“Trade what you see; not what you think.” – The Old Fool,

Richard McCranie, trader extraordinaire.

“The big money is not in the buying and selling. But in the

waiting.” - Charlie Munger, Vice Chairman, Berkshire Hathaway

JOBLESS CLAIMS (CNBC)

“The number of first-time filers for unemployment

benefits were slightly higher than expected last week as the labor market continues

its sluggish recovery from the coronavirus pandemic.

The Labor Department reported Thursday that initial

jobless claims for the week ending Sept. 19 came in at 870,000...” Story at...

https://www.cnbc.com/2020/09/24/weekly-jobless-claims.html

NEW HOME SALES (MarketWatch)

“Sales of new single-family homes in August exceeded an

annual rate of 1 million for the first time since 2006...Compared with last

year, new home sales are up 43%.” Story at...

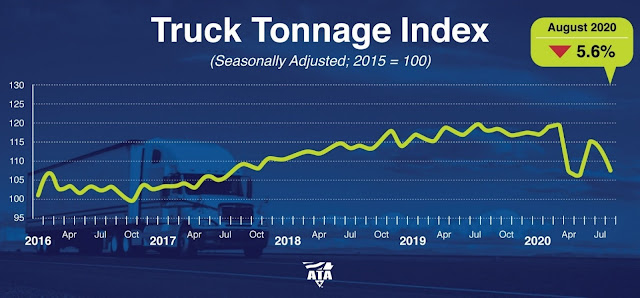

ATA TRUCK TONNAGE FELL IN AUGUST (American Trucking

Association)

“American Trucking Associations’ advanced seasonally

adjusted (SA) For-Hire Truck Tonnage Index decreased 5.6% in August after

declining 1.4% in July. In August, the index equaled 107.5 (2015=100) compared

with 113.9 in July.

“The August softness suggests that freight is very uneven in the trucking industry,” said ATA Chief Economist Bob Costello... Compared with August 2019, the SA index contracted 8.9%, the fifth straight year-over-year decline.” Press release at...

https://www.trucking.org/news-insights/ata-truck-tonnage-index-fell-56-august

This is not good since it may suggest a slowing economy.

STUNNING SHOCKING CHART CAUSES WORRY (Marketwatch)

“Is history repeating itself? Check out this chart,

courtesy of Mott Capital’s Michael Kramer, comparing the Nasdaq-100 NDX, -3.15% back then to the same tech-heavy index

today:

“I found this to be stunning and shocking,” Kramer told investors in a blog post. “I hope this turns out to be wrong, by the way.” More than just the chart, the numbers he highlighted this week mirror of the action in 1999 almost exactly.” Commentary at...

MORE DOWNSIDE AHEAD (Heritage Capital)

“Monday’s action saw the NASDAQ 100 close up on the day,

but the NASDAQ had four times the number of stocks going down than going up.

That’s not healthy behavior and continues to show what I have been warning

about since mid-July; there are many cracks in the foundation that need repair.

While nowhere near as egregious, this is what we saw in late 1999 and early

2000 before the Dotcom Bubble burst.”

Commentary at...

https://investfortomorrow.com/blog/market-finds-temp-low-on-schedule-but-more-downside-ahead/

CORONAVIRUS (NTSM)

Here’s the latest from the COVID19 Johns Hopkins website

at 5:00 Thursday. Total US numbers are on the left axis; daily numbers are on

the right side of the graph with the 10-dMA of daily numbers in Green.

MARKET REPORT / ANALYSIS

-Thursday the S&P 500 rose about 0.3% to 3247.

-VIX rose about 6% to 28.83.

-The yield on the 10-year Treasury slipped to 0.669%.

As of today, the S&P 500 is down 9.3% from its

all-time high. This is day 15 of the correction. The average time from top to

bottom for a correction is 35-days for corrections less than 10% and 68-days

for bigger corrections. The 200-dMA is now 3106, 4.5% lower than today’s close.

The daily sum of 20 Indicators improved from -4 to -2 (a

positive number is bullish; negatives are bearish). The 10-day smoothed sum

that smooths the daily fluctuations improved from -33 to -26. (These numbers

sometimes change after I post the blog based on data that comes in late.) Most

of these indicators are short-term and many are trend following.

RSI switched to Neutral today, so while we may be getting

closer to a bounce, there aren’t any indicators saying bounce now.

The Long Term NTSM indicator ensemble returned to SELL.

The Price, Volume and VIX Indicators are bearish. The Long term NTSM indicator

switched to SELL 3 days after the recent top, but I have been surprised that it

took so long for the VIX indicator to join the Bear Party. VIX may be warning

that this drop has a lot more room to fall.

I remain bearish.

MOMENTUM ANALYSIS:

TODAY’S RANKING OF

15 ETFs (Ranked Daily)

The top ranked ETF receives 100%. The rest are then

ranked based on their momentum relative to the leading ETF.

*For additional background on the ETF ranking system see NTSM Page at…

http://navigatethestockmarket.blogspot.com/p/exchange-traded-funds-etf-ranking.html

TODAY’S RANKING OF THE DOW 30 STOCKS (Ranked Daily)

Here’s the revised DOW 30 and its momentum analysis. The

top ranked stock receives 100%. The rest are then ranked based on their

momentum relative to the leading stock.

For more details, see NTSM Page at…

https://navigatethestockmarket.blogspot.com/p/a-system-for-trading-dow-30-stocks-my_8.html

THURSDAY MARKET INTERNALS (NYSE DATA)

Market Internals improved

to NEUTRAL on the market.

Market Internals are a decent trend-following analysis of

current market action, but should not be used alone for short term trading.

They are usually right, but they are often late. They are most useful when they diverge from

the Index.

Using the Short-term indicator in 2018 in SPY would have

made a 5% gain instead of a 6% loss for buy-and-hold. The methodology was Buy

on a POSITIVE indication and Sell on a NEGATIVE indication and stay out until

the next POSITIVE indication. The back-test included 13-buys and 13-sells, or a

trade every 2-weeks on average.

My current stock allocation is about 30% invested in

stocks. You may wish to have a higher or lower % invested in stocks depending

on your risk tolerance. 30% is a conservative position that I re-evaluate daily,

but it is appropriate for the correction.

As a retiree, 50% in the stock market is about fully

invested for me – it is a cautious and conservative number. If I feel very

confident, I might go to 60%; if this correction is deep enough, 80% would not

be out of the question.