. The headline general business conditions index

edged up two points to 23.3"… Story at…

PHILADELPHIA FED (Investing.com)

“The Philadelphia Fed's manufacturing

index fell in November, to a reading of 12.9 from 22.2 in

October, the Philly Fed reported on Thursday…While the region experienced

slower growth in November "the survey’s broad current indicators remained

positive…” Story at…

CRUDE INVENTORIES (OilPrice.com)

“The American Petroleum Institute (API) reported a

sizeable crude oil inventory build for the week ending on November 9th. The

build of 8.79 million barrels was the sixth in as many weeks. The report was

significantly higher than analyst expectations…” Story at…

GLOBAL SLOWDOWN (CNN Business)

“The global economic slowdown is happening and could spread

to the United States next year. The economies of Germany and Japan shrank in the third

quarter, according to data published Wednesday, providing a sharp contrast to

another quarter of strong US growth. In China, there are signs of a deepening

economic malaise.” Story at…

My cmt: It doesn’t help that today’s WSJ lead story was

“Global Economic Slowdown Deepens”.

MARKET REPORT / ANALYSIS

-Thursday the S&P 500 rose about 1.1% to 2730.

-VIX dipped about 6% to 19.98.

-The yield on the 10-year Treasury dipped to 3.112% as of

4:25 pm.

Today’s action was positive overall. The trend was generally up all day with decent

late-day action. We made a higher low

yesterday as confirmed by today’s move up. This is a chart pattern that suggests

a correction end. I haven’t got a good way to evaluate this in real time. We saw a good move in price today, but it

wasn’t confirmed by new-high new-low data that actually got worse. VIX remained stubbornly high. Only 63% of

volume was up today. That’s not a bad

number, but I’d expect a higher number if the market believed that the higher

low signaled that the bottom was in. Bottom line: I’ll keep watching, but it still

looks like we need to revisit the 2641 prior low.

I hope I made my position clear yesterday: I think stock

market crashes can precede and cause a recession rather than be the effect of

recession. As noted previously, this is probably not the start of a stock

market crash, but there is always a chance that it could be.

My daily sum of 17 Indicators slipped slightly from -5 to

-7 (a positive number is bullish; negatives are bearish) while the 10-day

smoothed version that negates the daily fluctuations slipped from +19 to +12.

Today is trading day 40 for this pullback (counting from

the top). The drop from the top is now 6.8% (9.9% max). These numbers are based

on closing data. Over the last 10-years, for drops less than 10%, the average

time from top to bottom has been 32-days to a final bottom, including a retest.

(The low is usually at the retest.) Except for major crashes, the average

correction was about 12% and lasted 53 trading-days including retests.

It looks like there will probably be retest of the

correction low. The Index is now about 3% above its prior low. We’ll have to

see what happens if and when the S&P 500 tests that 2641 low.

MOMENTUM ANALYSIS:

(Momentum analysis is not useful in a selloff.)

TODAY’S RANKING OF

15 ETFs (Ranked Daily)

The top ranked ETF receives 100%. The rest are then

ranked based on their momentum relative to the leading ETF. While momentum isn’t stock performance per

se, momentum is closely related to stock performance. For example, over the

4-months from Oct thru mid-February 2016, the number 1 ranked Financials (XLF)

outperformed the S&P 500 by nearly 20%. In 2017 Technology (XLK) was ranked

in the top 3 Momentum Plays for 52% of all trading days in 2017 (if I counted

correctly.) XLK was up 35% on the year while the S&P 500 was up 18%.

*For additional background on the ETF ranking system see

NTSM Page at…

*Over the last 2-months the only ETF that is up is the

XLU (Utilities) and it is up about 3% over that time frame.

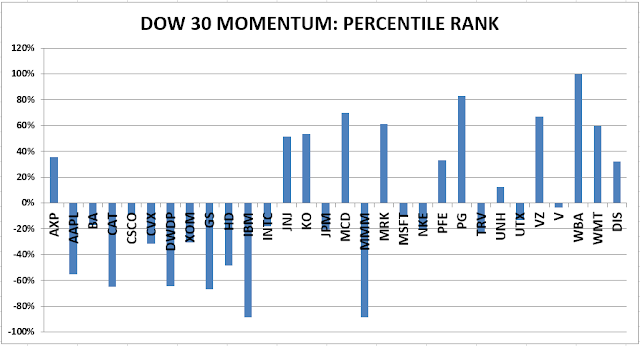

TODAY’S RANKING OF THE DOW 30 STOCKS (Ranked Daily)

The top ranked stock receives 100%. The rest are then

ranked based on their momentum relative to the leading stock.

*I rank the Dow 30 similarly to the ETF ranking system.

For more details, see NTSM Page at…

THURSDAY MARKET INTERNALS (NYSE DATA)

Market Internals deteriorated

to Negative on the market.

Market Internals are a decent trend-following analysis of

current market action but should not be used alone for short term trading. They

are usually right, but they are often late.

They are most useful when they diverge from the Index. In 2014, using these internals alone would

have made a 9% return vs. 13% for the S&P 500 (in on Positive, out on

Negative – no shorting).

I am now 30% invested in stocks. For me, fully invested

is a balanced 50% stock portfolio.

Given that the S&P 500 has dropped below its

trendline (going back 2-1/2 years) and closed below the 200-dMA on consecutive

days, I have a defensive stance now. If

we have a successful test of the prior low, and that could happen soon, I’ll be

right back in. On the other hand, since

we don’t really know where the bottom is, I am taking the conservative route.

This move may result in underperforming the S&P 500, but there is a risk

that declines may be more than we expect resulting in even bigger losses.

INTERMEDIATE / LONG-TERM INDICATOR - HOLD

Thursday, the Price

indicator was positive; Volume and Sentiment were neutral; the VIX indicator

was negative. Overall this is a NEUTRAL indication. (The first sell signal of

this corrective cycle by this indicator was on 11 October.)